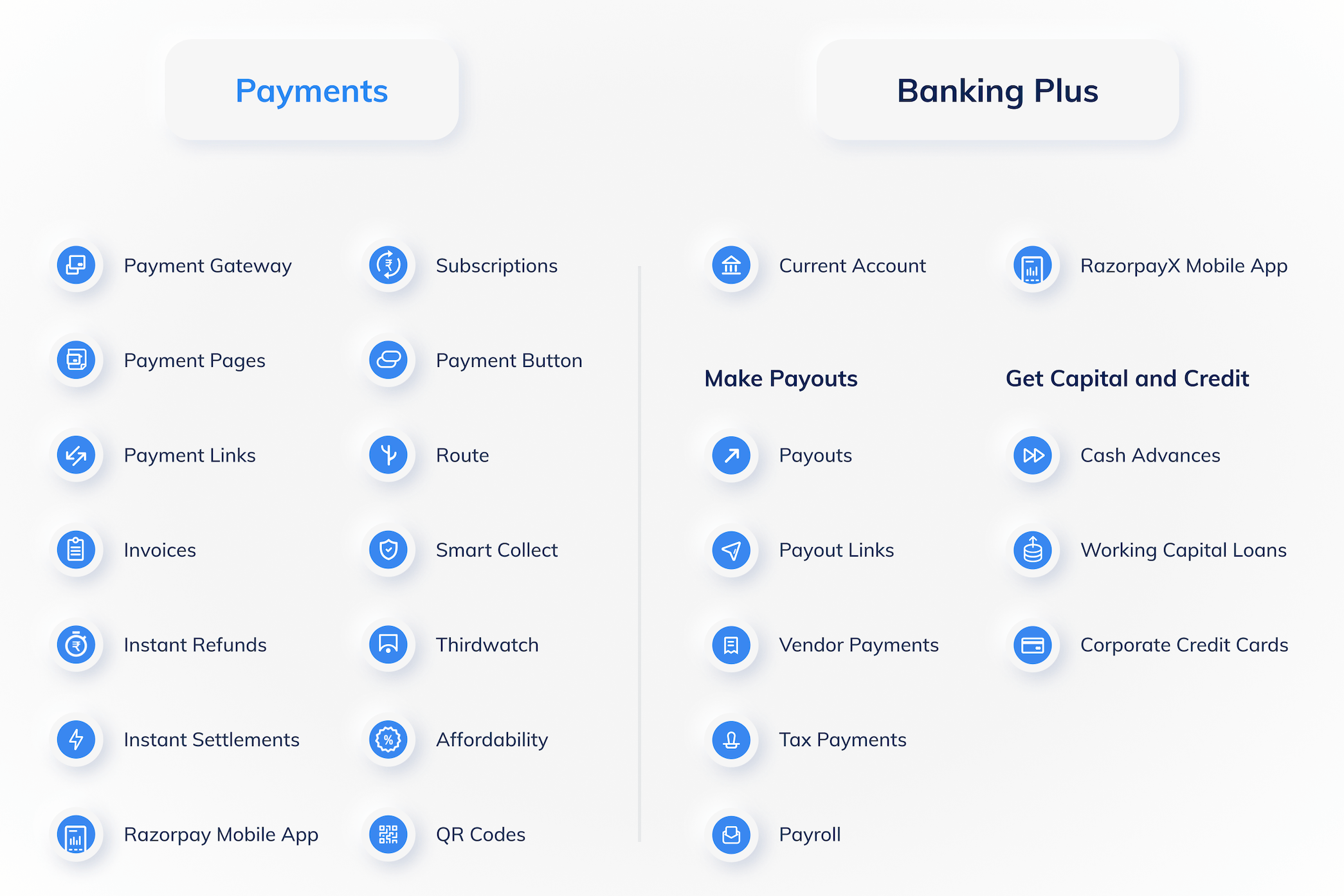

Razorpay Payments provide a range of products to accept payments and make payouts. It also offers solutions to add offers and assess risk associated with a customer order.

Product and Use

|

|---|

Payment Gateway: Integrate our Payment Gateway with your website or app to accept payments from customers.

|

Payment Pages: Easiest way to accept payments with a custom-branded online store. Accept payments with automated payment receipts. Take your store online instantly with zero coding.

|

Payment Links: Share payment link via an email, SMS, messenger or chatbot and get paid immediately.

|

Invoices: Create and send GST-compliant invoices that your customers can pay online instantly. Get paid faster and improve your cash flow.

|

Subscriptions: Offer your customers subscription plans with automated recurring transactions on various payment modes.

|

Payment Buttons: Take your store online instantly with zero coding. Accept one-time and recurring payments with automated payment receipts.

|

Smart Collect: Generate virtual bank accounts and UPI IDs on demand and accept payments using NEFT, RTGS, IMPS and UPI. Get notified for each incoming payment and automate the tedious reconciliation process.

|

Affordability Suite: Attract and retain customers by creating offers and providing popular payment methods, such as EMI, Cardless EMI, No Cost EMI and Paylater.

|

- Integrate your website or e-commerce store with the Razorpay Payment Gateway using any of the available integration types.

- Add a single line of code to your website or blog to get a Payment Button and start accepting payments.

Refund amount to your customers almost instantly using Instant Refund. Provide a great customer experience and gain your customers confidence and trust in your business.

With Instant Settlements, you get access to your funds as and when you want. Normally, you would receive settlements according to your settlement cycle. Razorpay Instant Settlements helps you reduce your settlement period from T+2 days (default settlement cycle) to a few minutes (from the time of the transaction), thus enabling your business to avoid cash-flow challenges and prepare better for working capital requirements.

Use Route to split incoming payments to individual accounts, make payments to vendors, manage marketplace money flow and much more using powerful APIs. RazorpayX is another Razorpay product that you can use to make payouts.

Thirdwatch is an AI-driven solution that helps online sellers prevent Return to Origin (RTO). Thirdwatch analyses orders placed by customers based on various parameters and flags risky orders in real-time. It allows you to make GO or No-GO decisions on these orders, preventing RTO losses to your business.

RazorpayX is a neo-banking platform that helps business owners with end-to-end management of their finances. It helps you make payouts, receive payments, tax payments, payroll management, raise loans for your business, and even robust analytics to help track and analyse your finance.

With a RazorpayX Current Account you can do the following with ease:

• Manage receivables and payables in one place

• Get instant loans without collaterals

• Automate your vendor and tax payments

• Get in-depth reporting into cash flow trends.

Product and Use

|

|---|

Payouts: Send payments instantly and securely to bank accounts. You can also send payout to UPI IDs and wallets via APIs, Dashboards and file uploads.

|

Payout Links: Send payments without bank account details. Enter the customer's name, contact details and amount to be paid. RazorpayX sends them a link where they can enter their account details (bank account or UPI ID). Once we get their account details, we send them the money.

|

Vendor Payments: Upload invoices and auto-pay vendors and TDS payments.

|

Tax Payments: Automate tax payments with pre-filled tax payment forms. You can collaborate with your accountant from the Dashboard for easy and timely tax disbursal and never miss a payment again.

|

Payroll: Calculate payroll and disburse salaries in a few clicks. RazorpayX Payroll automates payments and filings of compliances like TDS, PF, ESI, PT and much more.

|

Razorpay Capital is a lending platform that helps you to better manage your business financial needs with line of credit, corporate credit cards and collateral-free loans.

Product and Use

|

|---|

Cash Advance: Get the convenience of an unsecured line of credit to manage cash requirements prior to your customer payments. Withdraw cash up to your credit limit, repay when customers pay and borrow again when you need cash.

|

RazorpayX Corporate Credit Cards: Get high credit limit for your business expenditure with no security deposit or risk to personal credit score.

|

Working Capital Loans: Avail loans from top NBFCs at affordable rates without collateral. We offer online loan applications with quick processing and disbursal, along with the flexibility to repay automatically as a percentage of your settlements.

|

If you have an existing Razorpay account for Razorpay Payment products, you can use the same user ID and password for RazorpayX. Know more about getting started with RazorpayX.

Under the standard plan designed for small and medium enterprises, Razorpay charges 2% per transaction. Razorpay also offers an enterprise plan designed for large volumes, which gives you the best prices possible for your business. Know more about pricing.