The first transaction needs to go through the 2FA process. Further charges can be made automatically, without 2FA.

Methods

| Authorization

|

|---|

Debit cards

| OTP/3D secure

|

Credit cards

| OTP/3D secure

|

UPI

| UPI PIN

|

Emandate

| NetBanking

|

|

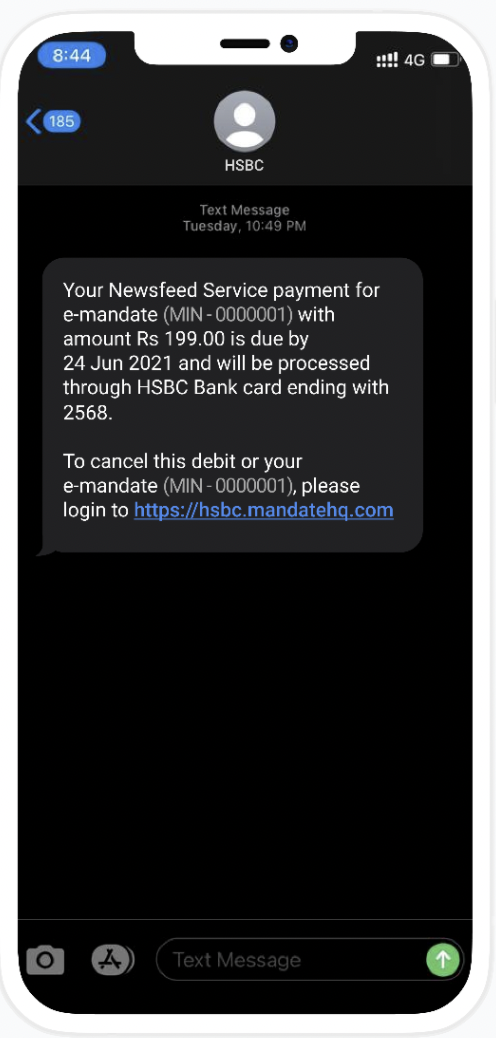

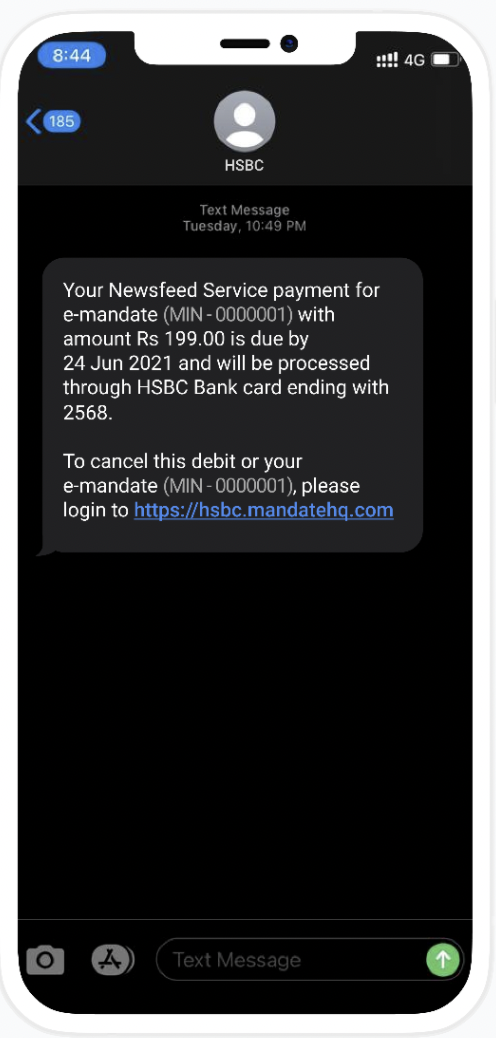

Some customers may receive such messages from the bank for subscription transactions. However, there is no need to worry about it as this communication is for information only. We assure you that all transactions on Razorpay are authorized as per RBI compliance.

We support Subscriptions for a maximum duration of 100 years. The number of billing cycles depends if the subscription is billed daily, weekly, monthly or yearly.

We support Subscriptions for a maximum duration of 100 years. The number of billing cycles depends if the subscription is billed daily, weekly, monthly or yearly.

We support Subscriptions for a maximum duration of 100 years. The number of billing cycles depends if the subscription is billed daily, weekly, monthly or yearly.

No. You do not need to capture the ₹5 token authorization payment used to validate a customer's card/UPI ID. This amount is auto-refunded to the customer.

No. You do not need to capture payments made for a Subscription. Upfront amount and subsequent charges are auto-captured.

Watch Out!

The payment will not be captured if you cancel the Subscription before it gets authorized.

Yes. You can update details such as the plan amount, duration and quantity of a Subscription, even if it is live. Refer to the Update Subscription section for more details.

Note: You can only update a Subscription authorized using cards. Currently, you cannot update Subscriptions authorized via UPI and Emandate.

Yes. Refer to the Add-ons section for more details.

Note: Currently, add-ons are only available for Subscription authorized using cards. Add-ons are not available for subscriptions authorized via UPI.

Method

| Merchant

| Customer

|

|---|

Debit Cards

| ✓

| x

|

Credit Cards

| ✓

| x

|

UPI

| ✓

| ✓

|

Emandate

| ✓

| x

|

|

Note: For UPI Subscriptions, you cannot resume a Subscription paused by your customer. If your customer pauses a Subscription, only they can resume it.

Subscriptions in the active state can be paused. You cannot pause a Subscription in any other state. Refer to the life cycle section for more details.

You can pause a Subscription:

Your customer can pause Subscriptions authorized via UPI from their UPI app.

Method

| Merchant

| Customer

|

|---|

Debit Cards

| ✓

| x

|

Credit Cards

| ✓

| x

|

UPI

| ✓

| ✓

|

Emandate

| ✓

| x

|

|

Note: For UPI Subscriptions, you cannot resume a Subscription paused by your customer. If your customer pauses a Subscription, only they can resume it.

You can resume a Subscription:

No. You cannot resume a Subscription paused by your customer. Only your customer can resume such Subscriptions.

Your customer can resume Subscriptions authorized via UPI from their UPI app.

Yes. You can cancel a Subscription:

Your customer can cancel only those subscriptions that are authorized via UPI from their UPI app.

The following payment methods are available for Subscriptions:

- Credit Cards

- Debit Cards

Watch Out!

Bank downtime can affect success rates when processing recurring payments via debit cards.

- UPI (early access)

- Emandate (limited access)

Follow these steps to enable or disable payment methods (Cards and UPI):

- Log into the Razorpay Dashboard.

- Navigate to Subscriptions → Settings.

- Configure the payment methods:

- Card: Enable this to accept recurring payments via cards for your subscriptions in any of our supported international currencies.

- UPI: Enable this to accept UPI payments when recurring charge is less than ₹5,000. Only INR is supported.

- eMandates (NetBanking): Enable this to accept recurring payments via Emandate (NetBanking) for your subscriptions. Only INR is supported.

Supported Applications

- PhonePe

- GooglePay (

okhdfcbank and okaxis)

- Paytm

- BHIM

- Amazon Pay

- IndusInd Bank App

Supported Banks

- Axis Bank

- Bank of Baroda

- Bank of India

- Canara Bank

- Capital Small Finance Bank

- Federal Bank

- HDFC Bank

- HSBC

- ICICI Bank

- IDBI Bank

- IDFC First Bank

- Indusind Bank

- Jio Payments Bank

- Karur Vysya Bank

- Kerala Gramin Bank

- North East Small Finance Bank

- Paytm Payments Bank

- Pragathi Krishna Gramin Bank

- Punjab and Sind Bank

- Punjab National Bank

- Rajkot Nagrik Sahakari Bank

- RBL

- Saraswat Co-operative Bank

- SBM Bank India Ltd

- Shivalik Small Finance Bank

- State Bank of India

- Suryoday Small Finance Bank

- Thane Janta Sahakari Bank

- Utkarsh Small Finance Bank

- Yes Bank Ltd

- Nainital Bank

- Patan Nagarik Sahakari Bank

- The Vijay Co-operative Bank

- The Adarsh Co-operative Urban Bank

- GP Parsik Sahakari Bank

- Capital Small Finance Bank

- Kotak Mahindra Bank

- Union Bank of India

- Indian Overseas Bank

- AU Small Finance Bank

Contact our support team to enable or disable a payment method for Subscriptions. This cannot be done from the Dashboard.

Contact our support team if a payment method is not available for Subscriptions on your account.

Businesses like yours can onboard customers and process recurring payments through debit, credit and prepaid cards of the following banks from October 1, 2021. Customers can now sign up for Subscription plans using their card details easily.

S.No

| Bank

| Debit Card

| Credit Card

| Prepaid

|

|---|

1

| HSBC

| N/A*

| ✓

| N/A*

|

2

| Equitas Small Finance Bank

| ✓

| N/A*

| N/A*

|

3

| City Union Bank

| ✓

| N/A*

| N/A*

|

4

| OneCard

| N/A*

| ✓

| N/A*

|

5

| Karur Vysya Bank

| ✓

| ✓

| N/A*

|

6

| Slice

| N/A*

| N/A*

| ✓

|

7

| Punjab National Bank

| N/A*

| ✓

| N/A*

|

8

| RazorpayX Corporate Cards

| N/A*

| ✓

| N/A*

|

9

| Niyo Global Card

| N/A*

| ✓

| N/A*

|

10

| Indian Overseas Bank

| ✓

| ✓

| N/A*

|

11

| Jupiter

| ✓

| N/A*

| N/A*

|

12

| Indian Bank

| ✓

| N/A*

| N/A*

|

N/A* - Bank does not support recurring payments via this method.

We are in the process of enabling cards of the following banks in the coming weeks. We will keep you posted on the same by updating this list.

- SBI

- ICICI Bank

- Axis Bank

- HDFC Bank

- YES Bank

- RBL

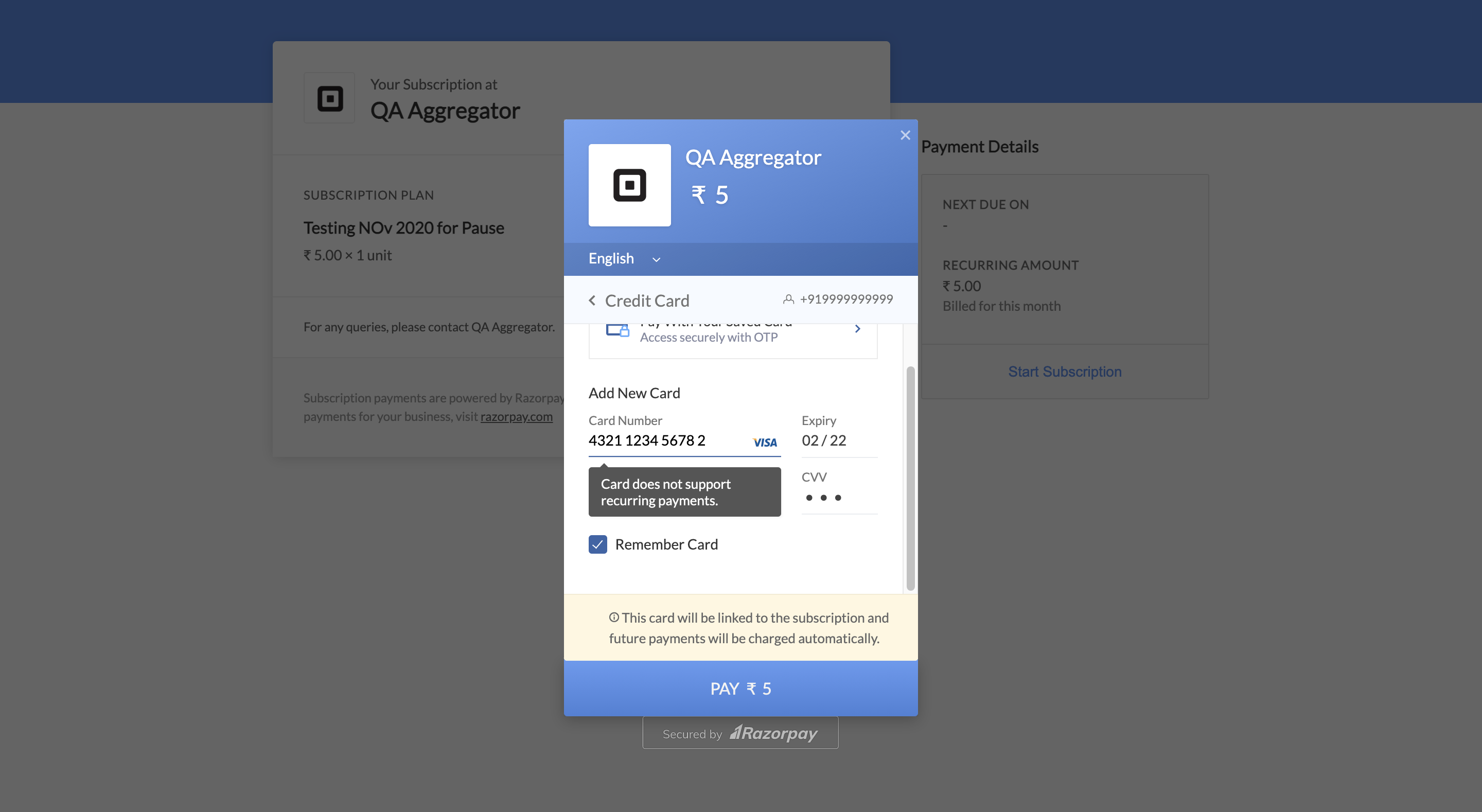

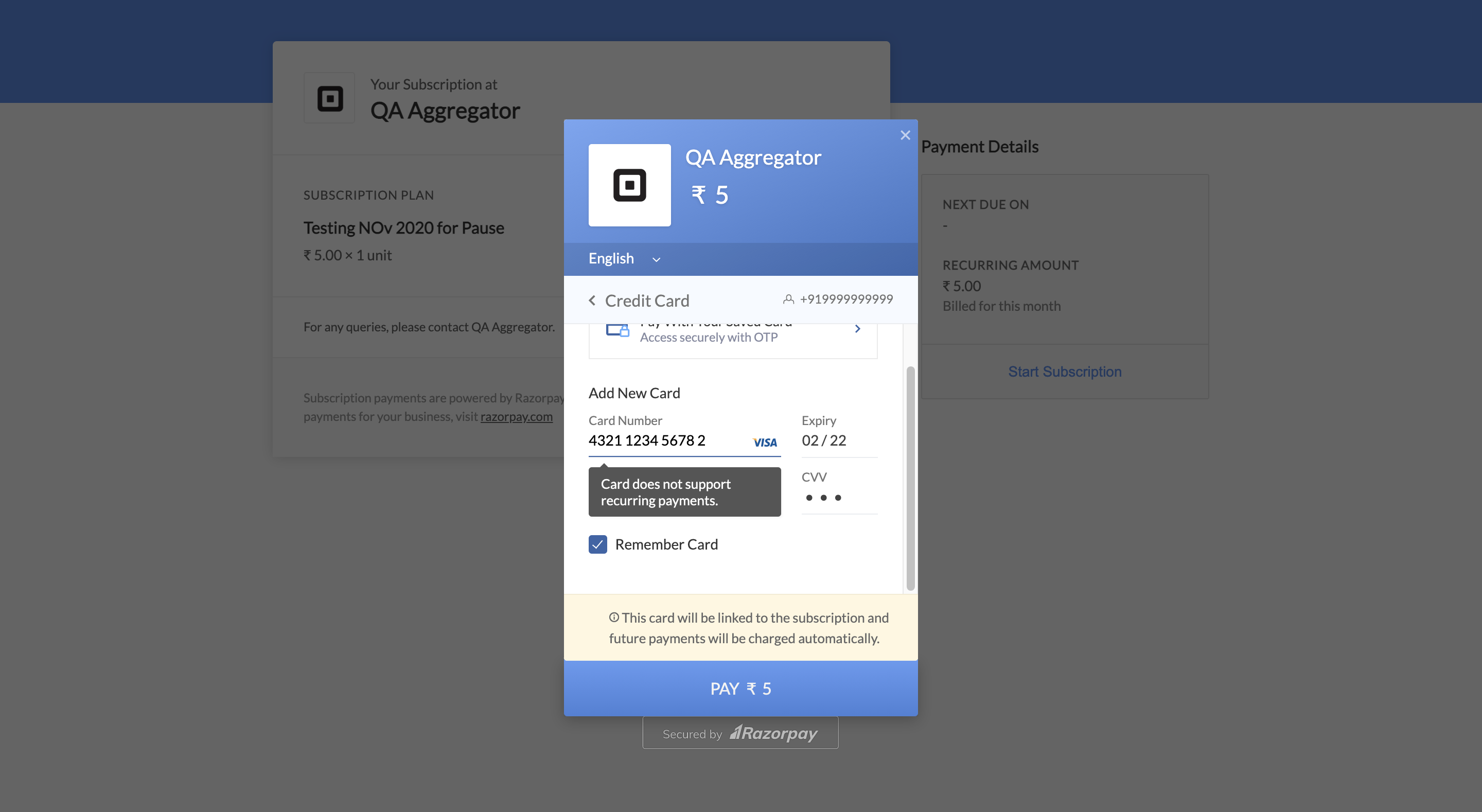

If a customer tries to enter card details of banks that are not live, an error message saying Card does not support recurring payments will be displayed, as shown below.

We will migrate existing Subscription plans of City Union Bank (CUB), OneCard and Karur Vysya Bank by September 30, 2021. Wel will continue to process debits on such Subscription plans even after September 30, 2021. For banks that will go live after September 30, 2021, we will migrate the Subscription plans of such banks as and when they go live.

Watch Out!

All of the Subscriptions that will be migrated are credit card based Subscriptions as debit cards of these banks were not enabled before.

All the Subscription plans of banks that are not live will be moved to the pending state on their respective billing dates starting from October 1, 2021. We will notify your customers through email with the following options to activate the Subscription again:

Option 1: Update with new card details of banks that are live.

Option 2: Use UPI as the alternate payment method and register to re-activate the subscription.

Alternate Approach - Register for a new Subscription

In case you wish to reach out to your customers to sign up for new Subscriptions, you can do the following:

- Cancel all card-based Subscriptions, and the status will be moved to the

cancelled state.

- Notify your customers about the cancelled Subscriptions and send new subscription links, and request them to register afresh using UPI or the cards of banks that are live.

Refer to the Subscriptions document for more information.

Starting October 1, 2021, we will initiate the debit on every Subscription 24 hours in advance. The respective banks will send a pre-debit notification to the customer’s registered mobile number or email ID. If the cutomer does not pause or cancel the Subscription, then the debit will be processed, and you will get the notification through a webhook or in the dashboard. A sample pre-debit notification is given below for your reference:

No, there are no changes in APIs to process card-based Subscriptions.

For plans upto maximum amount of ₹5,000, debits will be processed without any intervention from customers.

For plans above ₹5,000 an Additional Factor Authentication (AFA) is required from customers for every subsequent debit.

Note:

All the steps mentioned below will be taken care of by Razorpay and banks. No additional effort is required from businesses and customers.

To process debits of amounts below ₹5,000:

- Razorpay will initiate the debit 24 hours before the actual debit date.

- Bank will send a pre-debit notification SMS to the customer immediately.

- The amount will be debited 24 hours after the notification provided the customer does not pause or cancel the Subscription.

To process debits of amounts above ₹5,000:

- Razorpay will initiate the debit 24 hours before the actual debit date.

- Bank will send a notification with a link for Additional Factor Authentication (AFA) to the customer immediately. The AFA link will be active for 72 hours.

- The amount will be debited once the customer provides AFA.

The short animation below shows the customer side flow of giving consent through the AFA link.

No, there are no changes in processing debits for Subscriptions using international cards. The RBI guidelines apply only to domestic cards and not international cards.

Yes, cardholders can pause, resume and cancel active Subscriptions from the portal provided by the bank to manage them. You will get notifications through multiple webhooks when a cardholder initiates any such changes to the Subscriptions. You can also see these changes in the Razorpay Dashboard.

- Credit cards from the following card networks issued by any bank in India.

- American Express

- Mastercard

- Visa

- Debit cards on Mastercard and Visa network issued by the following banks.

- ICICI Bank

- Kotak Mahindra Bank

- Citibank

- Canara Bank

Subscriptions are allowed on the following network credit cards provided the customer authorizes the first transaction using 2FA authentication or 3D Secure.

- American Express

- MasterCard

- Visa

Subscriptions are allowed on Mastercard and Visa network cards issued by the following banks provided the customer authorizes the first transaction using two-factor authentication or 3D Secure.

- Citibank

- Canara Bank

- ICICI Bank

- Kotak Mahindra Bank

Cards are always shown as a payment method for subscriptions.

Method

| Condition

| Checkout

|

|---|

Card

| Plan amount + upfront amount < ₹2,000.

| ✓

|

Card

| Authentication amount + upfront amount < ₹2,000.

| ✓

|

Card

| Plan amount + upfront amount > ₹2,000.

| ✓

|

Card

| Authentication amount + upfront amount > ₹2,000.

| ✓

|

|

Yes. You can disable cards as a payment method using the Settings feature on the Subscriptions tab.

Method

| Payment

| TAT Guidelines

|

|---|

Card

| Authorization payment

| Real-time.

|

Card

| Subsequent charge

| Real-time.

|

|

Yes. All the Subscription frequencies are allowed when using Card as a payment method for Subscriptions.

No. There are no restrictions when using Card as a payment method for Subscriptions.

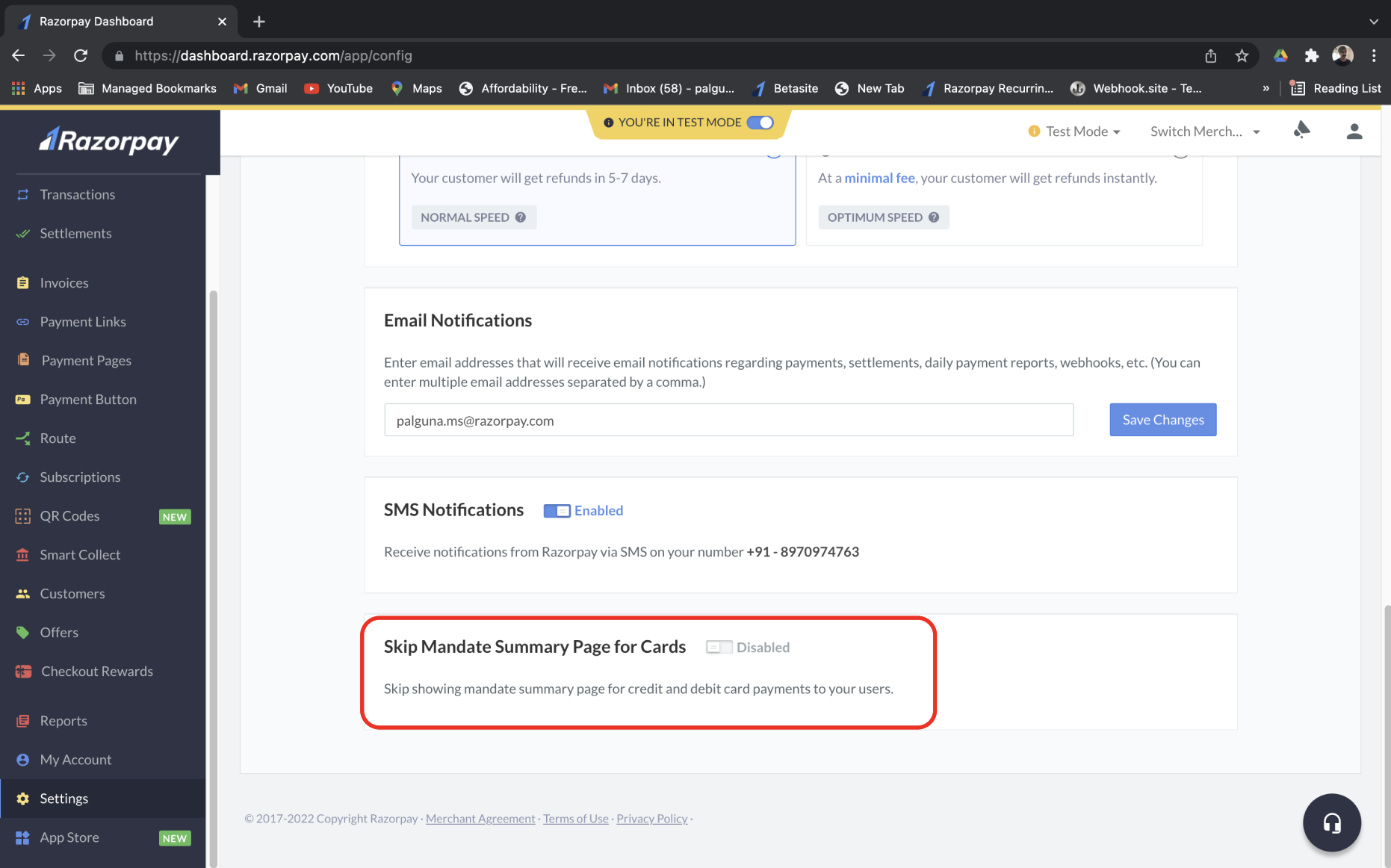

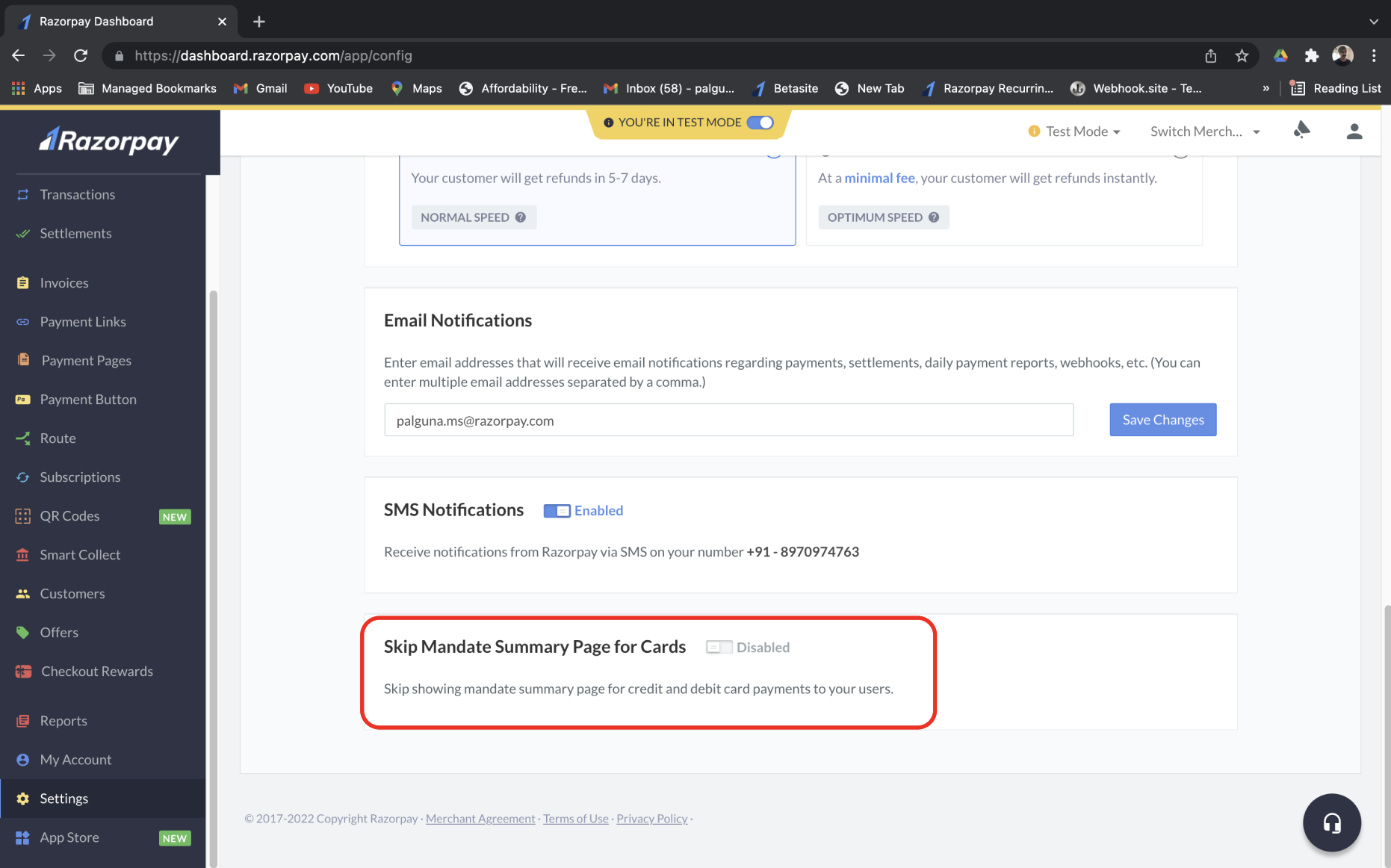

Yes, you can skip the MandateHQ summary screen by enabling Skip Mandate Summary Page for Cards option from the Razorpay Dashboard.

There are no changes to the existing APIs. However, there is a new API to pause Subscriptions that you will have to add to your integration.

Supported Applications

- PhonePe

- GooglePay (

okhdfcbank and okaxis)

- Paytm

- BHIM

- Amazon Pay

- IndusInd Bank App

Supported Banks

- Axis Bank

- Bank of Baroda

- Bank of India

- Canara Bank

- Capital Small Finance Bank

- Federal Bank

- HDFC Bank

- HSBC

- ICICI Bank

- IDBI Bank

- IDFC First Bank

- Indusind Bank

- Jio Payments Bank

- Karur Vysya Bank

- Kerala Gramin Bank

- North East Small Finance Bank

- Paytm Payments Bank

- Pragathi Krishna Gramin Bank

- Punjab and Sind Bank

- Punjab National Bank

- Rajkot Nagrik Sahakari Bank

- RBL

- Saraswat Co-operative Bank

- SBM Bank India Ltd

- Shivalik Small Finance Bank

- State Bank of India

- Suryoday Small Finance Bank

- Thane Janta Sahakari Bank

- Utkarsh Small Finance Bank

- Yes Bank Ltd

- Nainital Bank

- Patan Nagarik Sahakari Bank

- The Vijay Co-operative Bank

- The Adarsh Co-operative Urban Bank

- GP Parsik Sahakari Bank

- Capital Small Finance Bank

- Kotak Mahindra Bank

- Union Bank of India

- Indian Overseas Bank

- AU Small Finance Bank

For UPI, the maximum amount for any one transaction is ₹1,00,000, and for BFSI (Banking, Financial Services and Insurance) merchants, it is ₹2,00,000.

UPI is shown on the checkout in the following cases:

Method

| Condition

| Checkout

|

|---|

UPI

| Plan amount + upfront amount < ₹5,000.

| ✓

|

UPI

| Authentication amount + upfront amount < ₹5,000.

| ✓

|

UPI

| Plan amount + upfront amount > ₹5,000.

| x

|

UPI

| Authentication amount + upfront amount > ₹5,000.

| x

|

|

Method

| Payment

| TAT Guidelines

|

|---|

UPI

| Authorization payment

| Real-time.

|

UPI

| Subsequent charge

| On the scheduled date*.

|

|

* Due to retries, this may extend to T+1.

Payment Retry

In failure scenarios, we automatically retry the payment twice on the same day.

Below is the retry model:

- Let T=0 be the charge day.

- On T=0, we attempt to charge the card.

- If the charge fails, we automatically reattempt the charge after 10 minutes on the same day.

- If the charge fails again, we automatically reattempt the charge after an hour on the same day. If the charge still fails, the Subscription moves to the

halted state.

Yes. You can disable UPI as a payment method using the Settings feature on the Subscriptions tab.

No. Currently, you cannot update a Subscription authorized via UPI.

No. Currently, this is not possible. Add-ons are not available for Subscriptions authorized via UPI.

Yes. You can pause a Subscription authorized via UPI.

Yes. You can cancel a Subscription authorized via UPI.

No. Currently, it is not possible to update a Subscription authorized via UPI.

Yes. Your customers can cancel a Subscription authorized via UPI from their UPI app.

Yes. Your customers can pause a Subscription authorized via UPI from their UPI app.

No. Currently, UPI only supports INR payments.

Yes, your customer can use UPI as a payment method for Subscriptions.

Yes, all frequencies are allowed when using UPI as a payment method.

Yes. The maximum transaction amount allowed is ₹5,000 when using UPI as a payment method for Subscriptions.

Similar to Cards, Emandate is a digital payment service that can be used to set up recurring payments for Subscriptions on your bank account. With Emandate, you can provide standard instructions to your issuing bank, allowing them to debit the mentioned amount from your bank account automatically.

Emandate is automatically enabled for you on the Settings page, and hence there are no additional steps required to enable it.

Yes. You can disable Emandate as a payment method from the Settings page on the Subscriptions tab.

Currently, Subscription through Emandate is available for a few banks. Refer to the Supported Banks and Apps page for more information.

Yes. For Emandate, the maximum amount limit per debit request is ₹10,00,000. However, there is no limit on the number of transactions per day.

The Subscription changes to active when both registration and subsequent payments are made. This is a bank constraint as the payment and registration cannot happen on the same day. The update on this may take T+1 days. If the payment still fails, the Subscription remains in the created state.

No. If the charge day (T) is a bank holiday, we will charge on T-1 days. Similarly, if the charge day (T) and the previous day (T-1) are bank holidays, we will charge on T-3 days. This process will not affect your charge cycle for the subsequent months.

No, your customer cannot pause or cancel a Subscription that is authorized via Emandate. However, they can directly contact the bank and cancel a Subscription, and the subsequent payment will fail for such Subscriptions.

Occasionally Emandate payment may get delayed from the bank side. You would get an update in 1 to 2 days, and the Subscription status will be changed accordingly.

You can link an offer to a Subscription when creating the Subscription of after it has gone live.

Yes. You can upgrade a Subscription even it has an offer linked to it. However, you cannot downgrade a Subscription when an offer is linked to it.

To downgrade the Subscription, you will have to remove the offer linked to it, downgrade the Subscription and then reapply the offer to it.

No. You cannot downgrade a Subscription when an offer is linked to it.

To downgrade the Subscription, you will have to remove the offer linked to it, downgrade the Subscription and then reapply the offer to it.

To link an offer to a Subscription it should be in the active state.

You can remove an offer linked to a Subscription in any state. Do remember that invoices generated after the offer is removed will be charged in full.