Payout Life Cycle🔗

The following flow illustrates the various states in the payout life cycle:

Check the payout life cycle and the various states associated with the payout life cycle.

Payouts are made to Contacts. A payout has various states in its life cycle.

The following flow illustrates the various states in the payout life cycle:

Following are the various payout states:

pendingqueuedscheduledprocessingprocessedreversedcancelledrejectedfailedHandy Tips

For more information on the complete Payout States and the Status Response Code, refer Payout Status Details.

Get automatic notifcations about the payout states using Webhooks.

If you have the Approval Workflow feature enabled on your account, the payout moves to the pending state if the payout requires approval as per the Approval Workflow. At this stage, the payout details are stored in the system, but no processing is done either by Razorpay or the Contact's bank.

Handy Tips

Pending and Rejected states are available only if you have Approval Workflow enabled on your account.From the pending state, payouts can either move to the:

queued state if you do not have sufficient balance to process the payout.scheduled state if you have scheduled the payout.processing state if you have sufficient balance to process the payout.rejected state if you reject the payout or if you did not approve the payout before the scheduled date and time.A payout is assigned the queued status only when you do not have sufficient balance in your business account.

At this stage, the payout details are stored in the system, but no processing has been done either by Razorpay or the contact's bank.

Watch Out!

The payout remains in this state until you add sufficient funds to your business account.

From the queued state, payouts can either move to the:

processing state when you add sufficient balance to process the payout.cancelled state if you cancel the payout.Handy Tips

The scheduled state does not apply to Queued Payouts. Know more about Queued Payouts.

The payout remains in the scheduled state until the scheduled date and time. At this stage, the payout details are stored in the system, but no processing is done either by Razorpay or the Contact's bank.

From the scheduled state, payouts can either move to the:

processing state when the scheduled time is reached.cancelled state if you cancel the payout.failed state if you do not have sufficient balance to process the payout.Handy Tips

The queued state does not apply to Scheduled Payouts. Know more about Scheduled Payouts.

A payout can acquire the processing state in one of the three ways:

pending state, when you approve the payout and you have sufficient balance to process the payout.queued state, when you add sufficient funds to your account to process the payout.At this stage, either Razorpay or the Contact's bank process the payout. No further action is required by you while a payout is in the processing state.

IMPS and UPI payout can remain in the processing state for T+2 working days.

From processing state, payouts can either move to the:

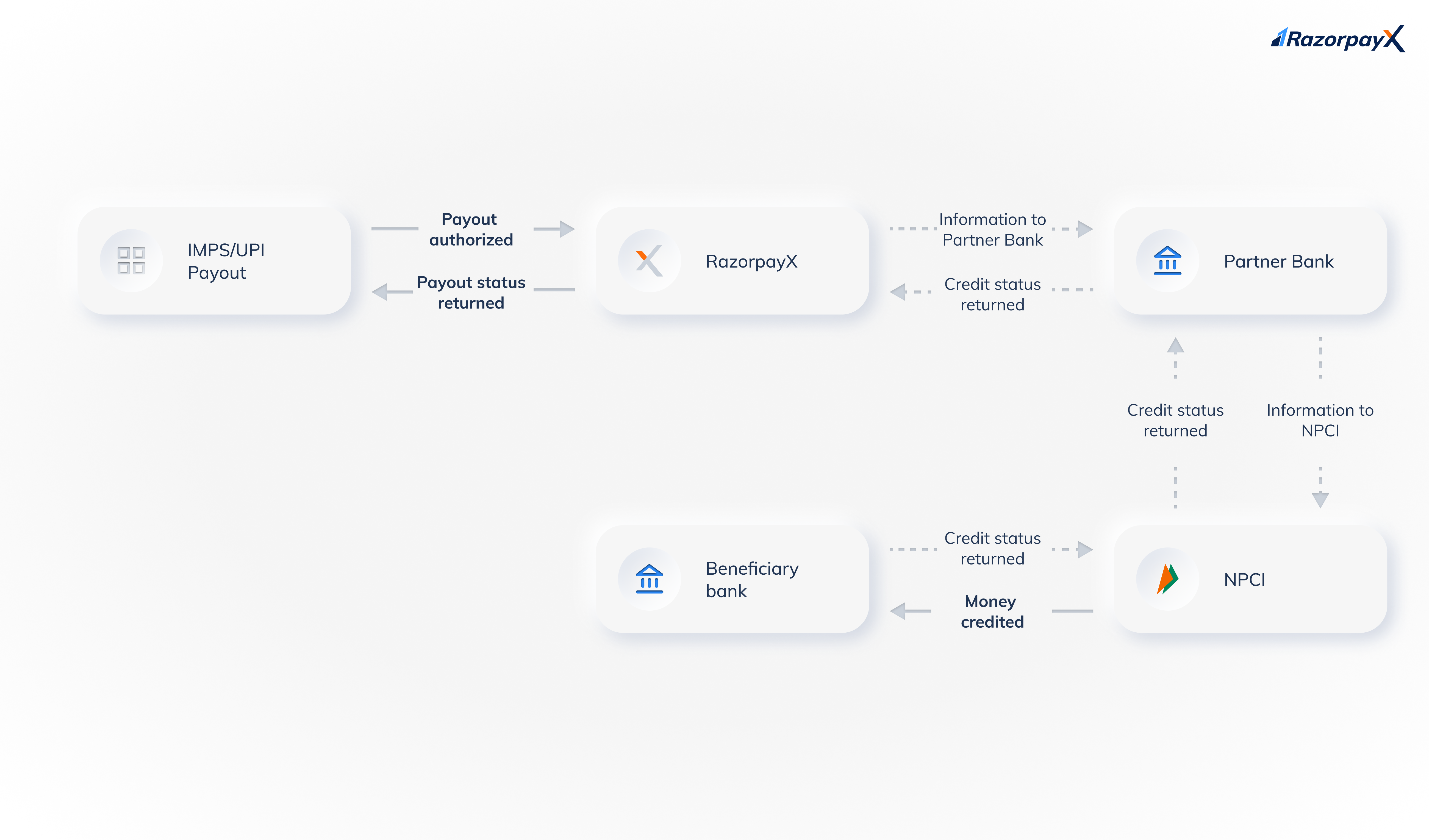

processed state if the payout is successful.reversed state if the payout fails.IMPS and UPI Payouts can be in the processing state for up to T+2 working days. NPCI marks these payouts as deemed success or deemed approved. Below is how a payout is processed from when you authorise it to you to when you receive the terminal payout state (processed/failed/reversed).

processed.reversed.Sometimes, there are technical errors when trying to credit the payout to the beneficiary account. When this happens, it is not possible to be certain if the payout was credited to the beneficiary. In such cases, NPCI moves the payout to an intermediate state (deemed success). From this state, the payout can go to the processed, failed or reversed state.

When we receive the deemed success from NPCI, we do not move the payout to a terminal state. We do this to avoid returning a false positive state to you. Instead, we keep the payout in the processing state till we receive the final status from the partner bank.

Once the transactions in the deemed success state are reconciled by the beneficiary bank and NPCI, we receive the final status from the partner bank and move the payout to the terminal state (processed/failed/reversed). This could take T+2 working days.

The processed status means that payout has been processed by the contact's Bank.

A payout in the processed state can move to the reversed state if a payout failure is detected.

This can happen due to various reasons such as the customer's bank reversing the transaction or if the payout was reversed by the clearing house.

This is a terminal state for a payout. No further action is possible on a payout at this state.

A payout acquires the reversed state when the payout operation fails. This can happen due to issues with our partner banks, clearing house or even the customer's bank.

As soon as Razorpay identifies a payout failure scenario, it moves the payout to the reversed state and creates a reversal transaction that credits your business account with the original payout amount including fees and tax.

A Payout can move from reversed state to failed state only in case of RazorpayX Current accounts.

This is a terminal state for a payout. No further action is possible on a payout at this state.

A payout in the pending state moves to the rejected state when:

No further action is possible on a payout at this state.

Handy Tips

The Pending and Rejected states are available only if you have Approval Workflow enabled on your account.

A payout moves to the cancelled state when you manually cancel a payout in the:

queued state. You can cancel a payout in the queued state either from the Dashboard or using our APIs.scheduled state. You can cancel a payout in the scheduled state from the Dashboard.A payout that is cancelled acquires the cancelled state. No further action is possible on a payout at this state.

This status is applicable only when a payout is made using your current account balance.

processing state move to the failed state when they are failed by our current account partner bank.scheduled state move to the failed state if you do not have sufficient balance to process them.This is a terminal state for a payout. No further action is possible on a payout at this state.

A reversal transaction is created whenever a payout fails. A payout may fail at Razorpay, at the contact's bank or elsewhere. In some rare scenarios, failure might happen a few days after the payout is moved to the processed state.

As soon as Razorpay detects a failure, we create a reversal transaction and credit the payout amount (including the fees and tax) to your business account. The original payout transaction status is changed to reversed.

Anytime a payout fails, a webhook is triggered to notify of the failure. A payout failure event is accompanied by a reversal transaction.

You can view a list of reversed transactions from the RazorpayX Dashboard.

Check out the RazorpayX Payouts Demo to understand how to create and make payouts in 4 simple steps. Experience making payouts in a jiffy, without having to sign up!