Razorpay offers a customized working capital loan for small and medium businesses to meet their working capital needs. To avail access to our Working Capital Loans, you are required to complete the Business Loan Application process, which involves a complete set of actions and services under the Loan Origination System (LOS).

LOS is a newly built powerful self-assisted model of loan processing for digital on-boarding of the merchants looking for access to credit. It aims to support multiple credit products without significant changes to the customer journey/data collection process.

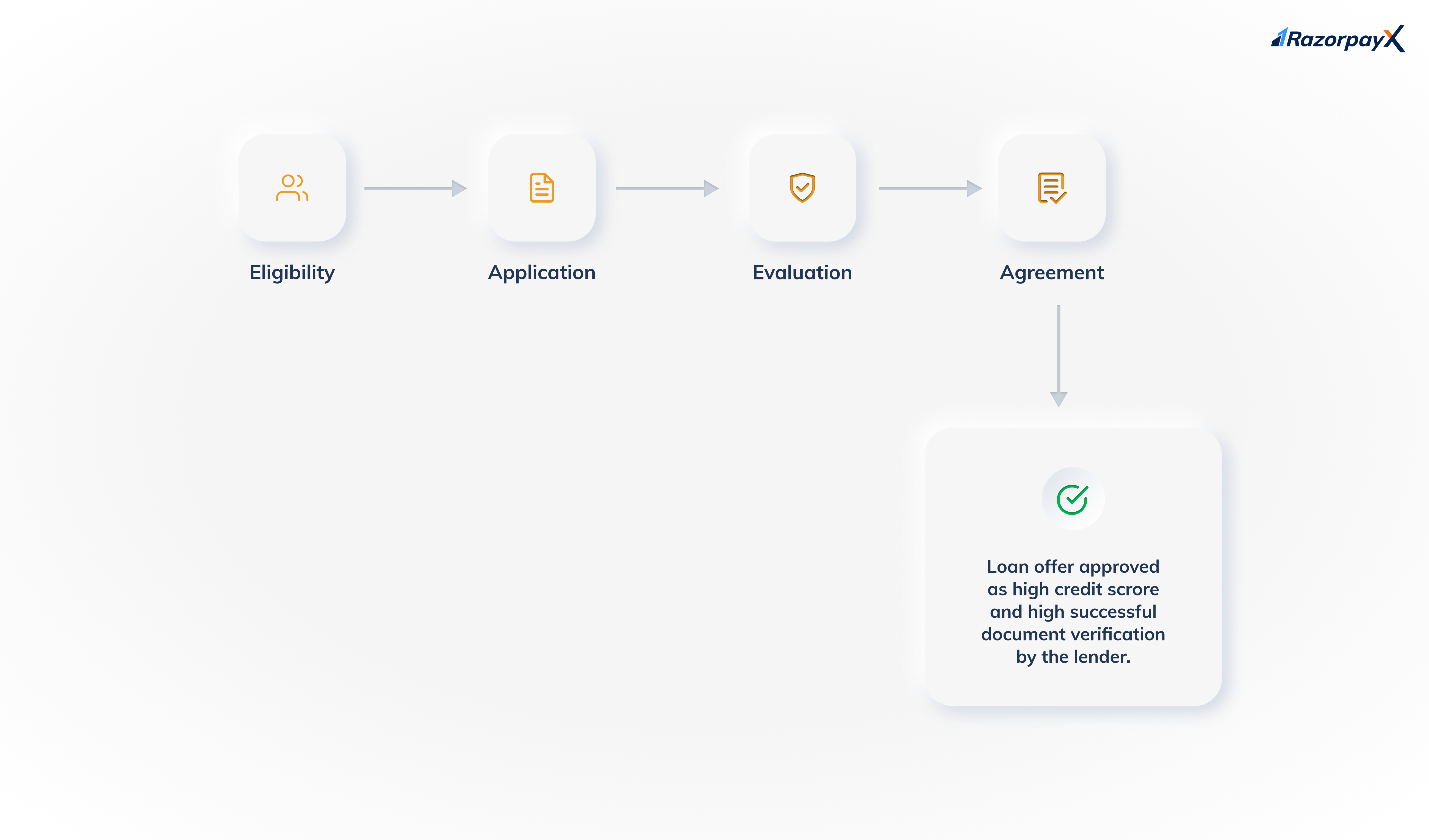

Business Loan Application process has been designed to provide a seamless experience while applying for loans, tracking disbursal amounts, as well as tracking collections. Complete your loan application process in just four simple steps:

As an existing Razorpay merchant, you will receive an invitation for Loan/Line of Credit from Razorpay on the basis of internal Transaction Data. You may hereby choose to accept and initiate the Business Loan Application process.

Following are the detailed steps to complete the loan application process and get funds disbursed to your account.

-

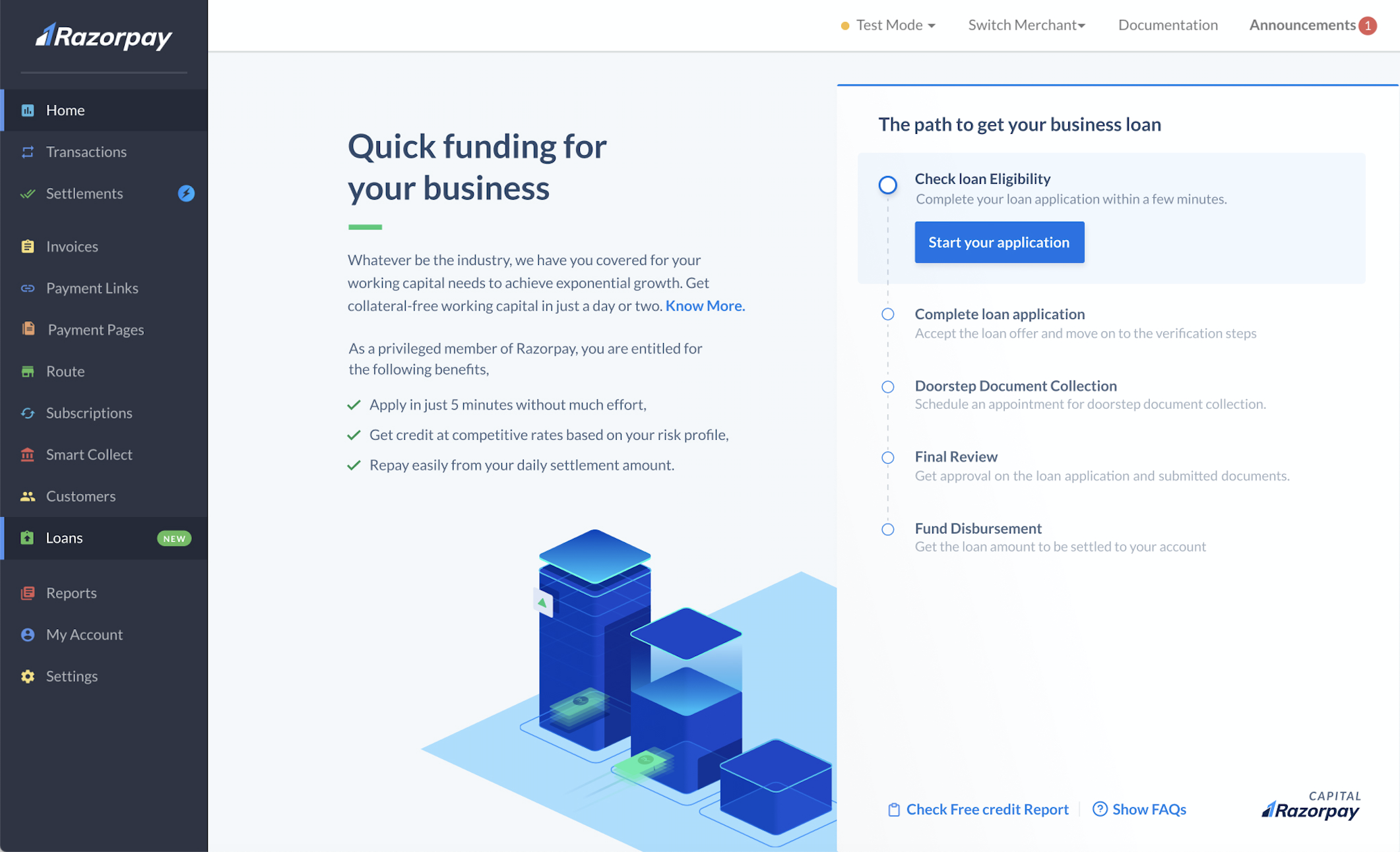

Log into the Dashboard with your credentials.

-

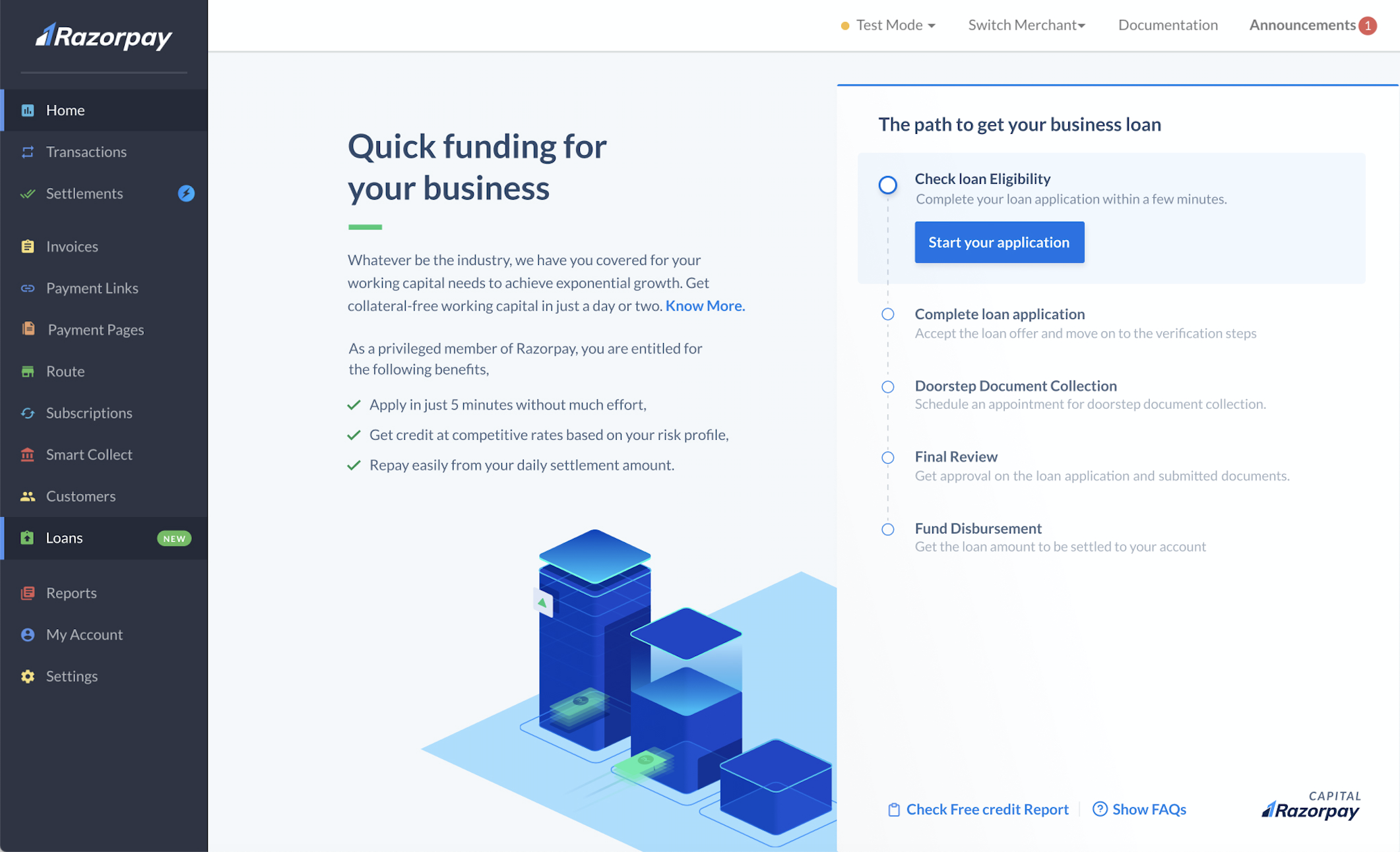

On the left panel, browse to the Loans tab. Click Start your application button under Check your loan eligibility section to initiate the Business Loan Application process.

-

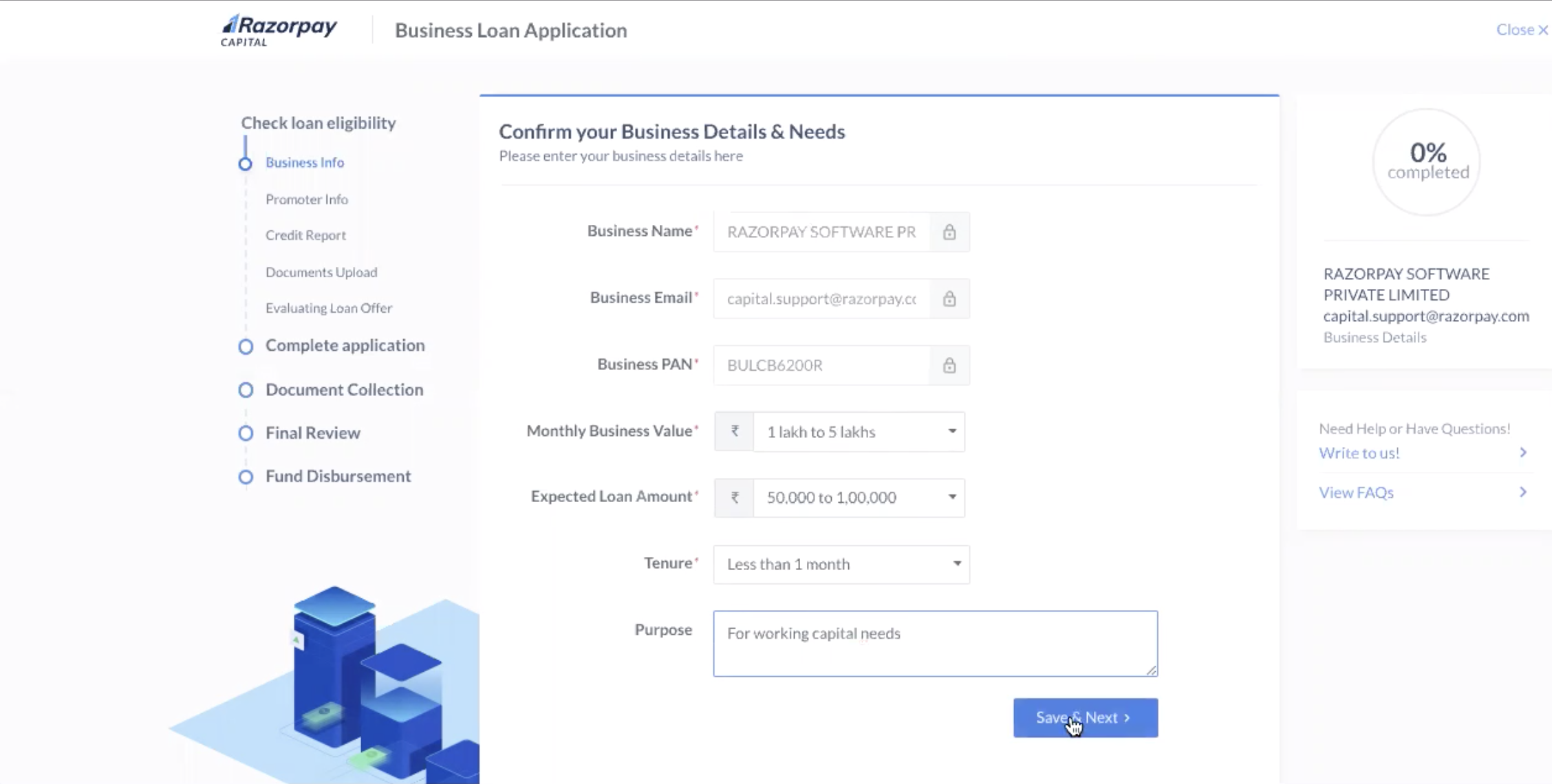

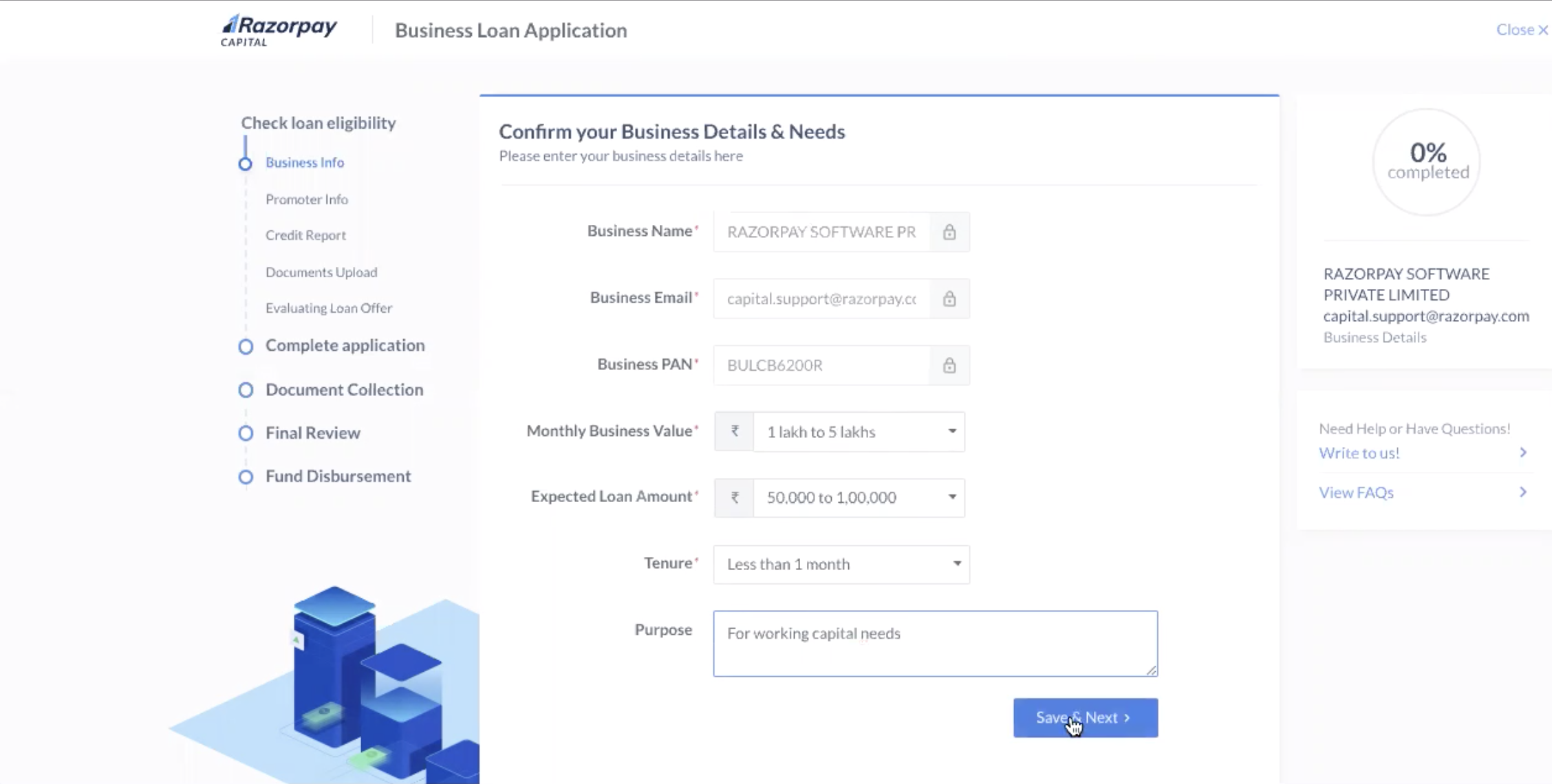

In the Business Info section, apart from the pre-filled basic details, you must select appropriate loan requirement details, such as Monthly Business Value, Expected Loan Amount, Tenure and Purpose. Click Save & Next.

-

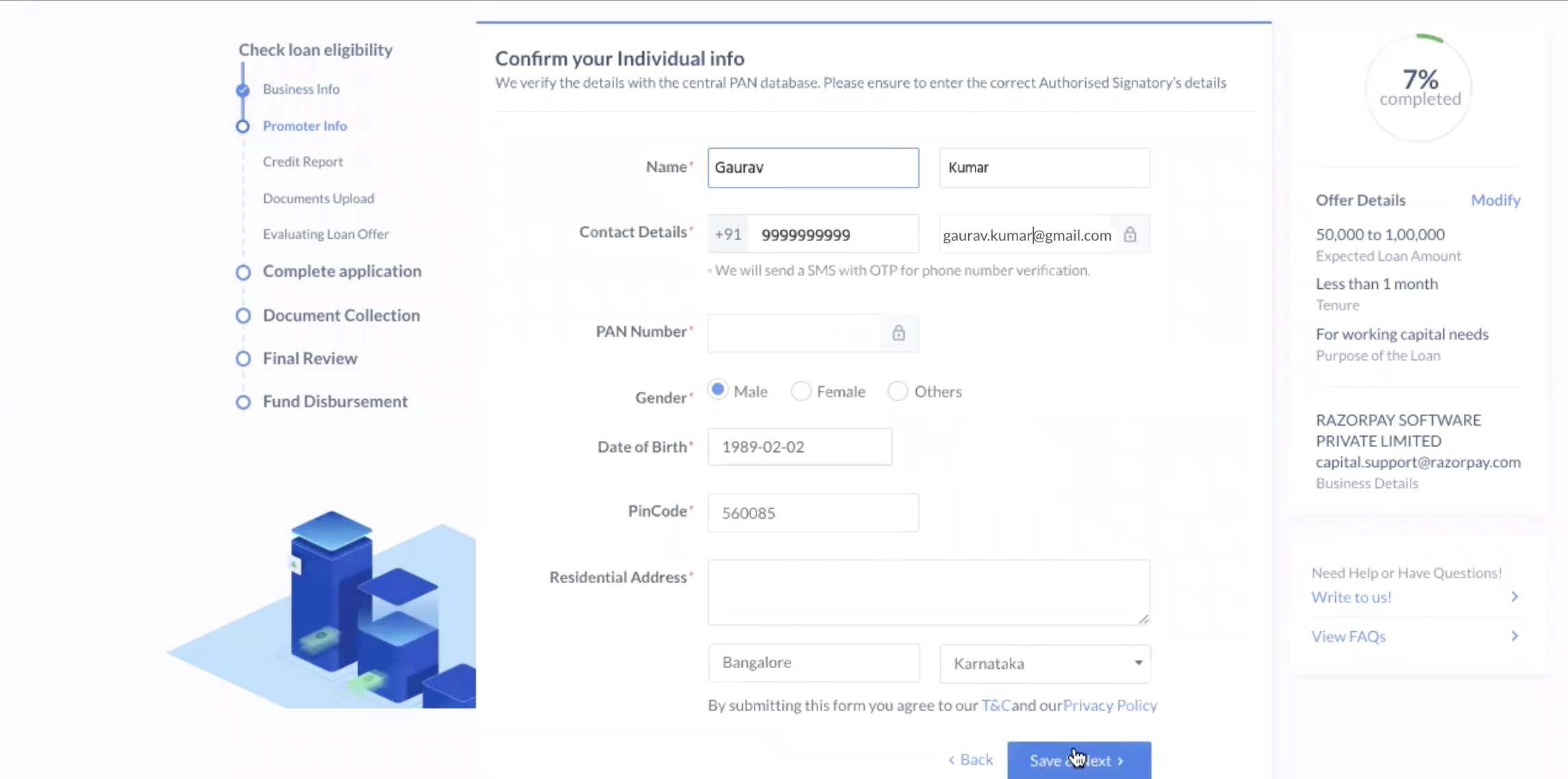

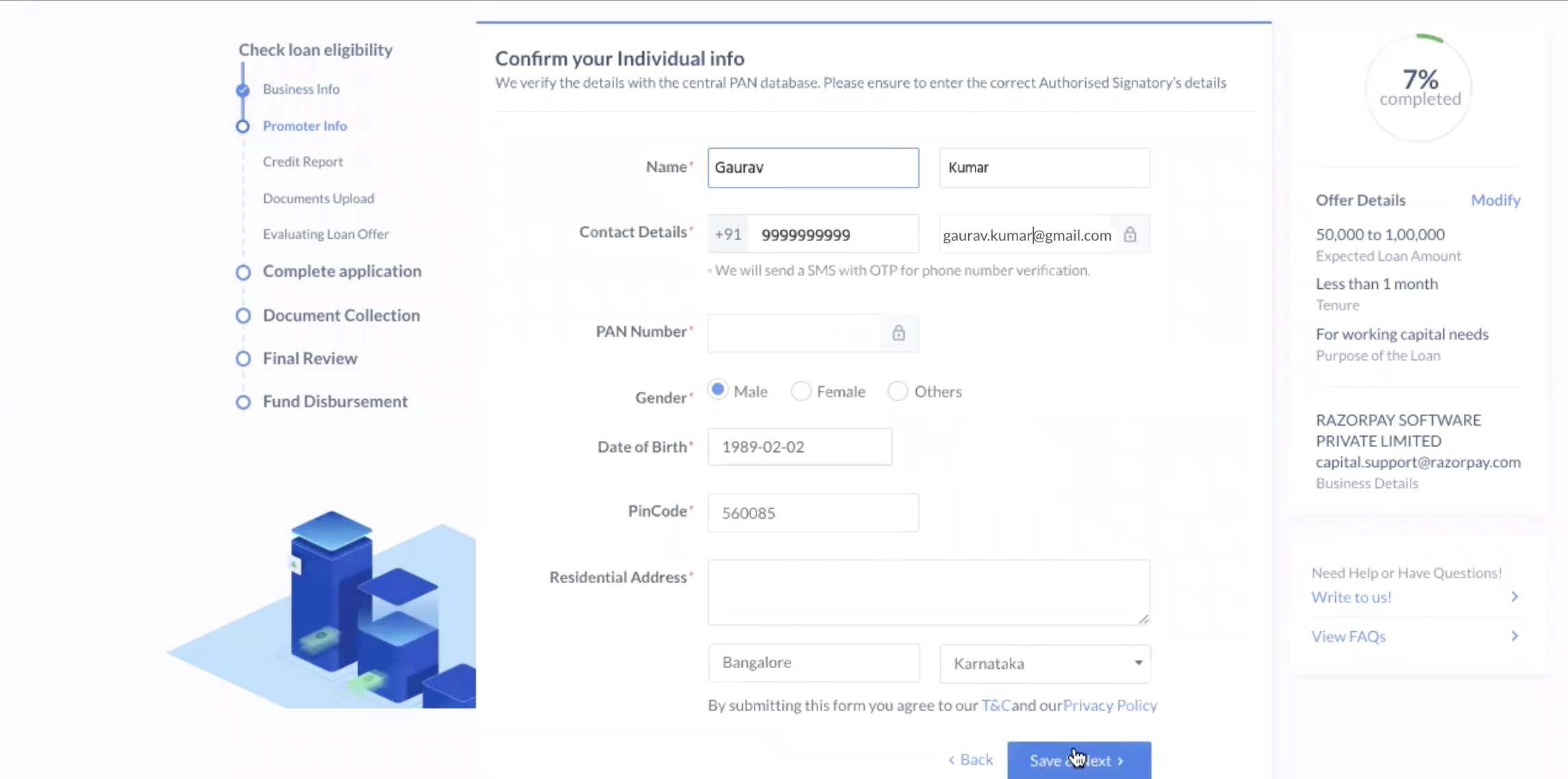

On the Promoter Info section, you are required to provide the Authorized Signatory's details. This information will be verified with central PAN database as it will be used to pull the credit report on your behalf. Read through the Terms and Conditions and click Save & Next.

Watch Out!

The phone number you enter here must be the same as the phone number linked to your PAN.

-

Click Modify (in the right panel) to modify the offer details.

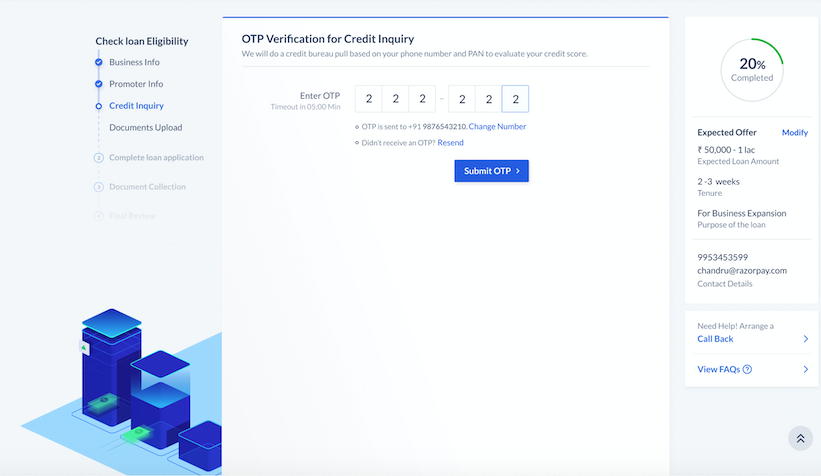

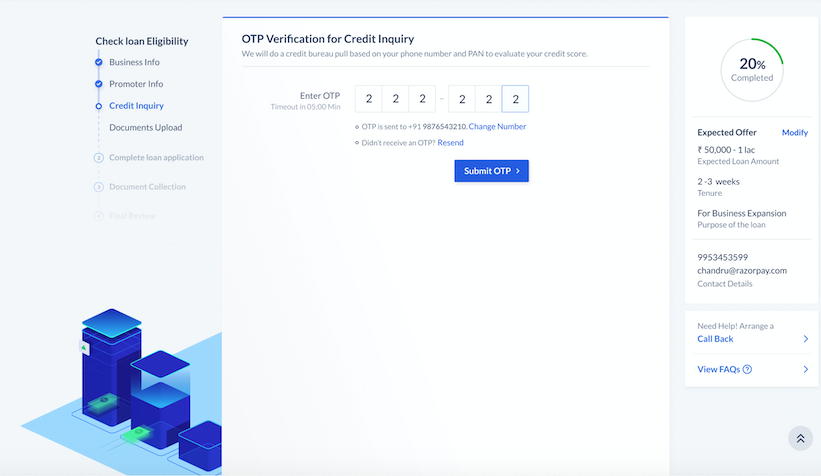

We need your credit score to make you a loan offer. We use your phone number and PAN to fetch your credit score.

-

On the Credit Report section, enter the OTP sent your phone number and click Submit OTP. This authorizes us to view your credit score.

-

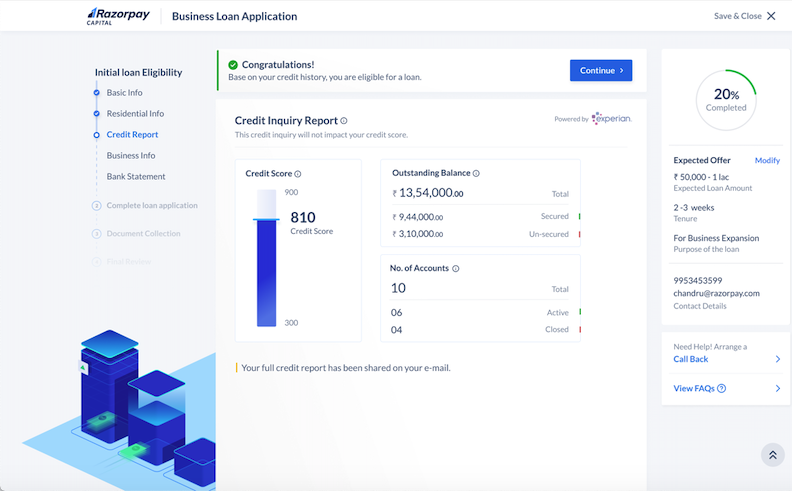

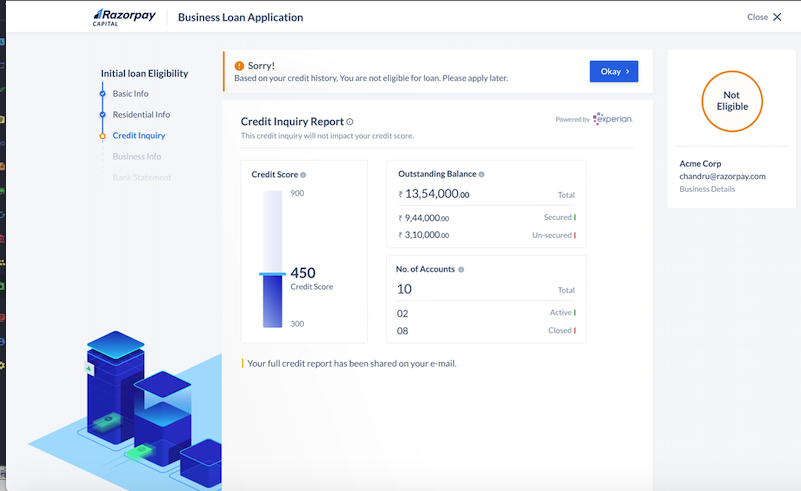

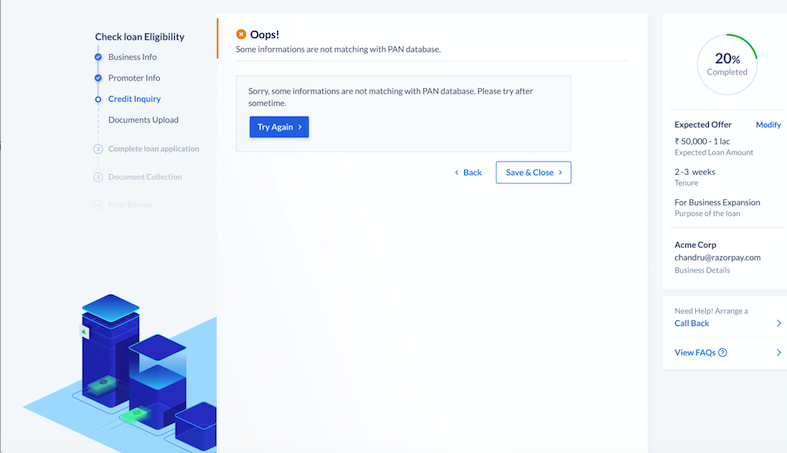

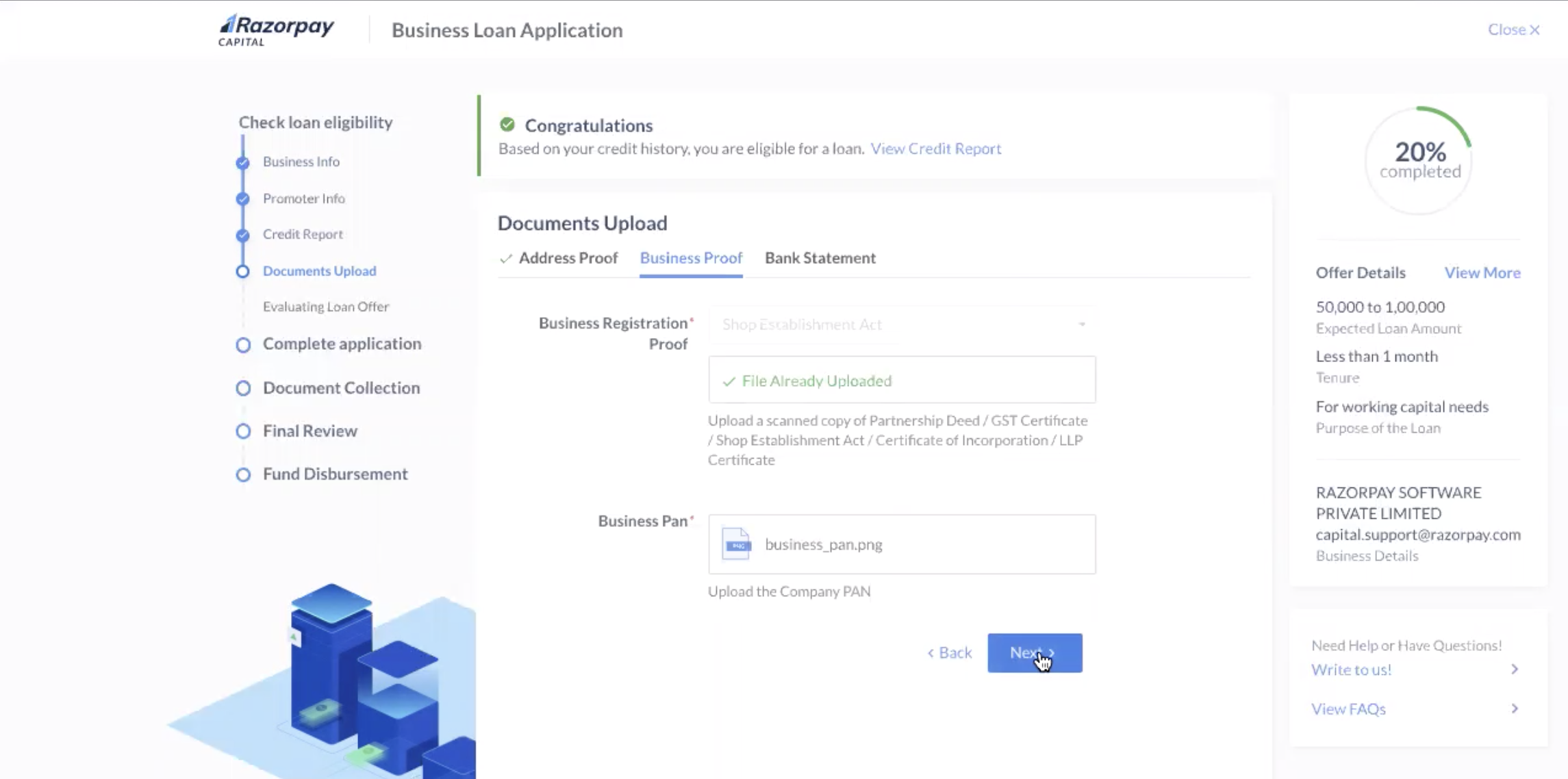

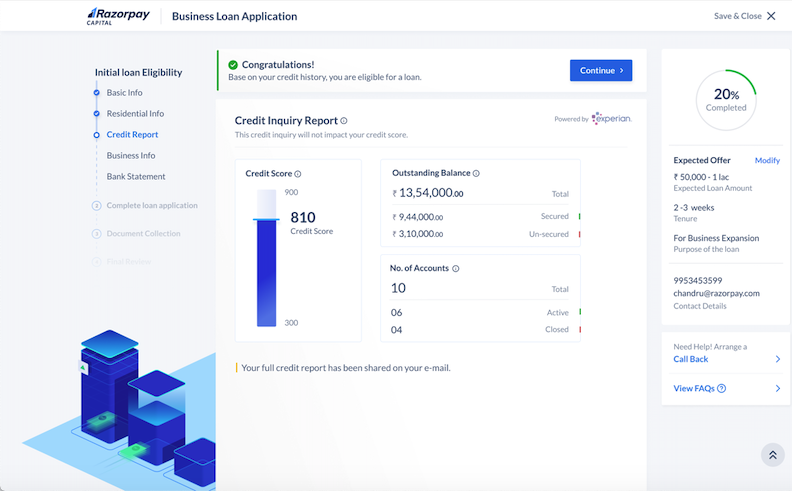

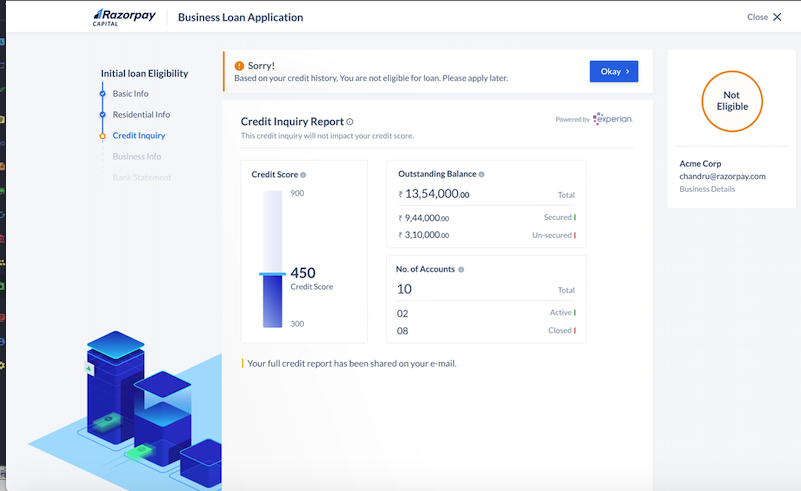

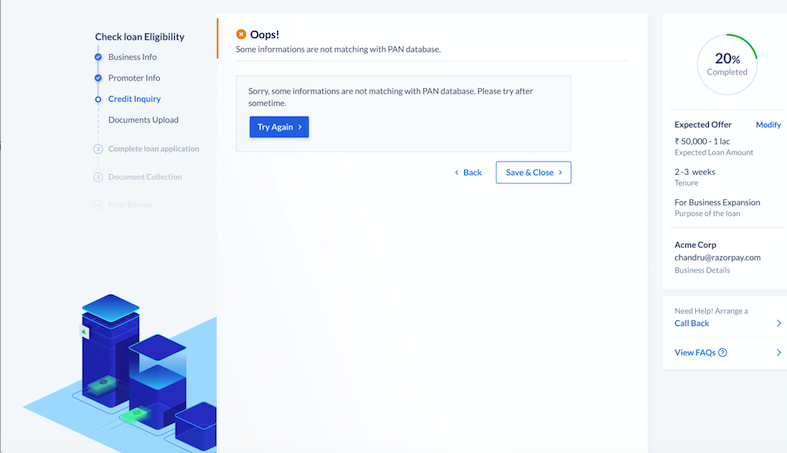

You can view your full credit report onscreen. The report is also sent to the email address you provided. Based on your credit history, we send you the loan offer status, that is:

- Eligible for the loan: The loan offer is approved. Click Next.

- Not eligible for the loan: The loan offer is rejected.

- Information Mismatch: There is a mismatch between the information provided and the information in the central PAN database. Click Try Again, which navigates you to the Check your loan Eligibility section. Click Continue applying and update the information so it matches data in the central PAN database.

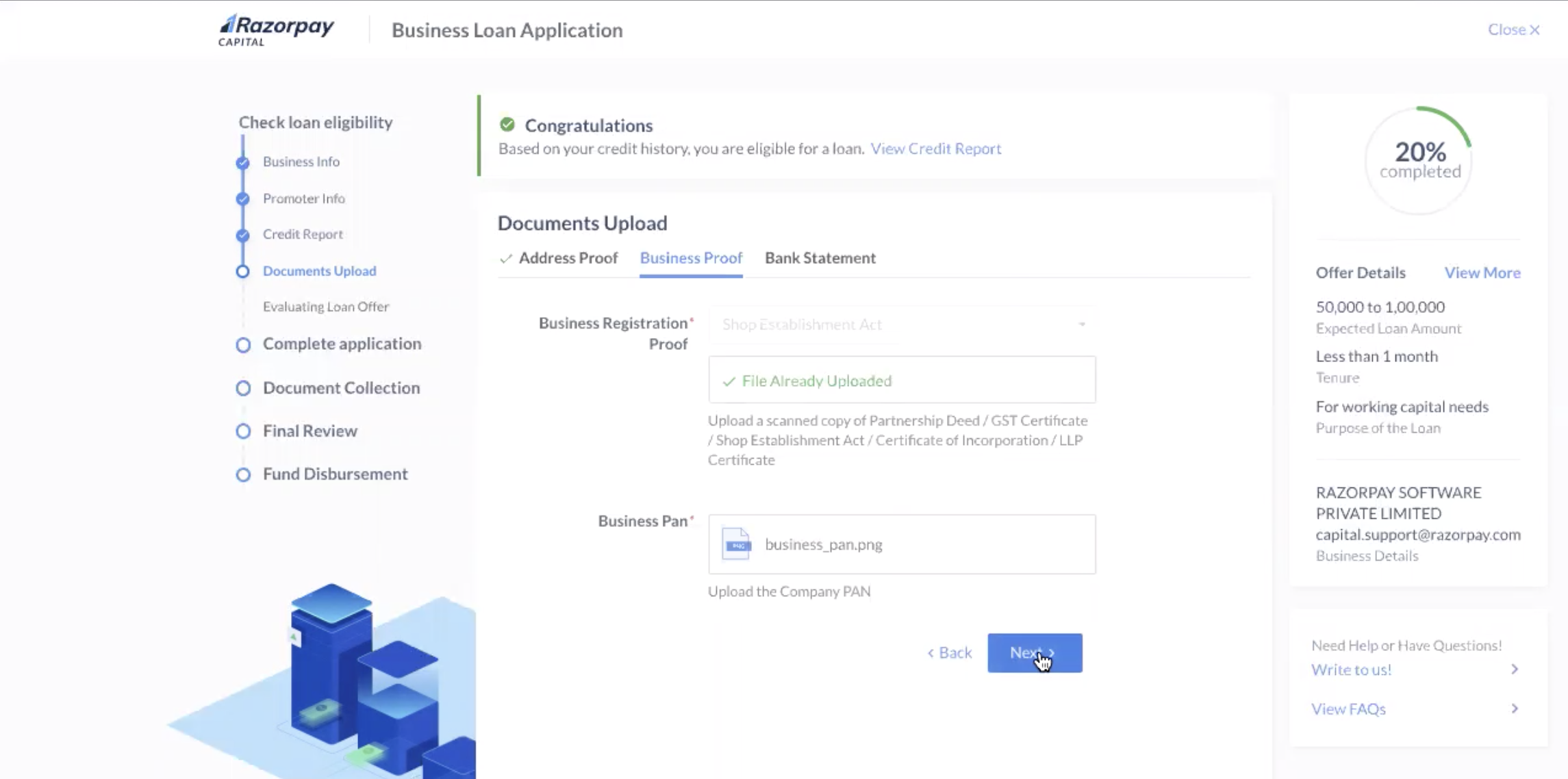

As part of the KYC verification, you need to submit documents including Address Proof, Business Proof and Bank Statements to Razorpay via the Documents Upload section.

Handy Tips

The KYC documents submission will depend on the business type such as Private Limited, Proprietorship, Partnership, Individuals, Public, LLP or Trusts, Societies & NGO.

- On the Address Proof tab, upload PDF copies of business documents such as Authorized Signatory's Address Proof and Business Owner PAN.

- On the Business Proof tab, upload PDF copies of business documents such as Business Registration Proof and Business PAN.

- On the Bank Statement tab, upload PDF copy of your last 6 months' Bank Account statement for us to evaluate your business transactions.

Once you upload the required documents, click Next.

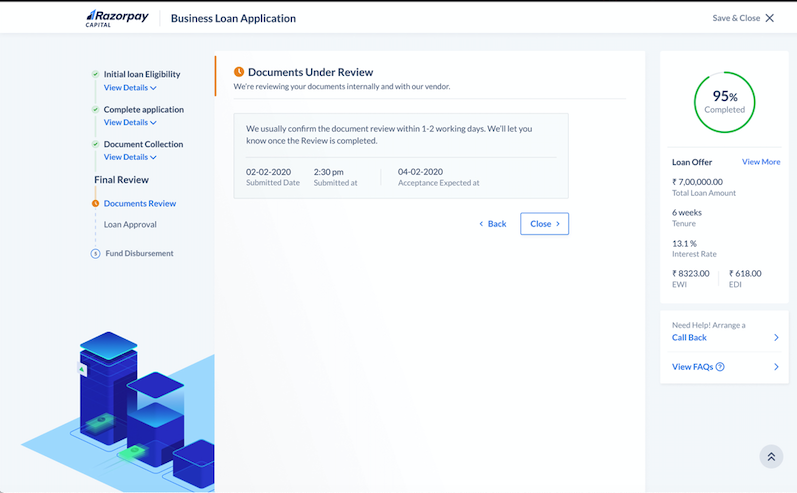

Razorpay starts the review process to evaluate the loan offer.

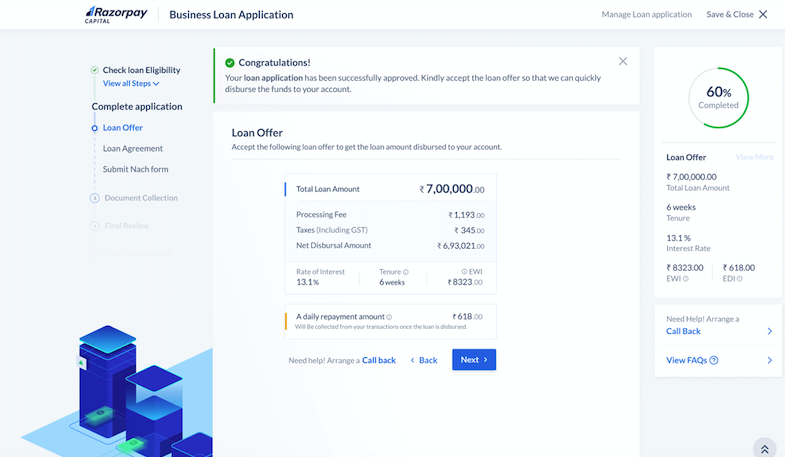

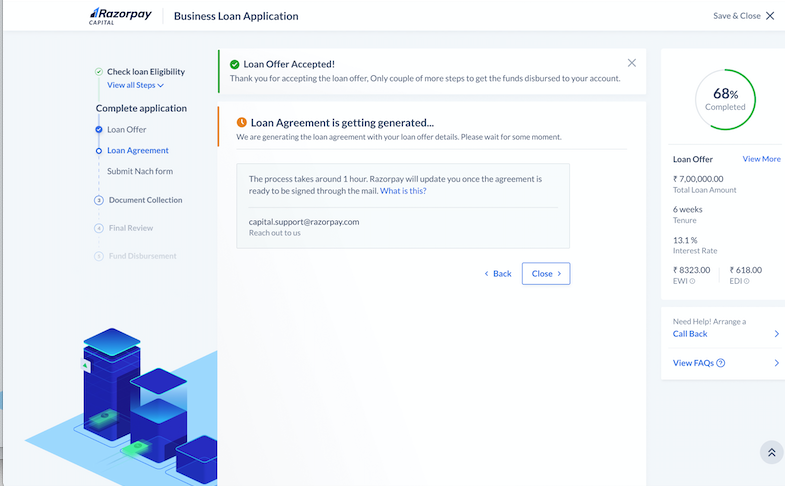

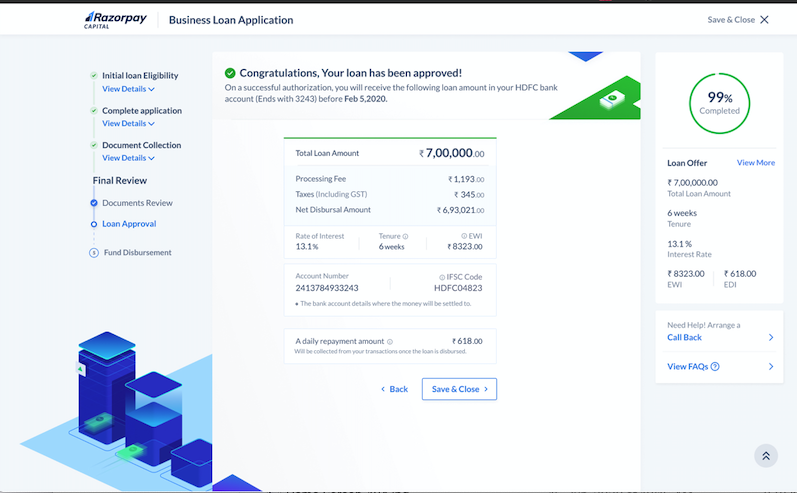

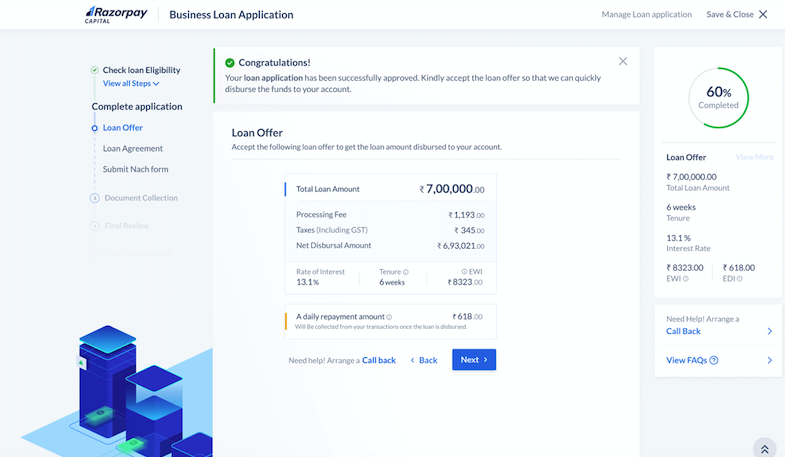

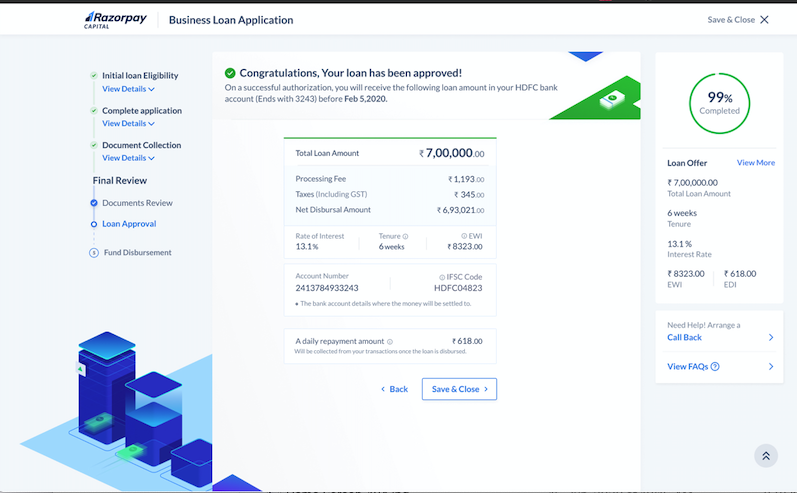

Once your loan is approved, you can see the actual approved loan amount that will get disbursed to your account as well as the charges that will apply in the Loan Offer section.

Click Accept Offer if you agree with the sanctioned amount and charges.

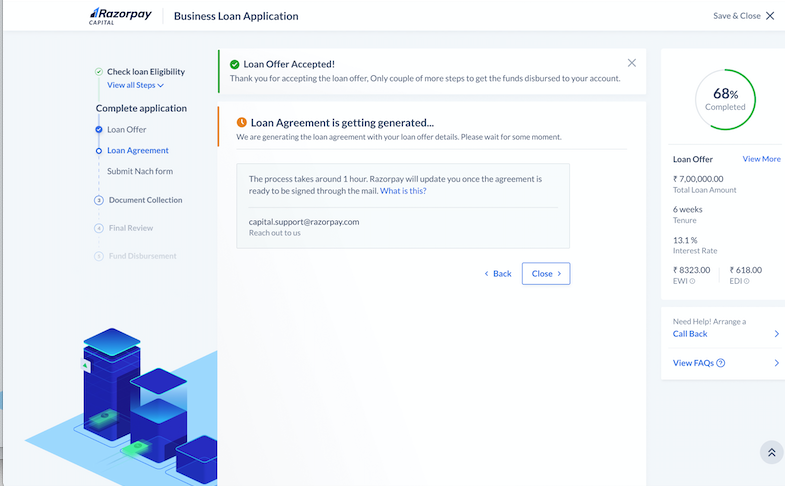

We generate and upload the loan agreement on the Loan Agreement tab. The loan agreement is also sent to you via email for you to sign.

Click Sign Loan Agreement to e-sign the legal agreements and click Next.

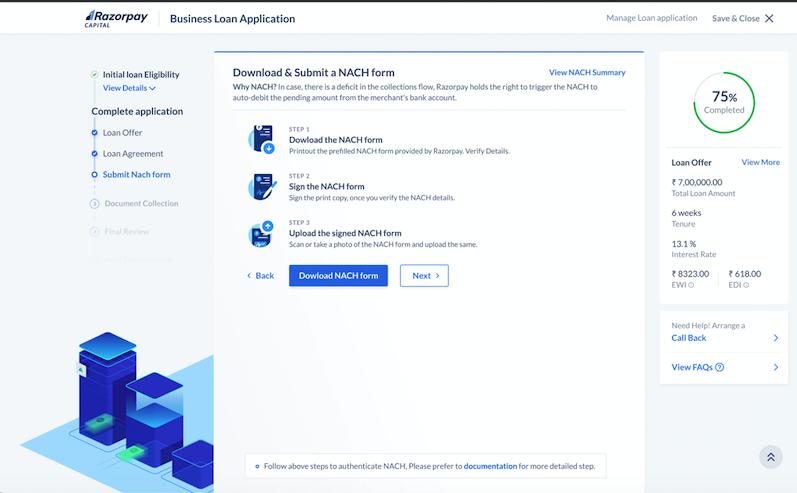

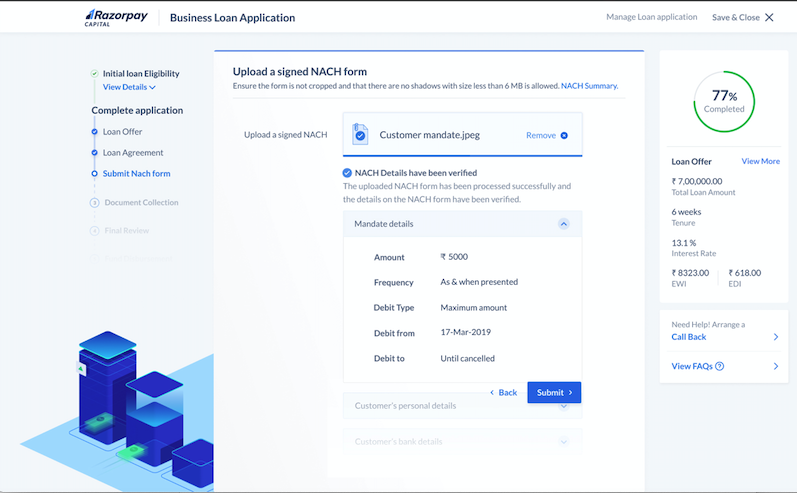

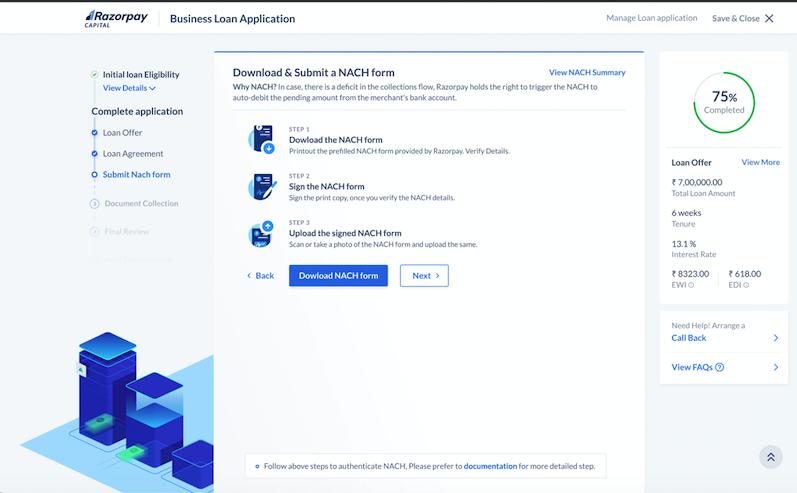

Once you have agreed to the final loan amount and the agreement is signed, a pre-filled NACH form is generated on the Submit NACH form section. You receive an email and SMS with the link to the pre-filled NACH form.

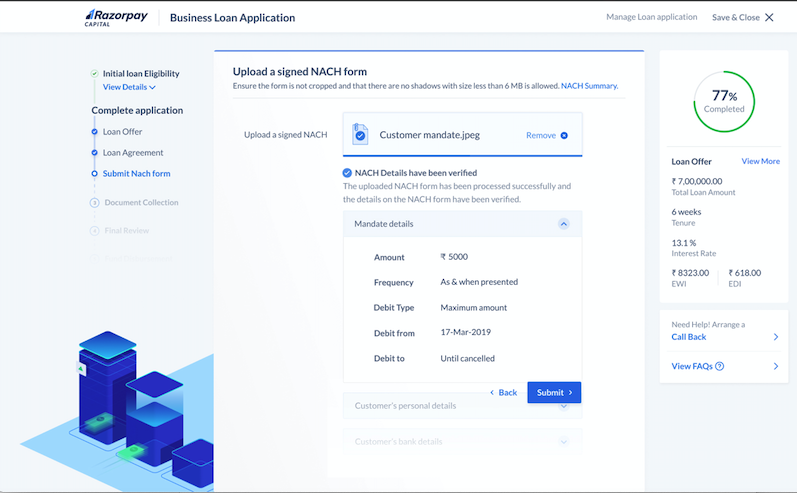

Click the link, download, print and sign the NACH form. Use the same link to upload the signed form as a PDF file and click Submit.

The details on the uploaded NACH form will be verified and you will be updated via email.

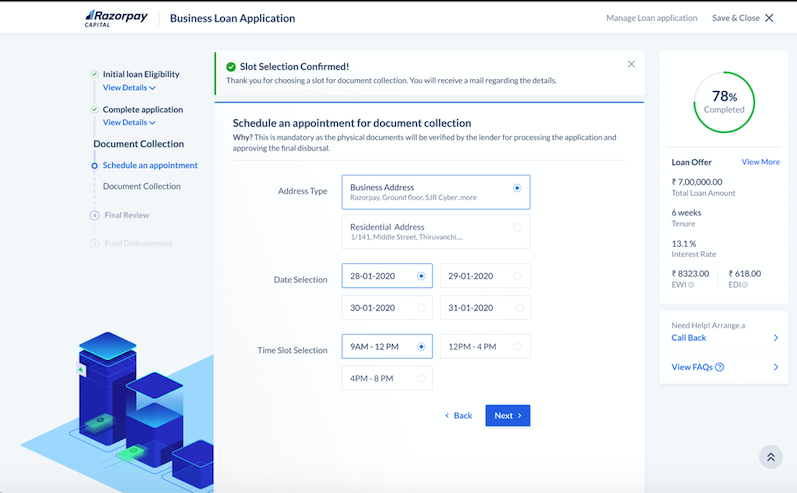

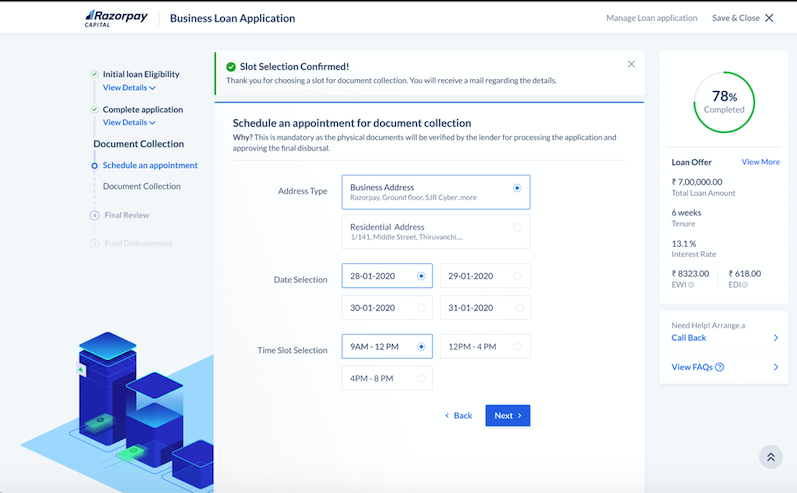

Once the NACH form is submitted, you must select a slot (date and time) and schedule an appointment for the document collection to be done. Click Next.

A representative will be sent to collect your documents, including Proof of Address Individual, Business KYC, NACH, PDC and Loan Agreement. The collated documents will have to be sent to the lender for validation for a final loan approval followed by loan amount disbursal.

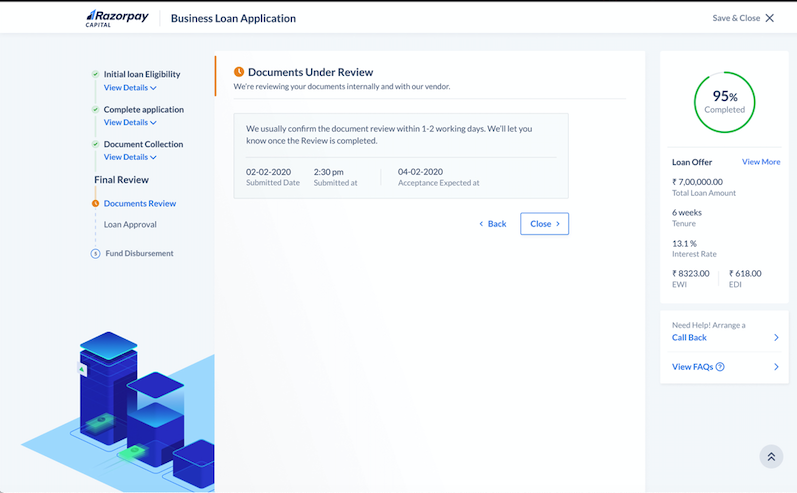

This is mandatory as the lender will verify the documents and approve/reject the loan. In either case, a call will go to you for a final confirmation about the disbursement of the loan amount. This process will take around 1-2 days.

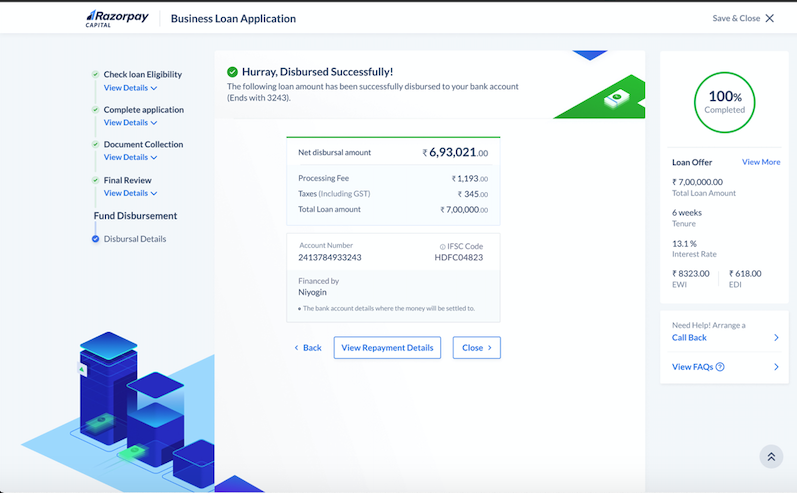

On a successful authorization, your loan offer will be approved.

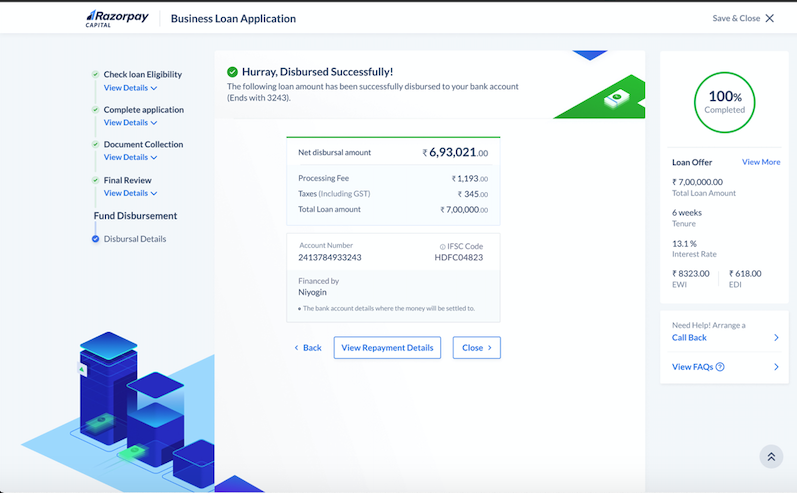

The lender will disburse the net disbursal amount to your bank account and notify us about the same so we can start tracking the collections.