Cash Advance

Check how you can get short-term loans when you need it.

Razorpay Capital Cash Advance is a self-serve loan portal offering low-interest short term loans. When you sign up for the Cash Advance feature, you get an unsecured Line of Credit from us. The amount you withdraw from this Line of Credit is converted to a short-term loan. Typically, these loans are for a few days or few weeks with interests starting at 0.05%/day.

We also give you the flexibility to automatically repay the loan as a percentage of your settlements. You select the date by when you want to finish repaying the loan. The loan amount is divided into daily EMIs and is automatically deducted from your settlement balance.

- Apply for a Line of Credit.

- Withdraw money as per your needs.

- Repay money as per your convenience.

Before we explain how you can make withdrawals, there are a few terms that you should be familiar with.

-

Total Withdrawable Balance

The original amount made available to you when your line of credit was approved.

-

Available Withdrawable Balance

When your application is successful, you are given a line of credit. Available Withdrawable Balance is the maximum available balance that you can withdraw from your line of credit.

CopyAvailable Withdrawable Balance =

Total Withdrawable Balance - Amount Due

-

Available Withdrawable Amount

This is the maximum amount you can withdraw in a single transaction.

For example, let us say your Available Withdrawable Balance is ₹50,000 and your Available Withdrawable Amount is ₹10,000. This means you can withdraw a maximum of ₹10,000 in a single transaction.

-

Due Repayments

This is the amount that you have withdrawn and need to repay.

CopyDue Repayments = Amount Withdrawn + Interest

Assume your Available Withdrawable Balance is ₹20,000 and your Available Withdrawable Amount is ₹10,000.

| Available Withdrawable Balance

| Due Repayments

|

|---|

Opening Balance

| ₹20,000

| ₹0

|

Withdraw ₹5,000

| ₹15,000

| ₹5,025 (Amount Withdrawn + Interest)

|

Withdraw ₹10,000

| ₹5,000

| ₹15,075 (Pending Balance + Amount Withdrawn + Interest)

|

Repay ₹3,000

| ₹8,000

| ₹12,075 (Pending Balance - Amount Repaid)

|

Withdraw ₹8,000

| ₹0

| ₹20,115 (Pending Balance + Amount Withdrawn + Interest)

|

Repay ₹12,500

| ₹12,500

| ₹7615 (Pending Balance - Amount Repaid)

|

The first step is to apply for a line of credit.

Handy Tips

This is a one time process.

-

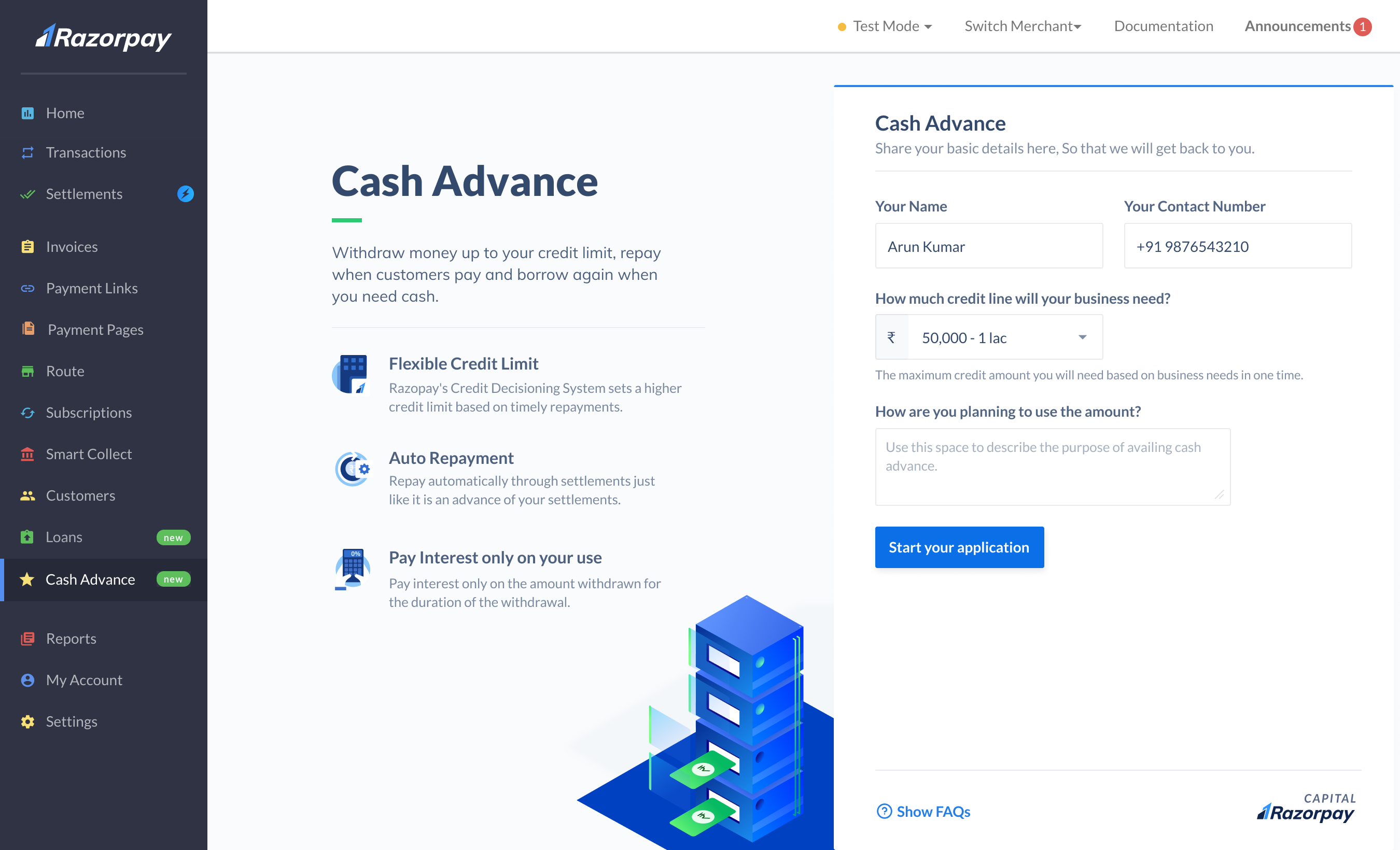

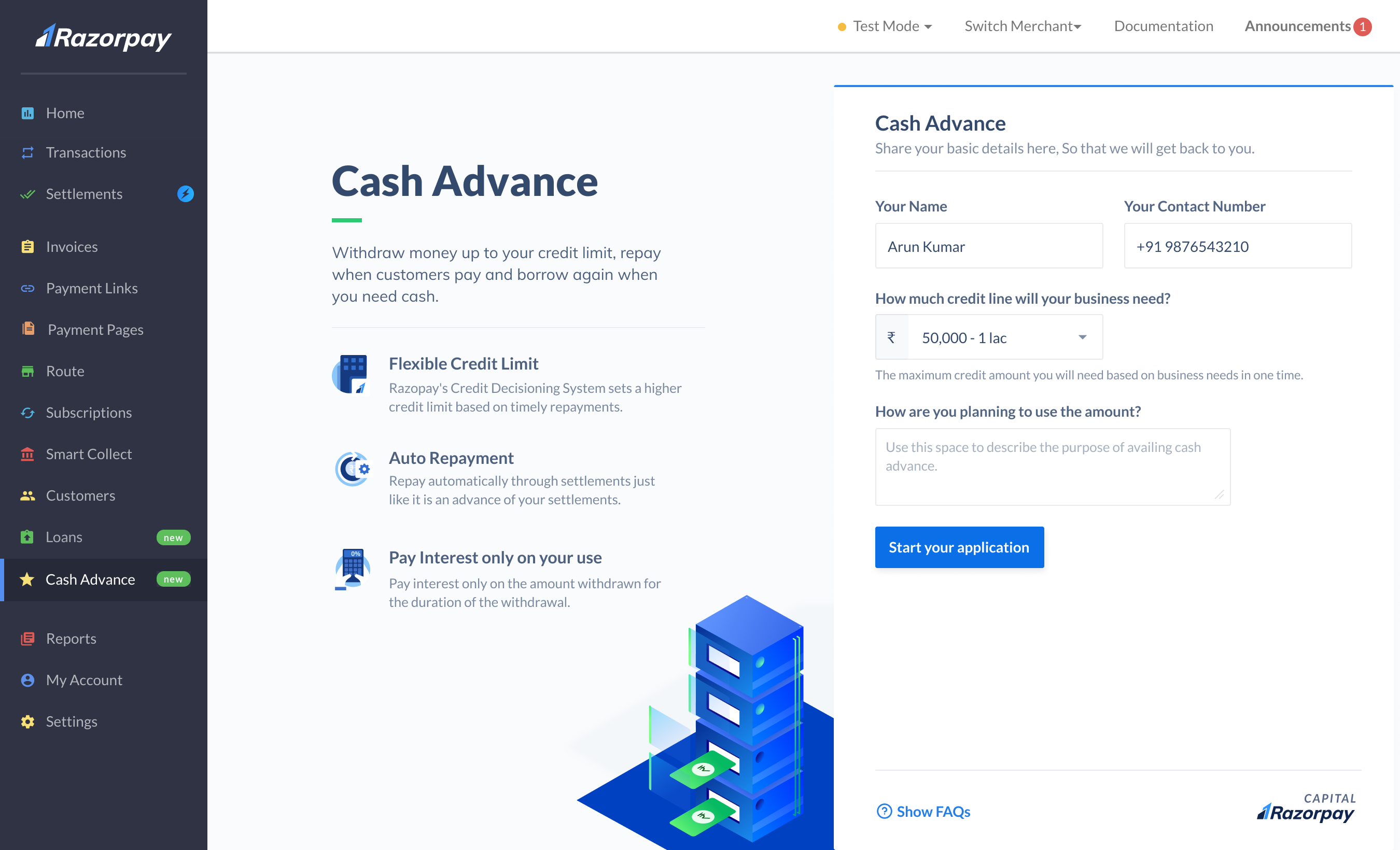

Log into the Dashboard and navigate to Cash Advance on your Dashboard.

-

Fill in a few details such as Name, Contact Number and how much credit you would like, and submit your application.

-

We review your application and approve your application, provided it meets the set criteria.

-

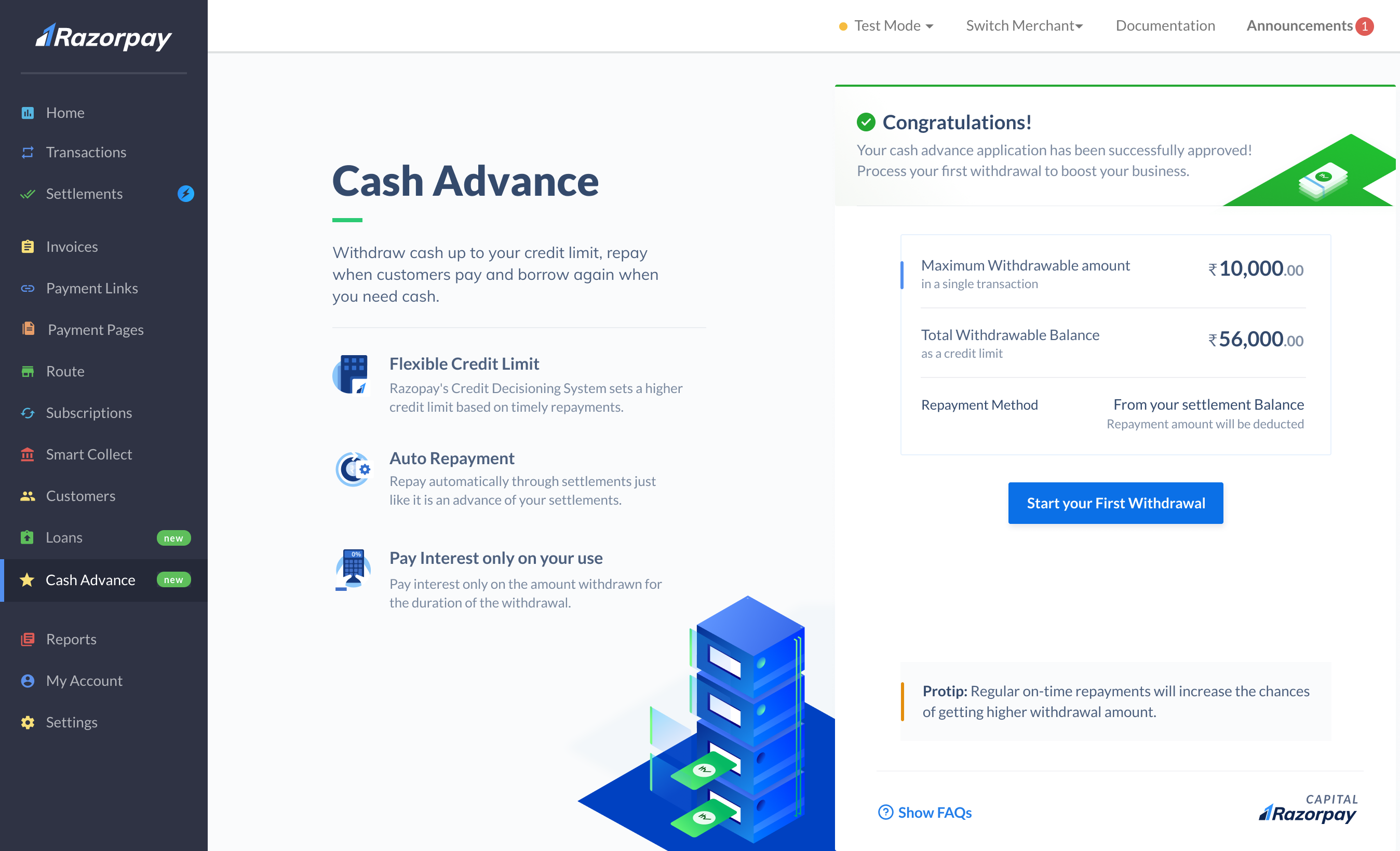

Once approved, you are given a line of credit from which you can make withdrawals as and when you need for an amount of your choice.

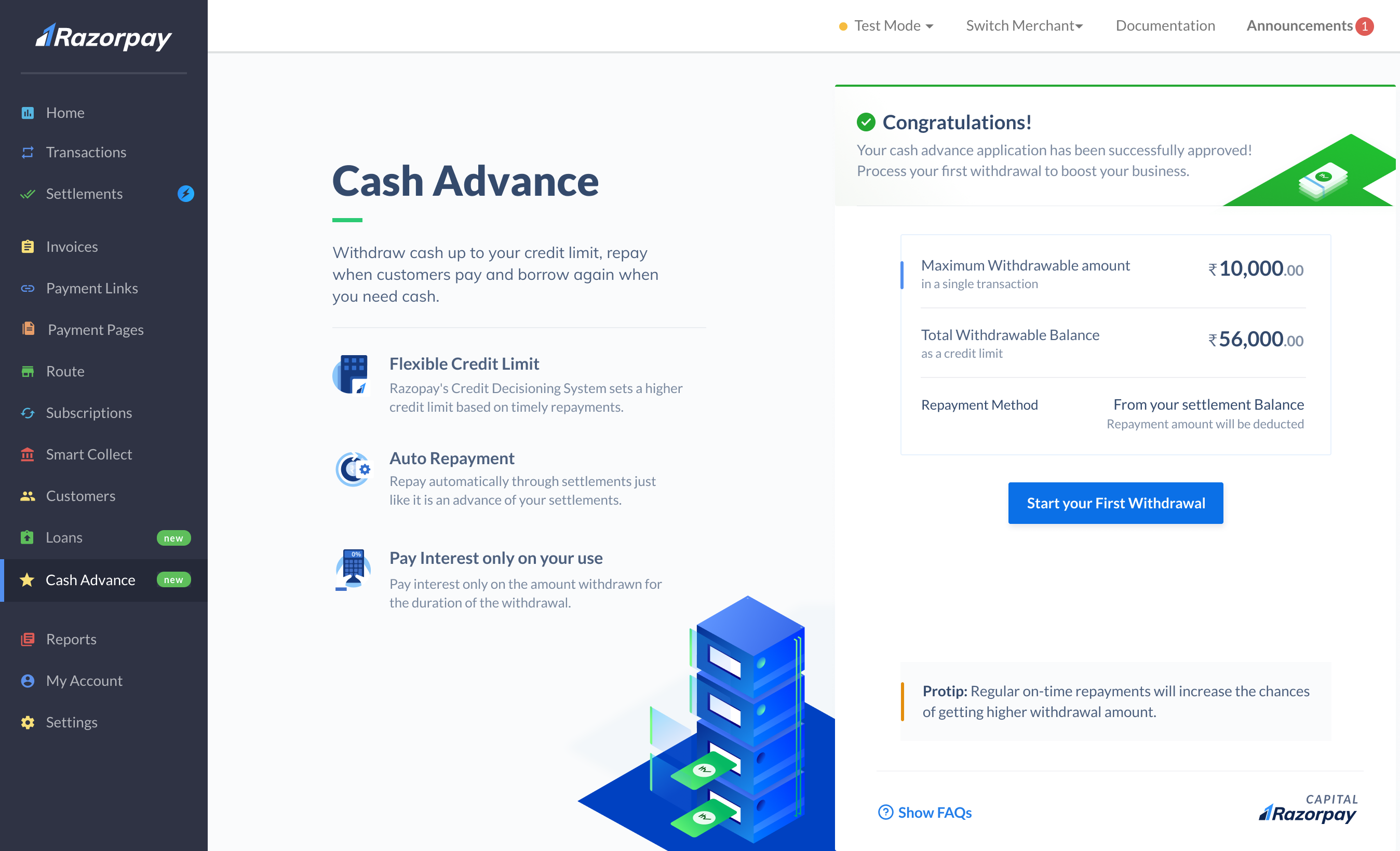

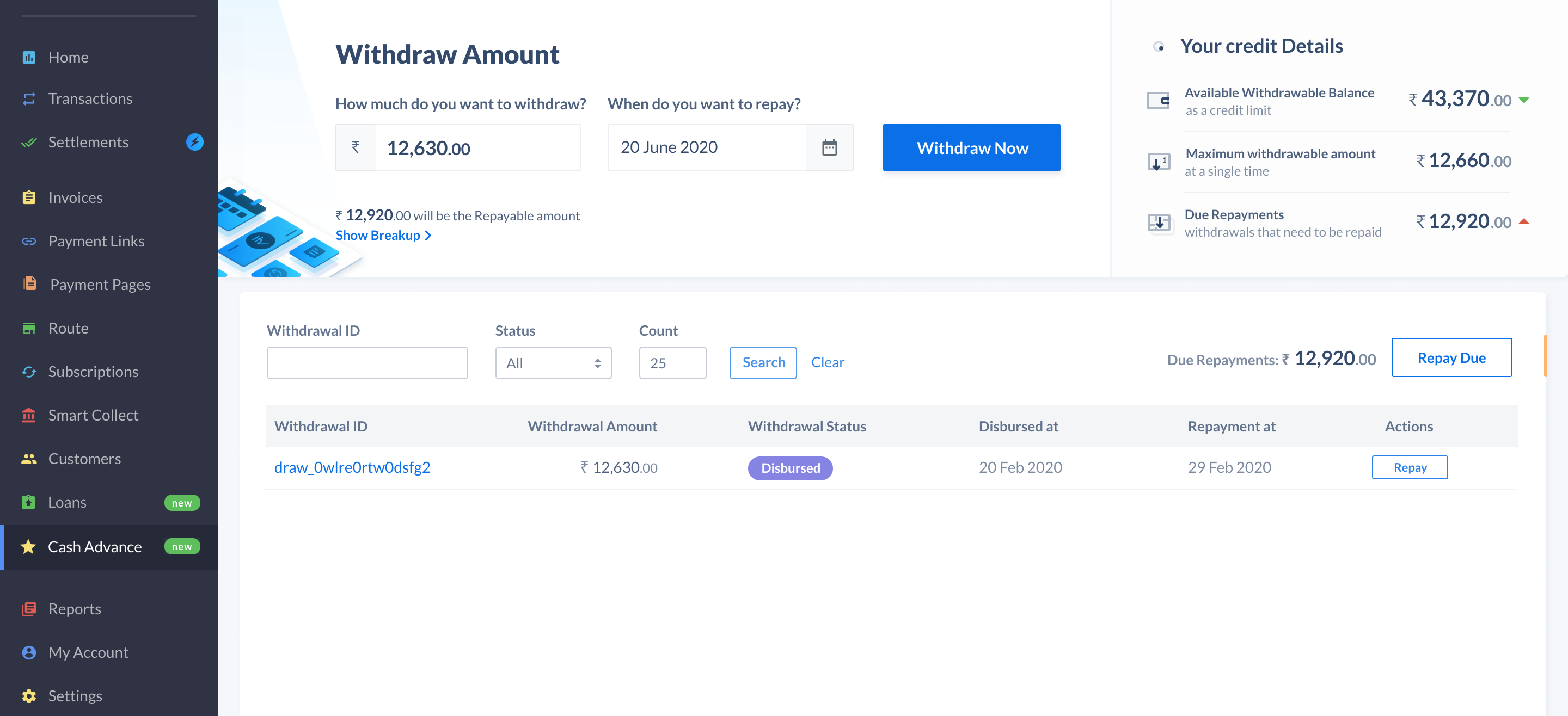

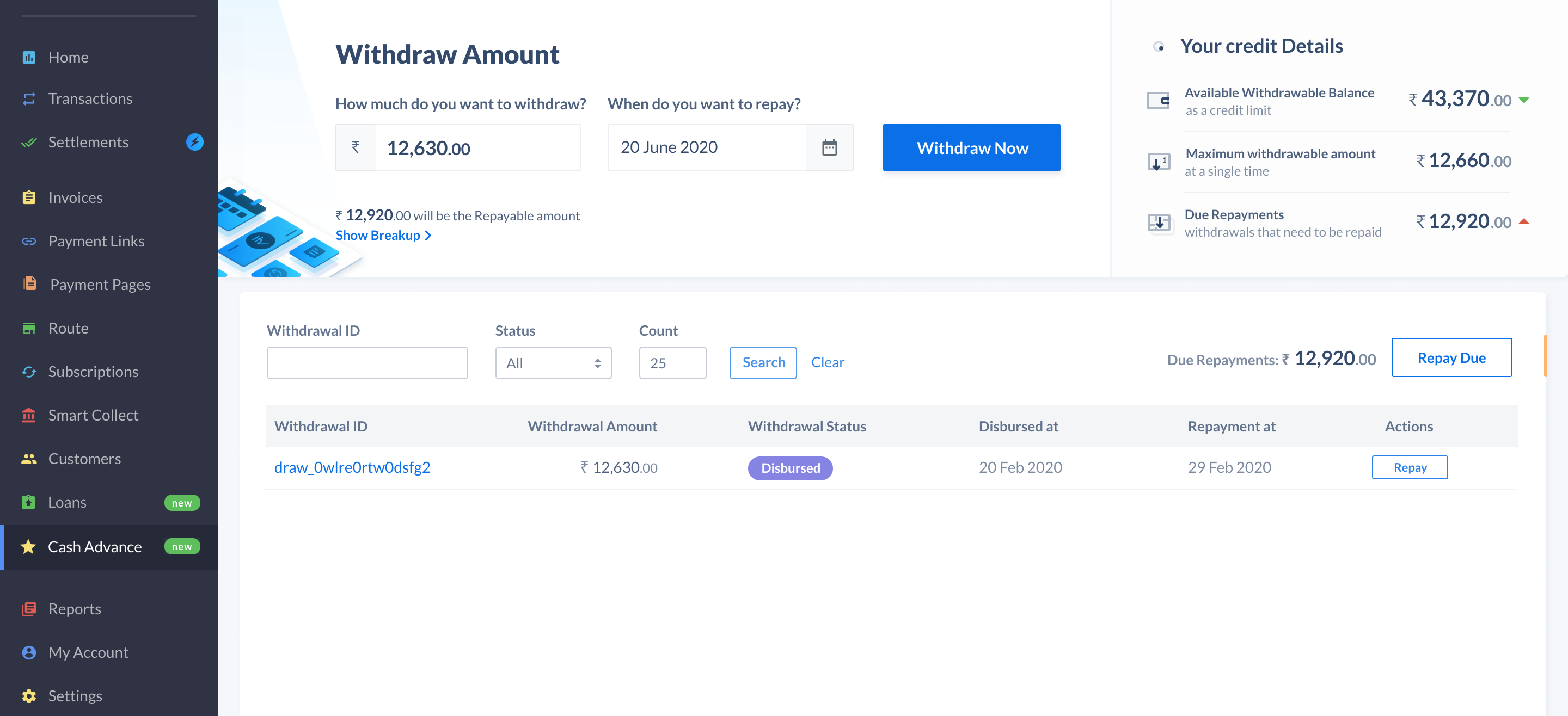

Once your line of credit is approved, you can make withdrawals as per your business needs. To withdraw money:

-

Log into the Dashboard and navigate to Cash Advance on your Dashboard.

-

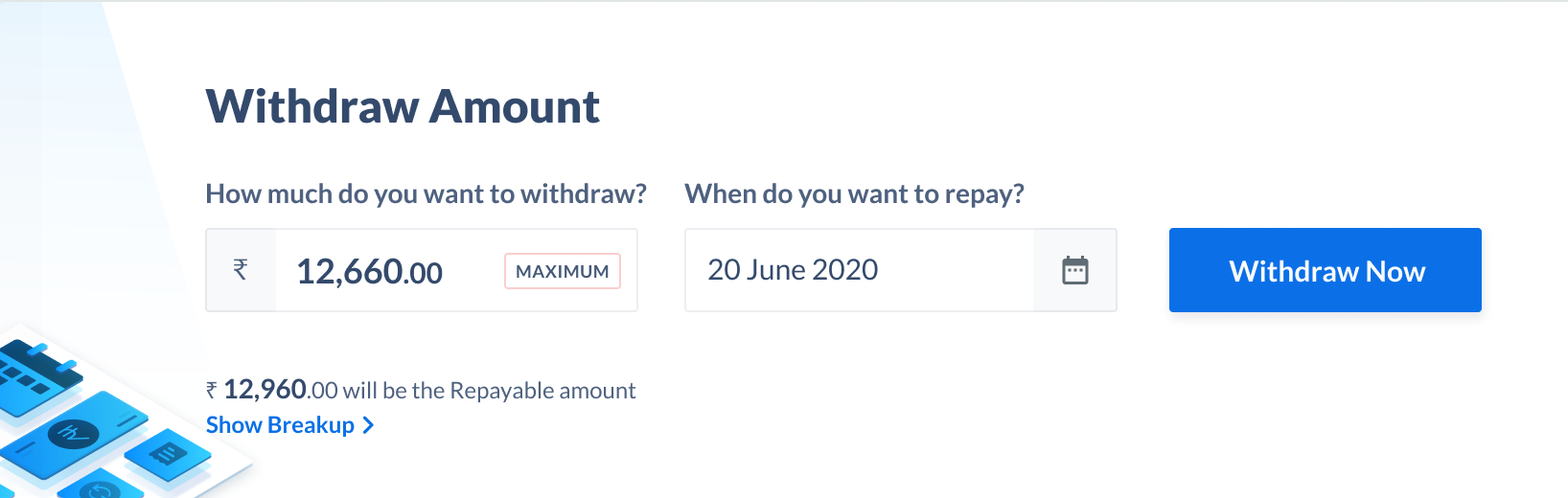

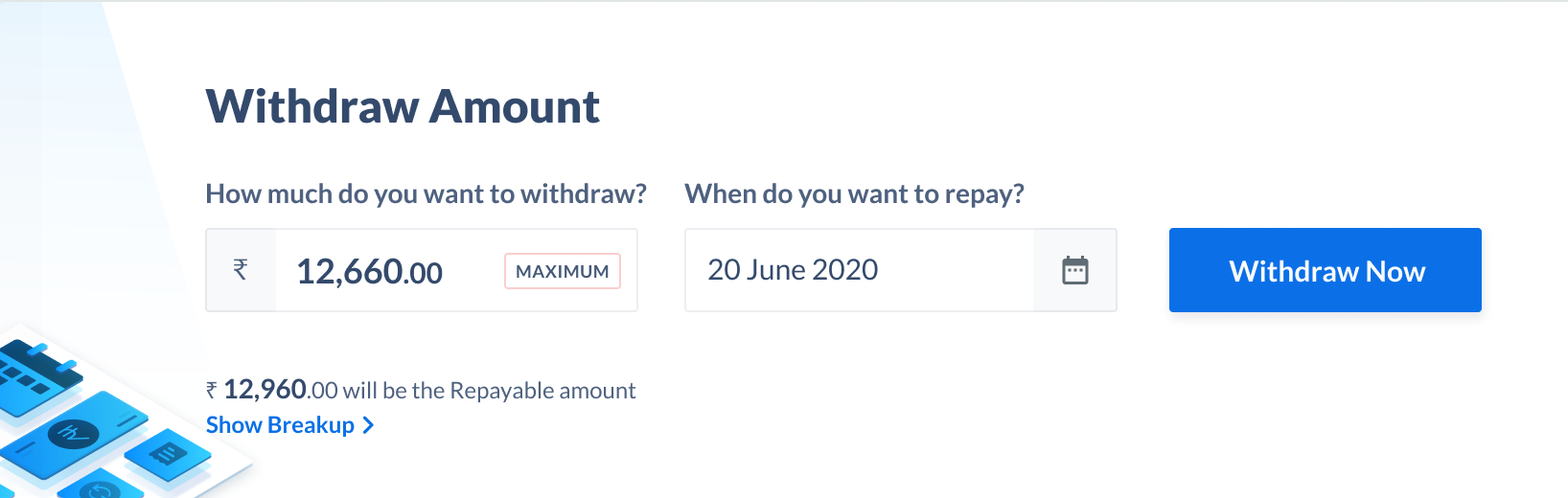

In the Withdraw Amount section:

- Enter the amount you want to withdraw.

- Enter a date by when you want to finish repaying the loan. Refer to the Make Repayments section for more details.

-

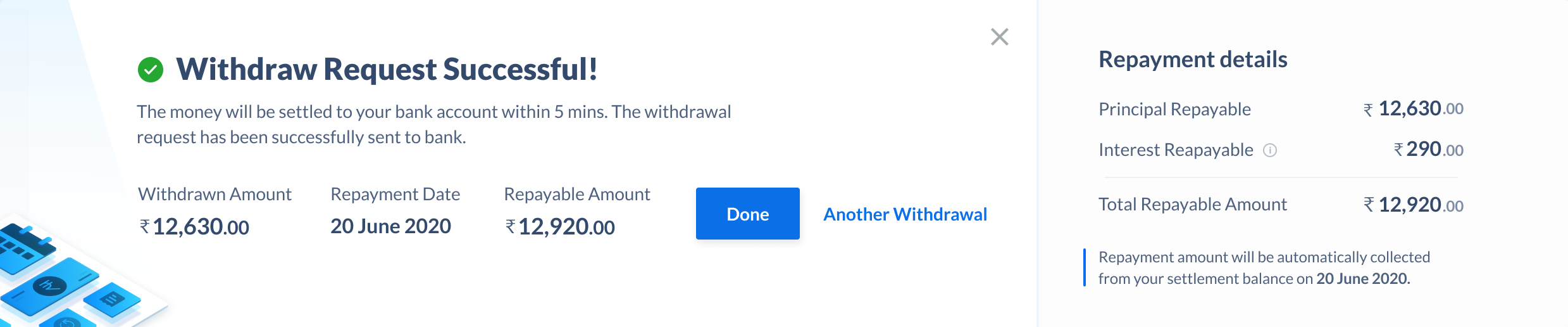

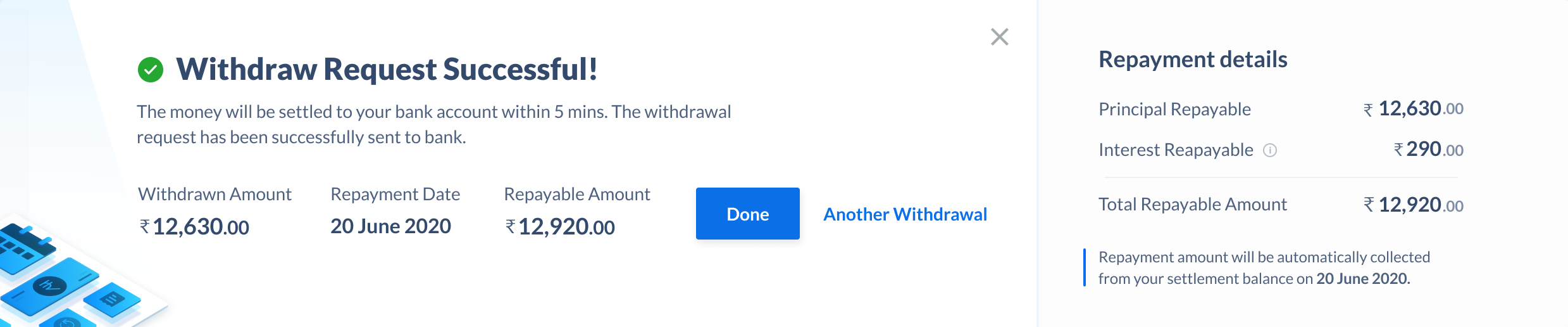

Click Withdraw Now. The request is now placed.

Status

| Description

|

|---|

Requested

| You have placed a withdrawal request on the Dashboard. The money will soon be credited to your account.

|

Disbursed

| Your request was approved. The money has been disbursed and will soon be credited to your account.

|

Partially Repaid

| You have partially repaid the amount you withdrew. For example, you withdrew ₹10,000 and repaid ₹6,000.

|

Repaid

| You have fully repaid the amount you withdrew.

|

Failed

| Your request was approved, but the transfer failed due to some error at the processing bank.

In such scenarios, you have to make a withdrawal again.

Any amount deducted from your Available Withdrawable Balance will be returned.

|

Rejected

| Your request was rejected by the bank. This could be because you exceeded your available withdrawable balance.

|

There are two types of repayments:

When you make a withdrawal, you select the date on which you want to finish making repayments. Based on the selected date, the outstanding amount (principal + interest) is automatically deducted from the settlement amount on a daily basis. There is nothing you need to do.

Assume you withdrew ₹10,000 on July 02 and selected July 12 as the repayment date. The interest on this loan for 10 days is ₹20.

CopyPrinciple + Interest = ₹10,020

Tenure = 10 days

Daily EMI = (Principle + Interest)/Tenure = 10,020/10 = ₹1,002/day

₹1,002 is collected everyday from your settlement balance starting on July 03 till July 12.

Manual repayments is any amount you choose to pay in addition to the daily deductions from your settlement amount. There is no limit on the number of repayments or the frequency at which you make these repayments.

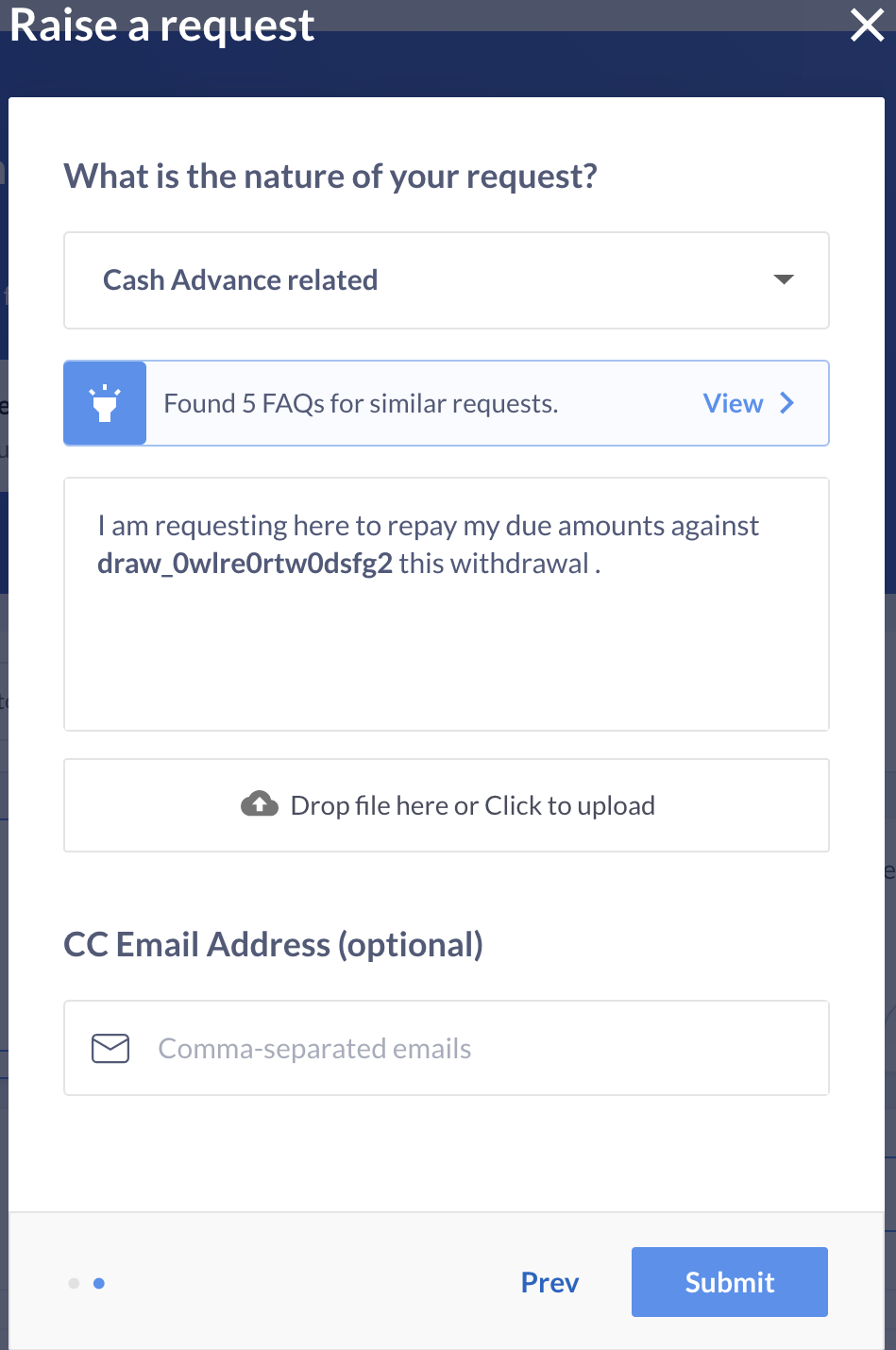

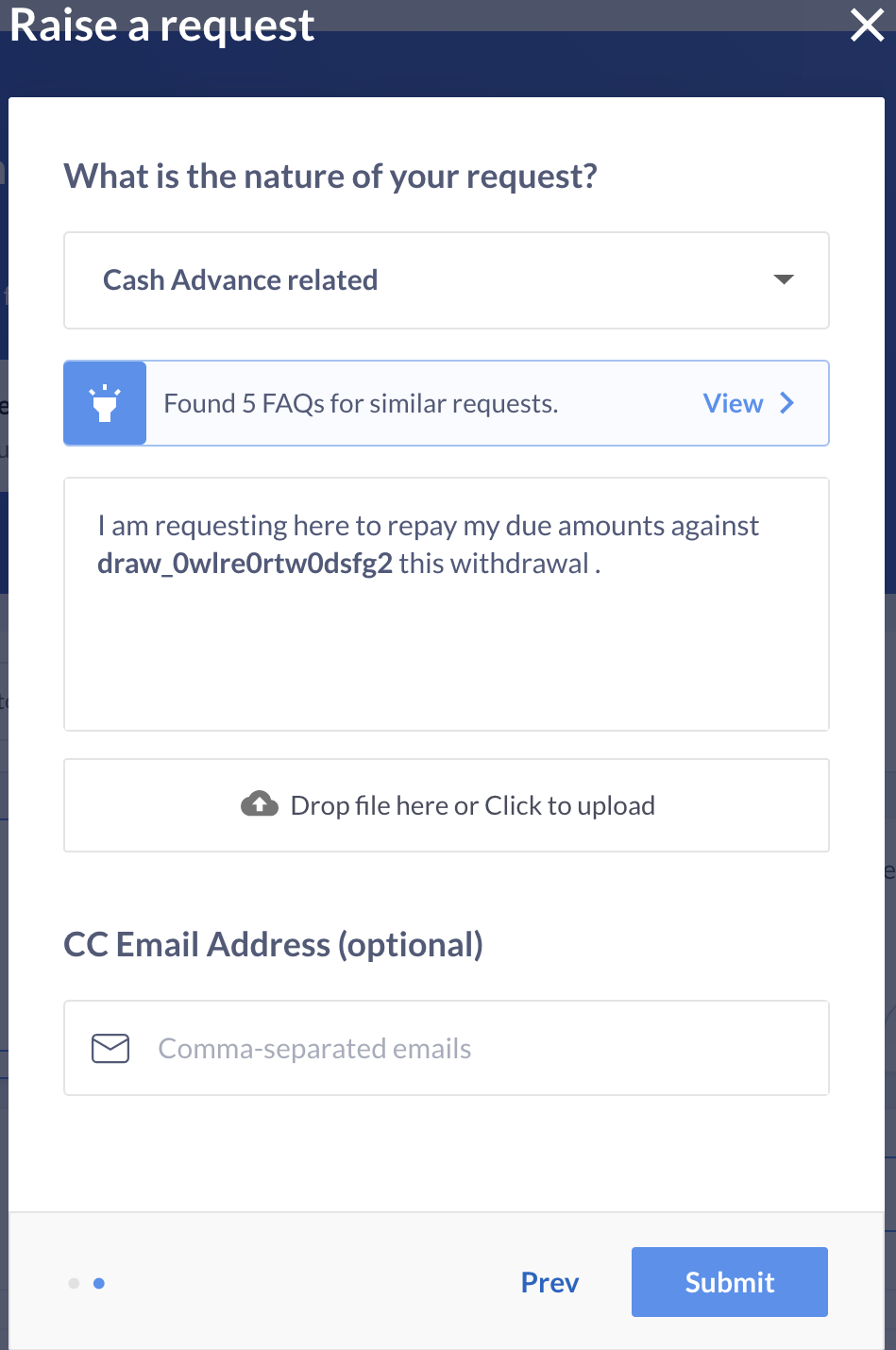

To make a manual repayment:

-

Log into the Dashboard and navigate to Cash Advance on your Dashboard.

-

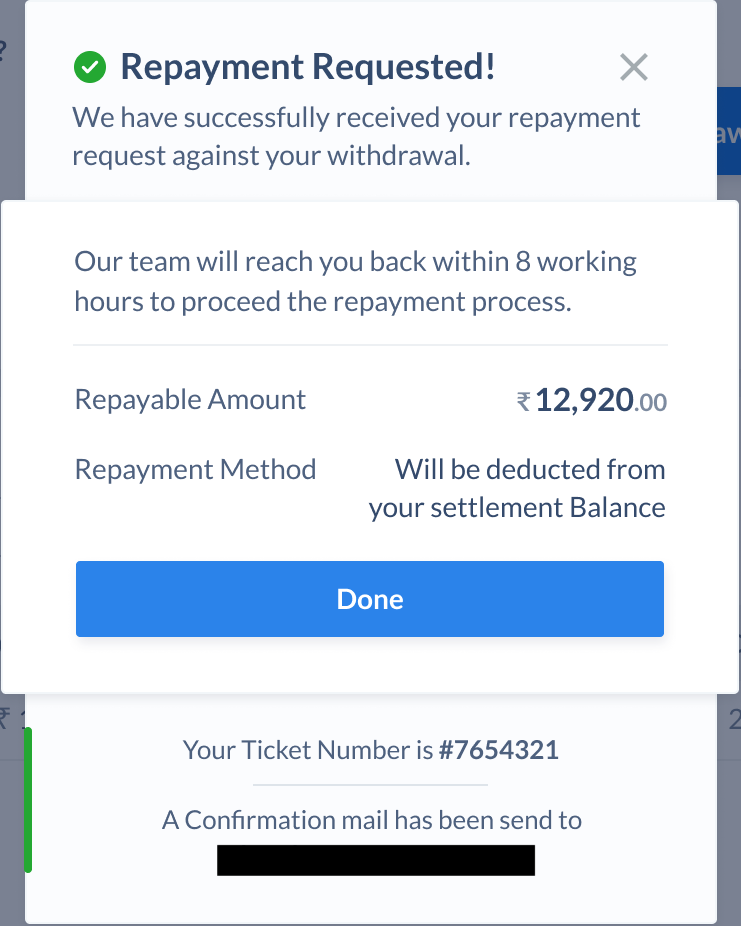

Click Repay.

-

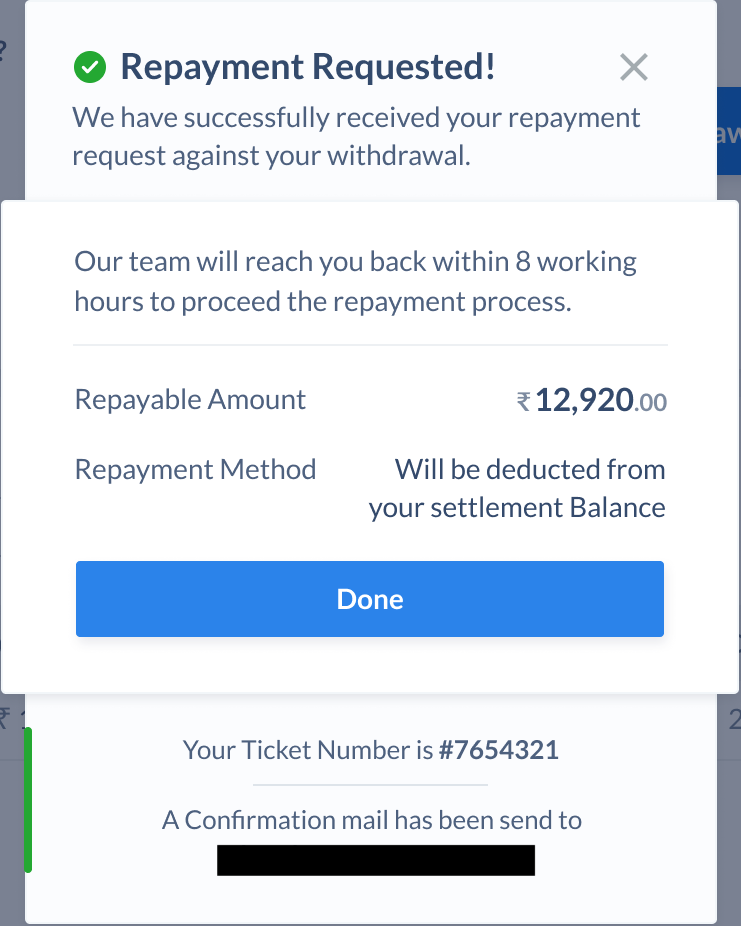

The support ticket portal opens with all options selected and details pre-filled. Click Submit.

-

A repayment request is successfully raised. We will get in touch with you for more details.