Smart Collect

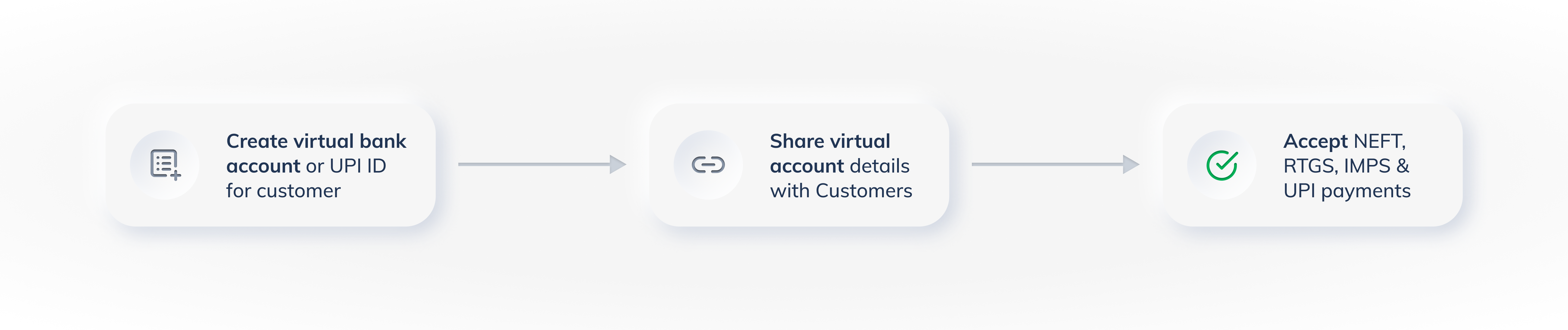

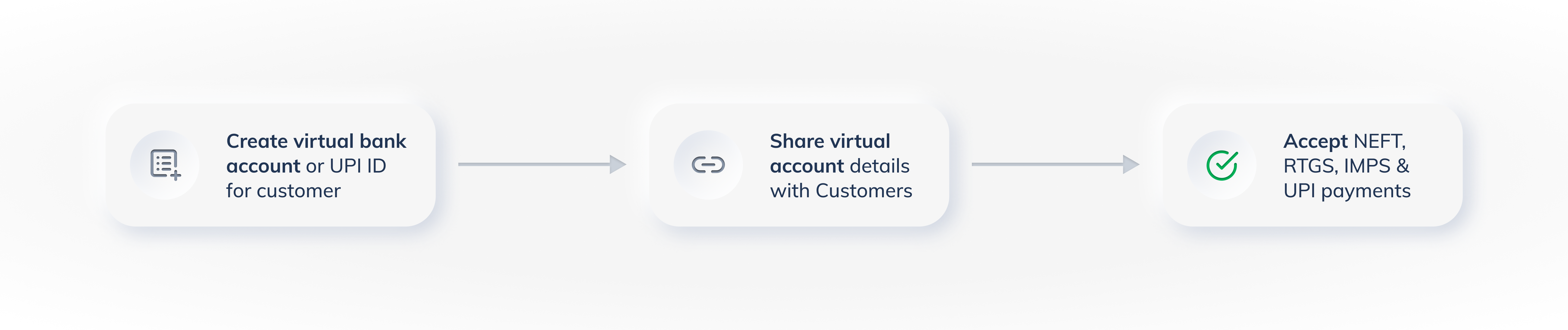

Create virtual bank accounts and UPI IDs on-demand for customers to pay via NEFT, RTGS, IMPS and UPI using Smart Collect.

For years, businesses have been collecting large payments from customers in the form of bank transfers. While collecting payments is easy, the reconciliation is a tough task as it is prone to human errors and increases administrative costs.

With Smart Collect, you can generate virtual bank accounts and virtual payment addresses (UPI IDs) on-demand and share the details with customers to accept payments via NEFT, RTGS, IMPS and UPI. These virtual bank accounts and UPI IDs are linked to the bank account you have registered with Razorpay.

Since a new virtual bank account or UPI ID can be created for each customer, you can easily track payments made by them. Razorpay notifies you of payments made to any of your accounts or UPI IDs and also handles the complexity of reconciling these payments on your behalf.

Handy Tips

Payments made using Smart Collect largely follow existing Razorpay payment flow. If you are new to Razorpay, it is recommended to understand this flow before you proceed to read the document.

Third Party Validation

Smart Collect also supports Third Party Validation. To know more, refer to the Third-Party Validation (TPV) section.

-

Instant Creation

Generate virtual bank accounts and virtual UPI IDs in real-time via Razorpay Dashboard and APIs.

-

Personalization

Create custom UPI IDs to match your business needs and branding. For example, rpy.acmecellno8449472988@icici and rpy.acmevendorakashkumar@icici.

-

Multiple Payment Avenues

Enable customers to make payments via NEFT, RTGS, IMPS and UPI.

-

Automatic Reconciliation

Eliminate the difficulty of manual reconciliation and save time and cost.

-

Account-level Visibility

View and manage every payment received from customers.

-

Real-time Notifications

Get real-time notifications on payments with Webhooks.

Here are some examples of how Smart Collect enables you to accept payments.

-

Single, large one-time payments

If you want to accept a single, large one-time payment from a customer (preferably via NEFT, RTGS, IMPS or UPI), you can create a virtual bank account or UPI ID and share the generated account details (account number and IFSC) or UPI ID. When the customer makes the payment to this account or UPI ID, Razorpay notifies you so that the account can be closed.

-

Regular payments of large volume

If you want to send customers regular invoices for payments of large volume, you can create a virtual bank account or UPI ID for them and share the details, the customer can add:

- The bank account as a beneficiary on their preferred netbanking portal and transfers the money using NEFT, RTGS or IMPS

- The UPI ID on their UPI payment service provider app such as Google Pay and transfers the money using UPI.

Razorpay notifies you every time a payment is made towards the account, thus simplifying the reconciliation process.

-

Campaign or event-based payment

If you want to accept several payments from multiple sources for a range of campaigns or events, you can use Smart Collect to create a virtual bank account or UPI ID for each campaign and share details accordingly. For every payment made towards any of these accounts or UPI ID, Razorpay notifies you of the account or UPI ID used, thus eliminating the need to identify which campaign the payment was made for.

-

Single Virtual Account, Multiple Customers

If you want to accept payments from multiple customers using a single virtual account, you can create a virtual account and share the details. Customers can make payments to the same virtual account. You can reconcile the payments using our webhooks and reports.

- Ensure that you do not fall under the

Unregistered merchant category as Smart Collect is not available for this Merchant Category Code (MCC).

- Read and understand the pricing model and have the API documentation for Smart Collect handy.

- Ensure that the business use case is well charted. Smart Collect supports many customers - one account and many customers - many accounts models.

- Raise a request through a Point of Contact (POC) or the Razorpay Dashboard to enable Smart Collect for your account.

- Raise a request through a Point of Contact (POC) or the Razorpay Dashboard to enable Smart Collect TPV for your account.

- Do check the list of banks which support Smart Collect with TPV.