How it Works🔗

On your website or app, customers select the products and proceed to Checkout.

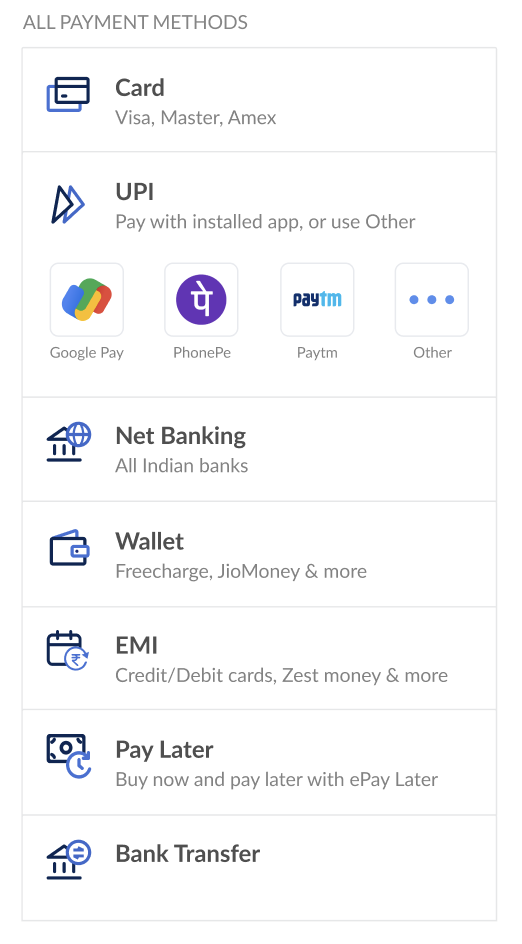

- On the Checkout page, the customers selects EMI as the payment method.

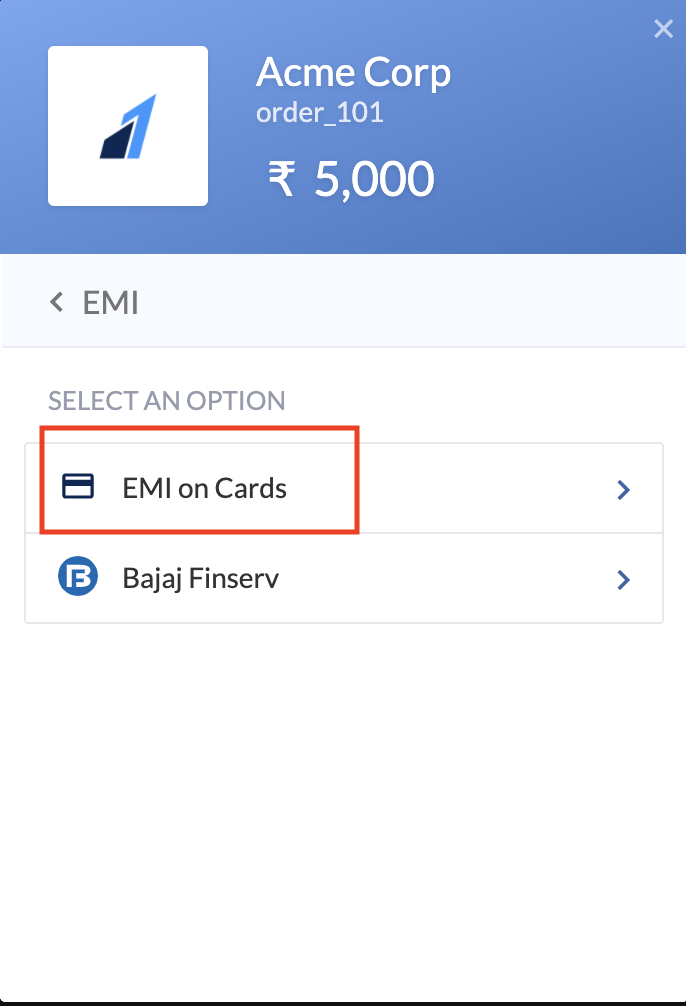

2. The customers select EMI on Cards option under the EMI tab.

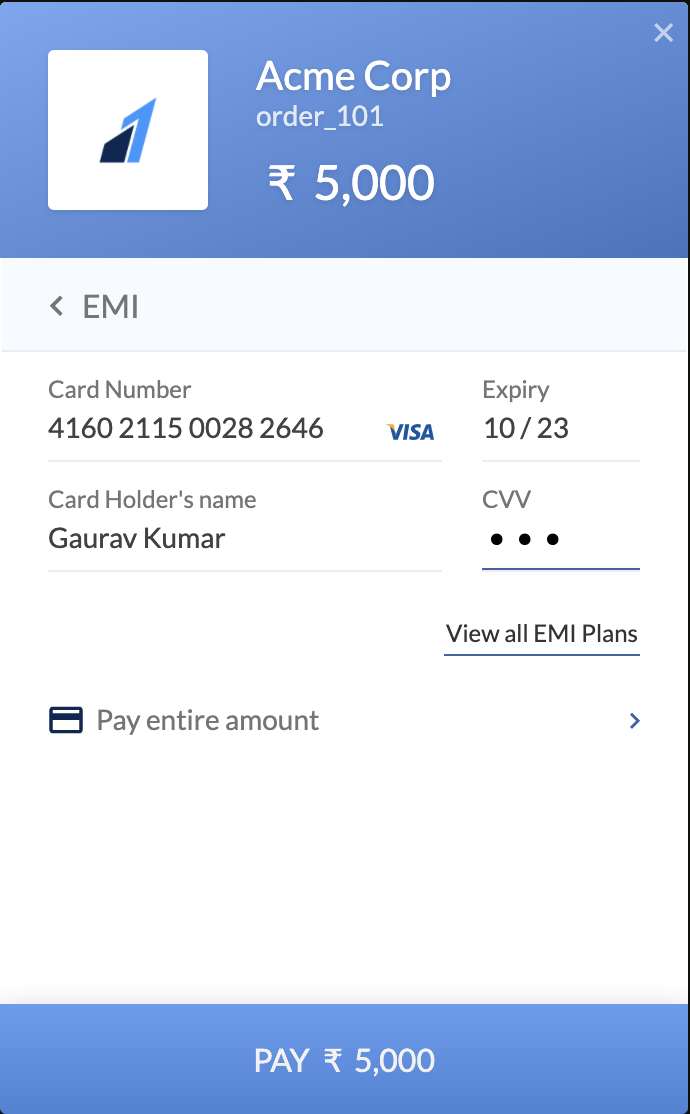

3. The customers enters the debit card details as shown below:

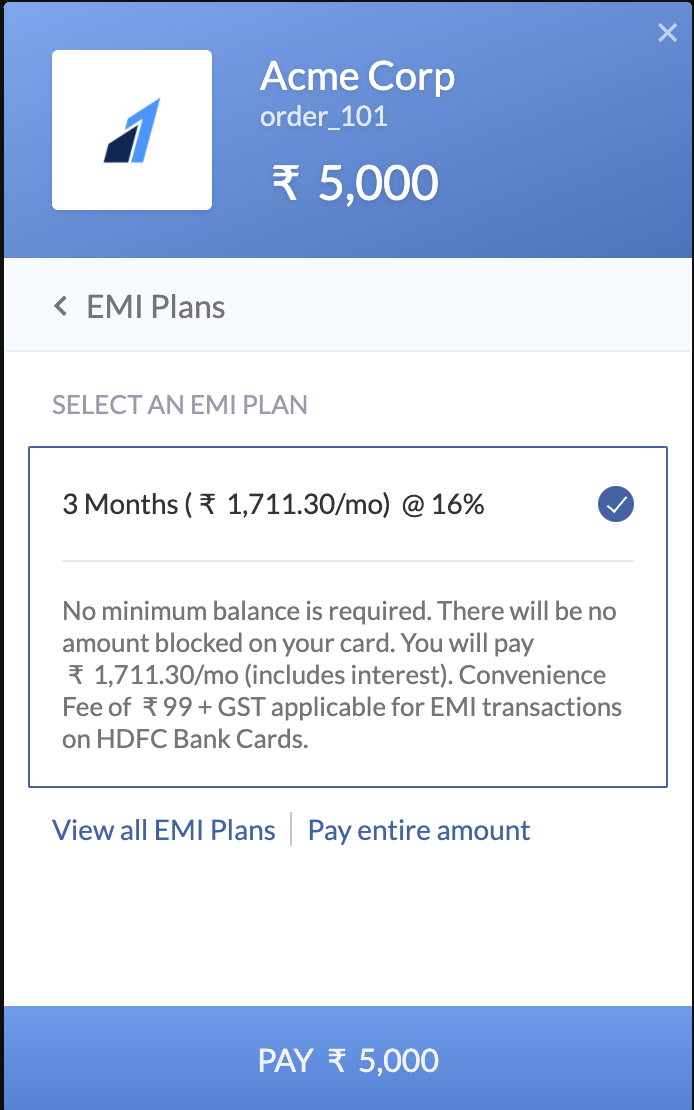

4. If the order amount is eligible for debit card EMI, the corresponding EMI plans along with the interest rates are displayed.

5. The customers select the EMI tenure. They are prompted to enter the phone number linked to their bank account.

6. If the customers are eligible for availing the EMI, OTPs are sent by their bank to validate their identity.

After the successful authentication, the customers are redirected to your application or website. Customers' monthly debit card statements will reflect the EMI amount with the interest charged by the bank.