Advance Tax Payments

Make advance tax payments using the RazorpayX Tax Payment app.

Advance tax is the amount of income tax that is paid much in advance rather than a lump-sum payment at the year-end. Also known as earn tax, advance tax is to be paid in installments as per the due dates decided by the income tax department.

Both individuals as well as businesses are liable to pay advance tax if their tax liability is greater than or equal to INR 10,000 post TDS payment in a fiscal year.

Watch this short video on using RazorpayX Dashboard to make Advance Tax payments:

Tax Schedule🔗

The table below gives you the advance tax schedule mandated by the Government of India.

Tax Installment | Due Date | Amount of Tax Payable |

|---|---|---|

1 | Either on or before 15th of June | At least 15% of the advance tax liability |

2 | Either on or before 15th of September | At least 45% of the advance tax liability |

3 | Either on or before 15th of December | At least 75% of the advance tax liability |

4 | Either on or before 15th of March | 100% of tax liability |

Set Up Advance Tax🔗

To set up Advance Tax:

- Log into your RazorpayX Dashboard.

- Navigate to Menu → Tax Payments.

- Tab across to Advance Tax.

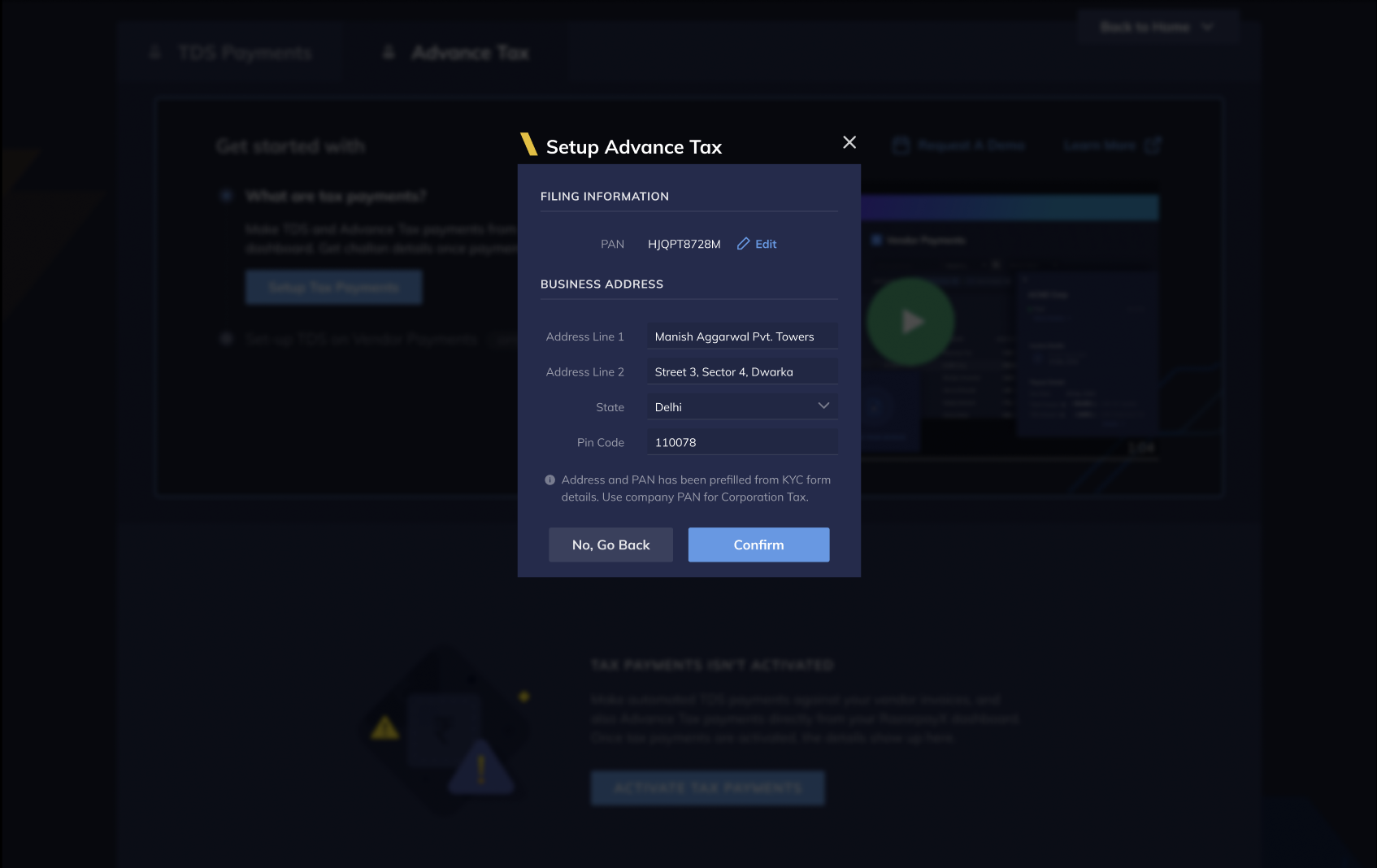

When using the Advance Tax feature for the first time, you must setup advance tax by confirming your PAN details, business address, both of which are automatically populated using your KYC details. This is a one-time process only. Here is a sample Setup Advance Tax screen:

Create Advance Tax Payout🔗

To create a payout for Advance Tax:

-

In the Advance Tax Payment window, click + Advance Tax.

-

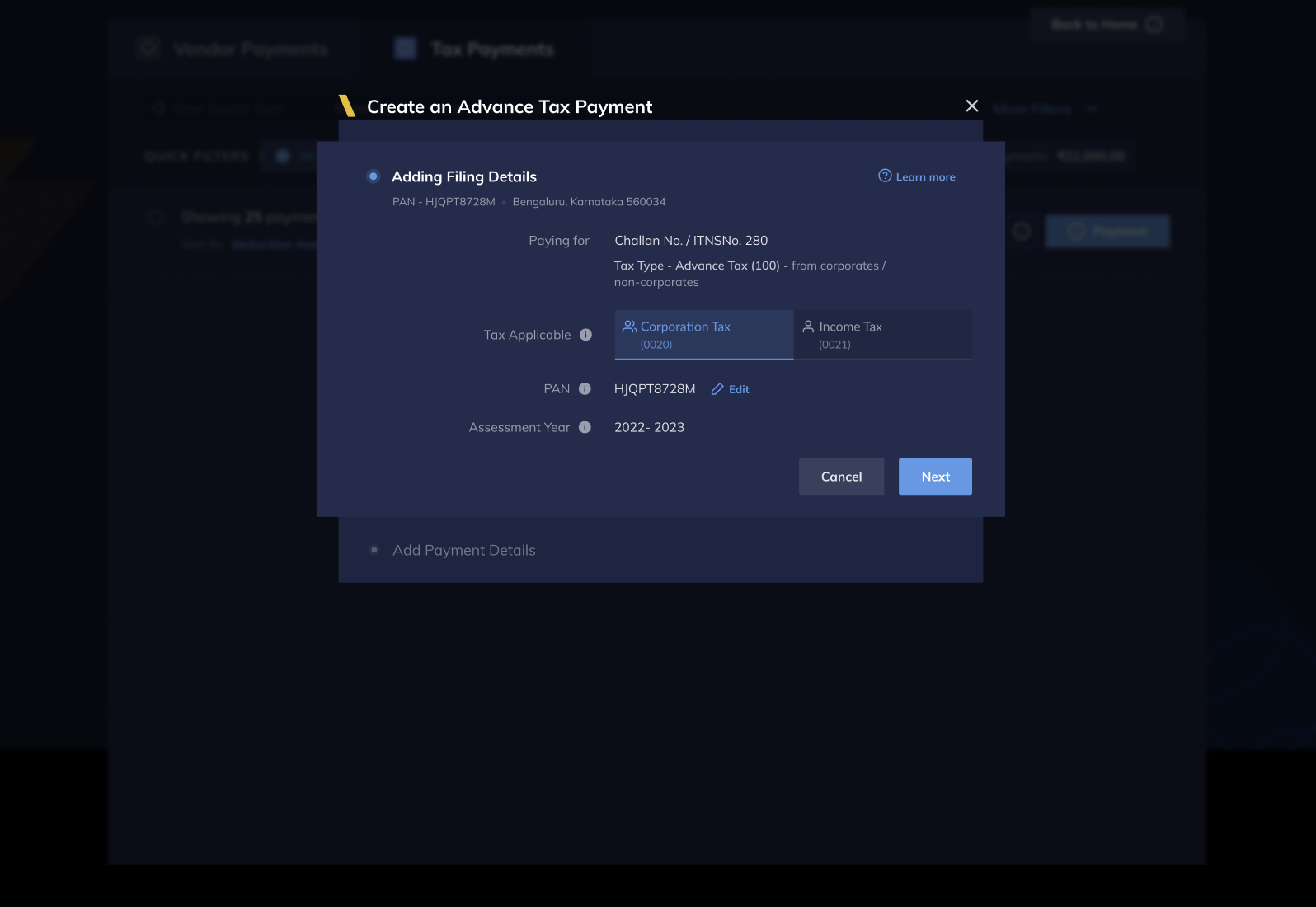

Confirm details for tax filing in the Adding Filing Details window as shown below:

-

Click Next.

-

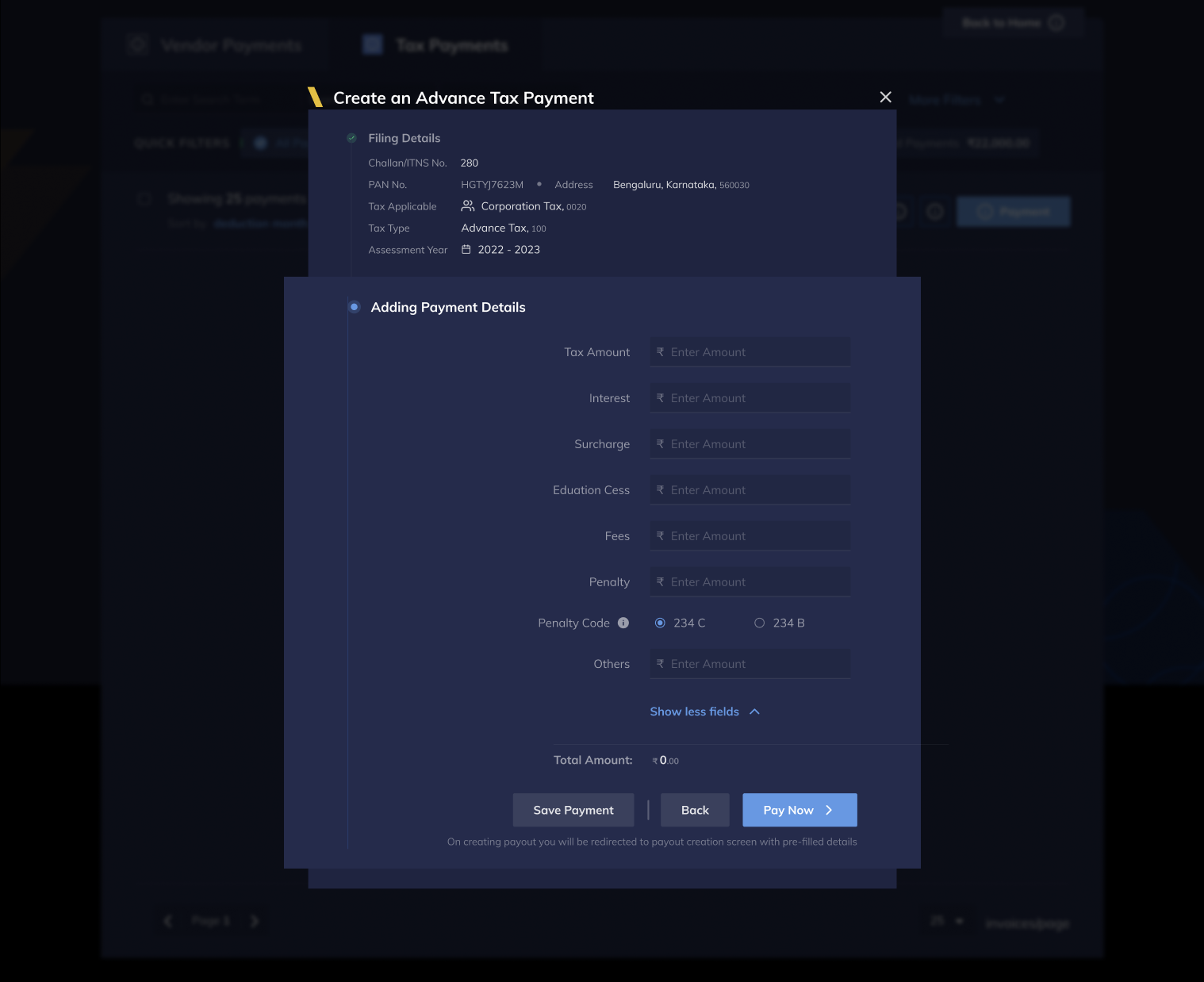

Add tax amount to be paid. You can enter break-up of the tax amount by using the Show all fields drop-down menu.

-

Click Save Payment to save the payment, or click Pay Now to proceed to making the payment.

-

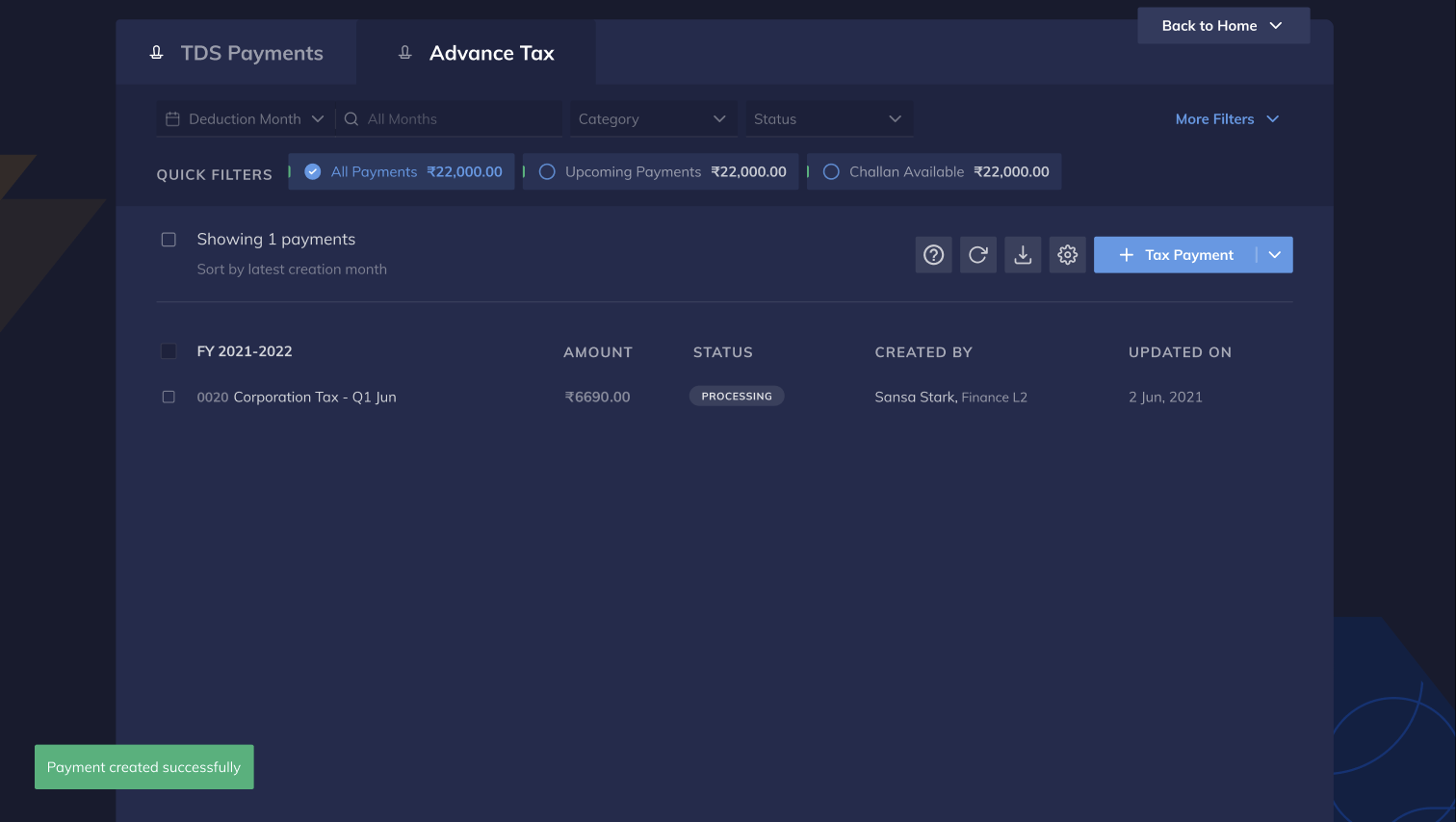

If you select Save Payment then, enter OTP to verify and click CREATE PAYOUT to save the payout. The payout is created and is listed in the Advance Tax screen as shown below:

-

If you select Pay Now, then enter OTP to verify and confirm the payment in case of making the payment.