Recurring Payments allows you to charge customers automatically at regular intervals that are defined and controlled by you. Essentially, Razorpay processes recurring payments as-and-when-presented by you.

Ensure you have sufficient balance/credits/funds in your Razorpay account to ensure there are no delays processing payments.

Methods

| Authorization

|

|---|

Emandate via netbanking

| Netbanking login

|

Emandate via debit card

| OTP/3D secure

|

Cards

| OTP/3D secure

|

Paper NACH

| Signature

|

UPI mandate

| UPI PIN

|

|

There could be various reasons why a recurring payment could fail. Potential reasons could be:

- Expired card.

- Credit card reported lost or stolen.

- Insufficient funds.

- Recurring payment canceled directly from the bank.

- Pre-debit notification failed.

You can track the real-time status of payments as created, captured (successful), failed via Razorpay Dashboard, polling our APIs or subscribing to our webhooks.

Settlements happen as per your settlement schedule. You can view your settlement schedule on the Dashboard (Settlements → View Settlement Cycle). In case the settlement is scheduled on a bank holiday; the settlement occurs on the next working day.

The customer is shown the following:

- Payment type ("Recurring" or "Standing Instructions").

- Frequency of recurring payments.

- Maximum amount to be deducted.

- Expiry date of standing instructions.

The following payment methods are available for Recurring Payments:

- Emandate via netbanking

- Emandate via debit card

- Emandate via aadhaar

- Credit Cards

- Debit Cards

- Paper NACH

- UPI

Yes. Emandate and Paper NACH are covered under the Negotiable Instrument Act. Refer to the Circular from NPCI for more details.

Supported Banks

- Axis Bank

- Bank of Baroda

- Bank of India

- Canara Bank

- Capital Small Finance Bank

- Federal Bank

- HDFC Bank

- HSBC

- ICICI Bank

- IDBI Bank

- IDFC First Bank

- Indusind Bank

- Jio Payments Bank

- Karur Vysya Bank

- Kerala Gramin Bank

- North East Small Finance Bank

- Paytm Payments Bank

- Pragathi Krishna Gramin Bank

- Punjab and Sind Bank

- Punjab National Bank

- Rajkot Nagrik Sahakari Bank

- RBL

- Saraswat Co-operative Bank

- SBM Bank India Ltd

- Shivalik Small Finance Bank

- State Bank of India

- Suryoday Small Finance Bank

- Thane Janta Sahakari Bank

- Utkarsh Small Finance Bank

- Yes Bank Ltd

- Nainital Bank

- Patan Nagarik Sahakari Bank

- The Vijay Co-operative Bank

- The Adarsh Co-operative Urban Bank

- GP Parsik Sahakari Bank

- Capital Small Finance Bank

- Kotak Mahindra Bank

- Union Bank of India

- Indian Overseas Bank

- AU Small Finance Bank

Supported Apps

- BHIM

- Paytm

- PhonePe

- Amazon Pay

- IndusInd Bank App

Contact our support team to enable or disable a payment method for Recurring Payments. This cannot be done from the Dashboard.

Contact our support team if a payment method is not available for recurring payments on your account.

Currently, Recurring Payments through Emandate is available for a few banks. Additionally, the following banks allow customers to set up standing instructions via Netbanking login: ICICI, HDFC and Axis Bank.

For Emandate, the maximum amount for any one transaction is ₹10,00,000. However, there is no limit on the number of transactions/day.

Method

| Bank

| TAT Guidelines

|

|---|

Emandate

| All Banks via NPCI

| Real-time

|

Emandate

| via ICICI and Axis

| Real-time

|

Emandate

| via HDFC and SBI

| T+1 working days.

|

In the case of Emandate, the process varies from bank to bank. If the Emandate is setup using Netbanking login, it can take up to 2 working days for payment authorization.

Method

| Bank

| TAT Guidelines

|

|---|

Emandate

| ICICI Bank

| Real-time

|

Emandate

| Axis

| Same day

|

Emandate

| HDFC Bank

| Same day

|

Emandate

| State Bank of India

| T+1 working days

|

Emandate

| Other Banks

| Same day

|

Handy Tips

To ensure same-day debit authorization, Razorpay must receive the request by 8:59 a.m. on a bank working day.

We recommend uploading the files by 6 am (IST). The funds may settle around 6 pm on the same day.

To improve the Emandate registration user experience for your customers:

- Before customers proceed with the authorisation transaction, you can display a message asking your customers to keep their netbanking credentials handy. This will help prevent time-out at the checkout.

- Inform your customers that there might be a ₹1 or ₹2 deduction during the authorisation transaction. This amount will be refunded to your customer in 3-5 bank working days.

Businesses like yours can onboard customers and process recurring payments starting from October 1, 2021 using cards of the banks listed in the below table.

S.No

| Bank

| Debit Card

| Credit Card

| Prepaid

|

|---|

1

| HSBC

| N/A*

| ✓

| N/A*

|

2

| Equitas Small Finance Bank

| ✓

| N/A*

| N/A*

|

3

| City Union Bank

| ✓

| N/A*

| N/A*

|

4

| OneCard

| N/A*

| ✓

| N/A*

|

5

| Karur Vysya Bank

| ✓

| ✓

| N/A*

|

6

| Slice

| N/A*

| N/A*

| ✓

|

N/A* - Bank does not support recurring payments via this method.

The short animation below shows the cutomer journey for mandate registration.

We are in the process of enabling cards of the following banks in the coming weeks. We will keep you posted on the same by updating this list.

- SBI

- ICICI Bank

- Axis Bank

- HDFC Bank

- YES Bank

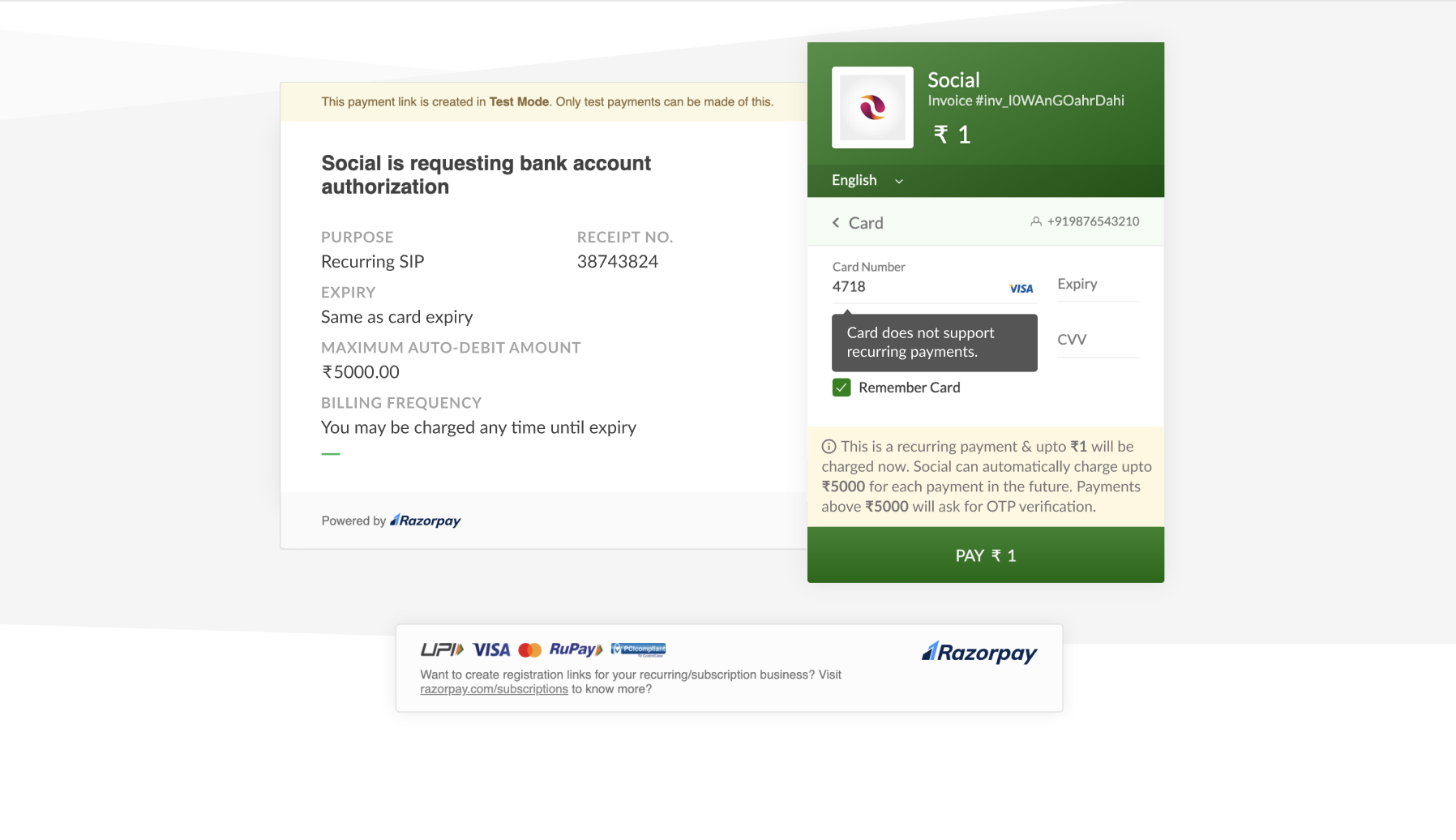

- RBL

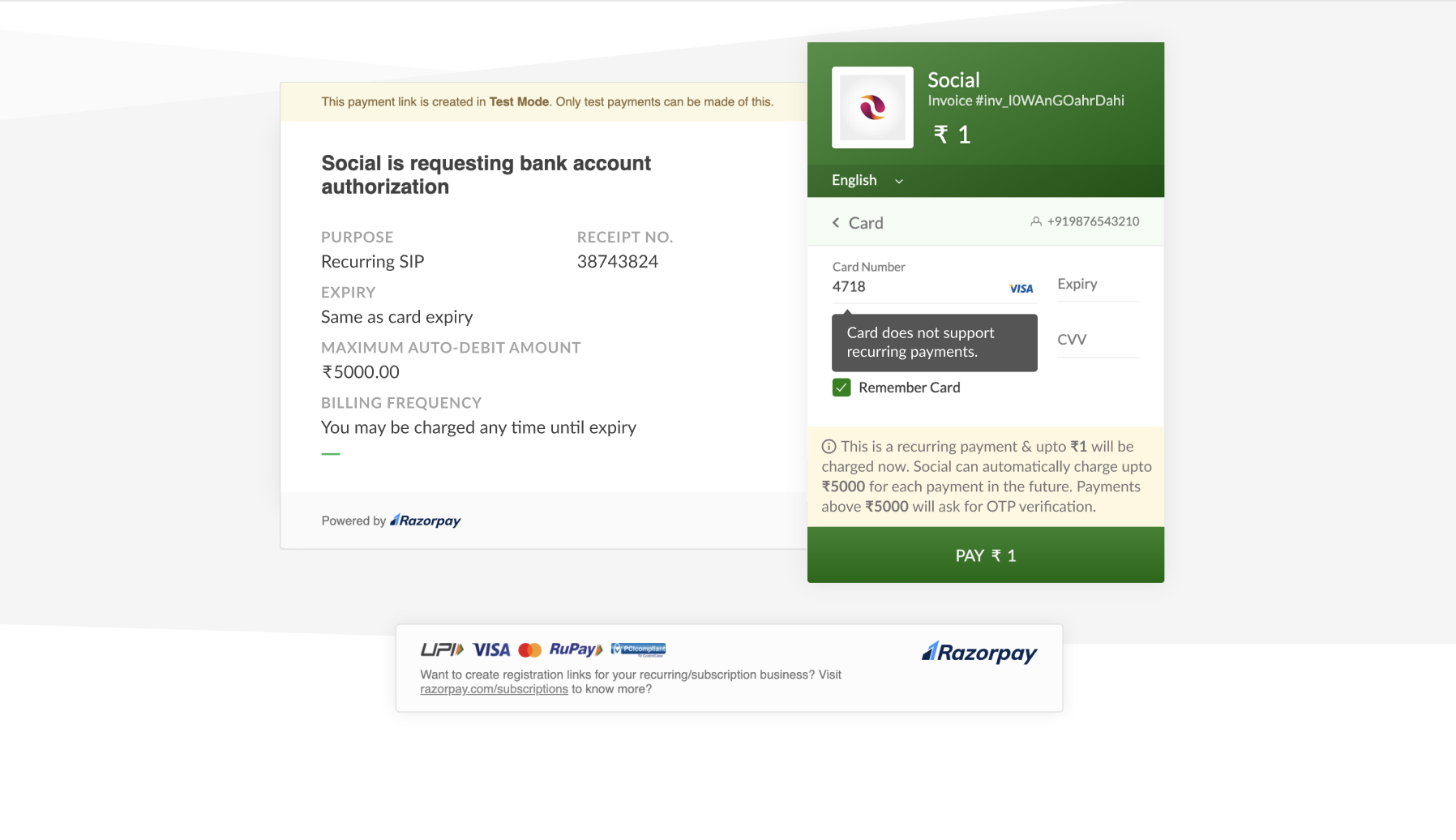

If a customer tries to enter card details of banks that are not live, an error message saying Card does not support recurring payments. will be displayed, as shown below.

We will migrate existing credit card tokens of City Union Bank (CUB), OneCard and Karur Vysya Bank by September 30, 2021. Therefore, you can continue to process recurring payments on such mandates even after September 30, 2021. For banks that will go live after September 30, 2021, we will be migrating the existing mandates of such banks as and when they go live.

Watch Out!

All of the card tokens that will be migrated are credit card tokens as debit cards of these banks were not enabled for recurring before.

All the card tokens of banks that are not live will be in paused state from October 1, 2021. You will not be able to debit these mandates. Do reach out to your customers in advance and register new mandates using alternate payment methods such as UPI or Emandate.

Refer to the Recurring Payments document for more information on payment methods.

Alternatively, you can also use Payment Links from Razorpay Dashboard or mobile application and collect payment from customers on the due date.

Refer to the Payment Link document for more information.

You can go to the Reports section in your Razorpay Dashboard and download the token report on October 1, 2021 to know the status of all your tokens to take appropriate action.

To download the token report:

- Log into the Razorpay Dashboard and click the Reports from the left menu.

- Select Token Report from the Select Report Type drop-down list.

- Select the relevant Period from the Select Period drop-down list.

- Select the file format from the Select Format drop-down list. You can choose CSV, XLSX or XLS formats.

- Click Generate Report to download or get it emailed to your registered email address by selecting the Email Report To check box.

Watch the animation below for steps to check token status.

There are no changes in the existing integration flow. However, we have added a few optional token parameters to the Create Order API. If these parameters are not passed in the request, then the default values are assumed.

Refer to the Recurring Payments API document for more information on changes.

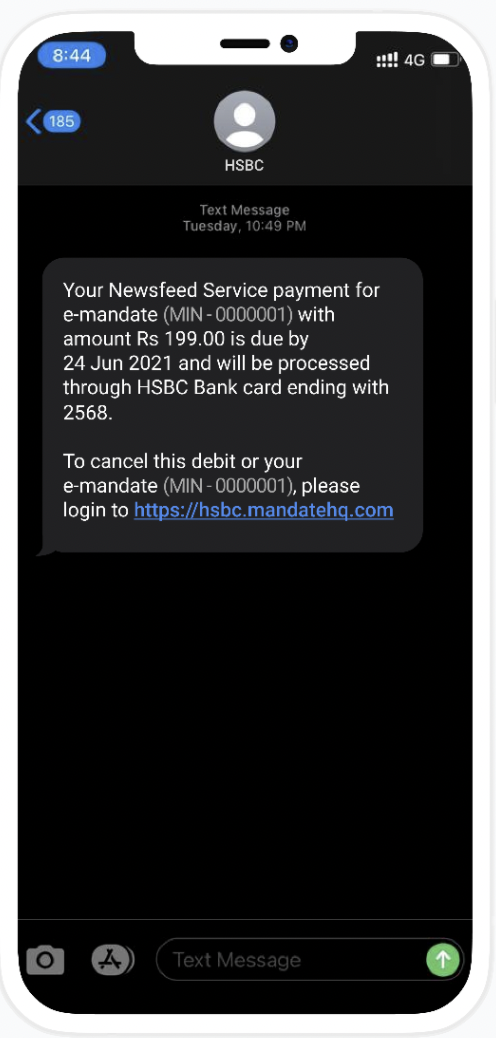

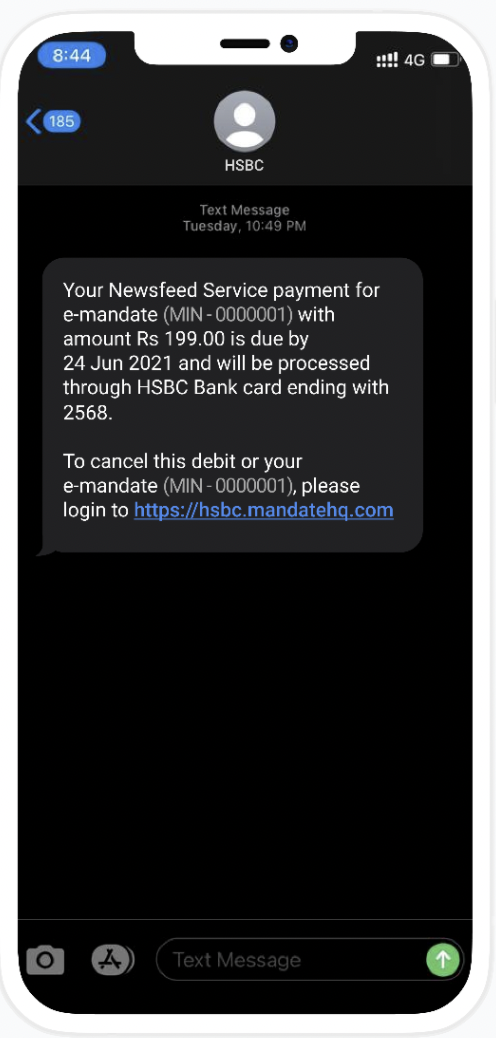

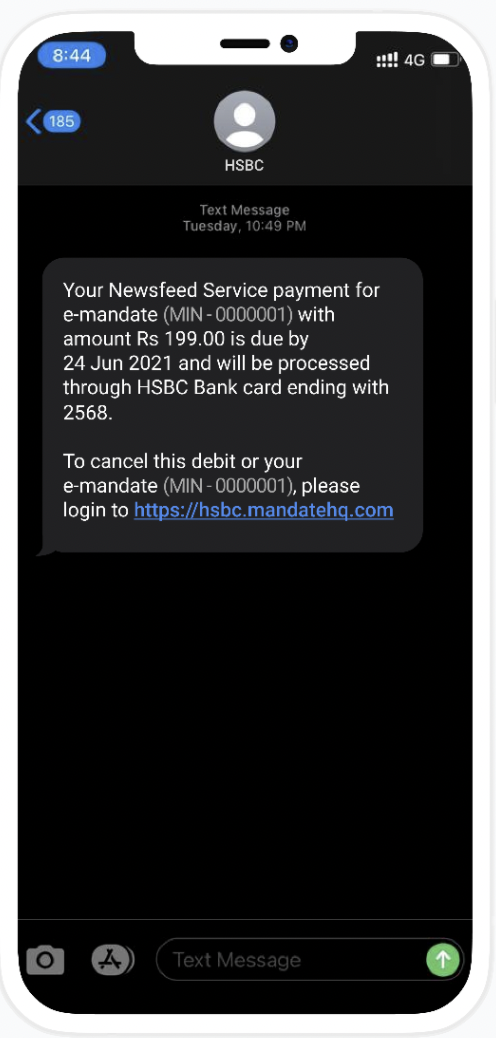

Starting October 1, 2021, you will have to raise the debit request 24 hours in advance for processing debits on registered mandates. A pre-debit notification will be sent to the customer’s registered mobile number or email ID. If they do not pause or cancel the mandate, then the recurring debit will be processed, and you will get the notification through a webhook or in the dashboard. A sample pre-debit notification is given below for your reference:

You can register mandates up to a maximum of ₹5,000 without any intervention from customers and process subsequent payments.

To register and process mandates of amounts greater than ₹5,000, an Additional Factor Authentication (AFA) is required from customers for every subsequent debit.

Note:

Businesses to only initiate the debit, and the rest will be taken care of by banks and Razorpay.

To process subsequent debits below ₹5,000:

- Businesses initiate the debit for an amount less than ₹5,000.

- Bank will send a pre-debit notification SMS to the customer immediately.

- The amount will be debited 24 hours after the notification.

To process subsequent debits above ₹5,000:

- Businesses initiate the debit for an amount greater than ₹5,000.

- Bank will send a notification with a link for Additional Factor Authentication (AFA) to the customer immediately. The AFA link will be active for 72 hours.

- The amount will be debited as soon as the customer provides AFA.

The short animation below shows the customer side flow of giving consent through the AFA link.

No, there are no changes in processing recurring payments on international cards. The RBI guidelines apply only to domestic cards and not international cards.

For card mandates, the status is updated in real-time.

Method

| Bank

| TAT Guidelines

|

|---|

Cards

| All Banks

| Real-time

|

|

In the case of cards, the status is updated in real-time.

Method

| Bank

| TAT Guidelines

|

|---|

Cards

| All Banks

| Real-time.

|

|

For processing debits below ₹5,000, the TAT is 24 hours after raising the debit request, subject to the customer not pausing or cancelling the mandate.

For processing debits above ₹5,000, the amount will be debited as soon as the customer provides consent through AFA, which has a validity of 72 hours.

Yes, cardholders can pause, resume and cancel card tokens from the portal provided by the bank to manage them. You will get notifications through multiple webhooks when a cardholder initiates any such changes to the card tokens. You can also see these changes in the Razorpay Dashboard.

Yes. You can use the cancel a card mandate by deleting the token. Tokens can be deleted:

For physical mandates, the maximum amount for any one transaction is ₹1,00,00,000 (₹1 crore). However, there is no limit on the number of transactions per day.

The signed NACH form can only be uploaded as an image. We support the following file formats:

If you get an error while uploading the NACH form, you can try to upload the form again. You can retry the upload as many times as you want, until a successful upload.

Handy Tips

A few things to keep in mind when uploading the signed NACH form:

- Do not change or write over any of the fields on the form.

- Do not crop the border.

- Review the information, sign and upload the form.

Below is a sample signed NACH form.

If you want to set up recurring payments on a current account via Paper NACH, you might be required to add your company seal on the NACH form. Use the blank space available for the 2nd and 3rd signatory to add the seal.

The following table indicates the time required to update the token status from initiated state to the confirmed state for the physical mandates:

Method

| Bank

| Expected Time to Complete

|

|---|

Paper NACH

| All Banks

| Up to ₹5 lacs, T+5 working days.

More than ₹5 lacs, T+10 working days.

|

|

The following table indicates the time required to update the token status from created state to the authorized state for the physical mandates:

Method

| Bank

| Expected Time to Complete

|

|---|

Paper NACH

| All Banks

| Same day

|

|

To improve the Emandate registration user experience for your customers:

- Before customers proceed with the authorisation transaction, you can display a message asking your customers to keep their netbanking credentials handy. This will help prevent time-out at the checkout.

- Inform your customers that there might be a ₹1 or ₹2 deduction during the authorisation transaction. This amount will be refunded to your customer in 3-5 bank working days.

Following are the account types supported for Paper NACH:

savings (default)currentcc (Cash Credit)nre (SB-NRE)nro (SB-NRO)

The below table lists the errors that may appear while uploading the NACH file, the reason, explanation and next steps:

Reason

| Explanation

| Next Steps

|

|---|

unknown_file_type

| The file type of the image is not supported.

| Upload an image that is in either of .jpeg, .jpg or .png formats.

|

file_size_exceeds_limit

| The file size exceeds the permissible limits.

| Upload an image of smaller size.

|

image_not_clear

| The uploaded image is not clear. This can either be due to poor resolution or because part of the image is cropped.

| Upload an image with better quality without any cropping of the form.

|

form_mismatch

| The ID of the uploaded form does not match with that in our records.

| Check that the form is uploaded against the correct order ID.

|

form_signature_missing

| The signature of the customer is either missing or could not be detected.

| Check that the customer has signed in the appropriate box and that the image uploaded is clear. For current account, a company stamp may also be required.

|

form_data_mismatch

| One or more of the fields on the NACH form do not match with that in our records.

| Check that the image is clear and that the data has not been tampered with before uploading again.

|

form_status_pending

| A form against this order is pending action on the destination bank. A new form cannot be submitted till a status is received.

| Wait for an update from the destination bank on the approval/rejection of the mandate.

|

|

Supported Banks

- Axis Bank

- Bank of Baroda

- Bank of India

- Canara Bank

- Capital Small Finance Bank

- Federal Bank

- HDFC Bank

- HSBC

- ICICI Bank

- IDBI Bank

- IDFC First Bank

- Indusind Bank

- Jio Payments Bank

- Karur Vysya Bank

- Kerala Gramin Bank

- North East Small Finance Bank

- Paytm Payments Bank

- Pragathi Krishna Gramin Bank

- Punjab and Sind Bank

- Punjab National Bank

- Rajkot Nagrik Sahakari Bank

- RBL

- Saraswat Co-operative Bank

- SBM Bank India Ltd

- Shivalik Small Finance Bank

- State Bank of India

- Suryoday Small Finance Bank

- Thane Janta Sahakari Bank

- Utkarsh Small Finance Bank

- Yes Bank Ltd

- Nainital Bank

- Patan Nagarik Sahakari Bank

- The Vijay Co-operative Bank

- The Adarsh Co-operative Urban Bank

- GP Parsik Sahakari Bank

- Capital Small Finance Bank

- Kotak Mahindra Bank

- Union Bank of India

- Indian Overseas Bank

- AU Small Finance Bank

Supported Apps

- BHIM

- Paytm

- PhonePe

- Amazon Pay

- IndusInd Bank App

For UPI, the maximum amount for any one transaction is ₹1,00,000, and for BFSI (Banking, Financial Services and Insurance) merchants, it is ₹2,00,000. However, there is no limit on the number of transactions/day.

No. Currently, UPI mandates only support INR payments.

For UPI mandates, the token status is updated from initiated state to the confirmed state in real-time.

Method

| Bank

| Expected Time to Complete

|

|---|

UPI

| All supported banks

| Real-time.

|

|

For UPI mandates, the following table indicates the time required to update the token status from the initiated state to the confirmed state:

Method

| Bank

| Expected Time to Complete

|

|---|

UPI

| All supported banks

| 24-36 hours. This is because of the failure of pre-debit notification and/or any retries that we attempt for the payment.

|

|

Pre-debit notifications are notifications sent to consumers 24 hours prior to the payment, allowing customers to pay, pause or cancel the e-mandate.

Yes. You can cancel a UPI mandate from the Razorpay Dashboard or using APIs.

No. You cannot pause a UPI mandate.

No. It is not possible to modify or update a UPI mandate. However, you can cancel the UPI mandate.

Yes. Your customers can cancel a UPI mandate from their UPI app.

Yes. Your customers can pause a UPI mandate from their UPI app.

No. Currently, it is not possible to modify or update a UPI mandate. However, your customers can pause or cancel the UPI mandate from their UPI app.

For UPI, do not create subsequent payments on the last day of the cycle. This will cause the payment to fail.

The feature, Charging Customers During Registration, is available only on emandate via netbanking.

The feature, Charging Customers During Registration, is only supported by HDFC and ICICI.

First Payment Amount

The customer is not immediately charged. First, the mandate is registered. We automatically charge the customer the first payment amount only after the mandate is successfully registered.

Charging Customers During Registration

With this feature, you can charge the customer immediately when they click the Pay button, while initiating a mandate registration in the background.

You can charge the customer a maximum of ₹10 lakhs using using the Charging Customers During Registration feature.