Pay Later

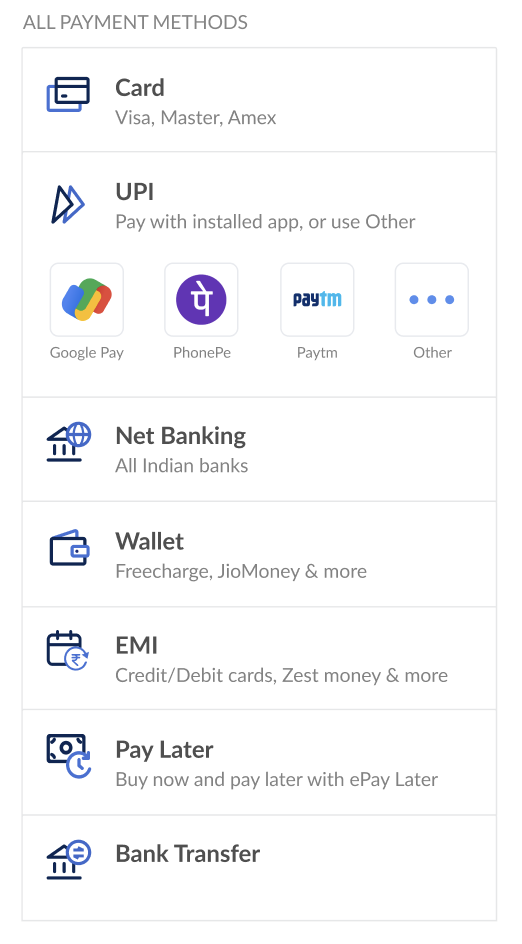

Let your customers make payments using the Pay Later payment method at the Razorpay Checkout.

On the Razorpay Checkout form, you can let your customers make payments using the Pay Later service offered by various third-party providers.

Based on the concept, Buy now, Pay Later, the customers get a running line of credit by registering with any providers. When customers buy goods or services on your website or apps, no money is debited from their accounts. Instead, you will receive the payments from their providers. The customer pays back to the provider as per the fixed schedule defined by the provider. Know about how to enable/disable Pay Later as a payment method for your account.

Provider

| Provider Code

| Availability

| Minimum Transaction

| Maximum Transaction

|

|---|

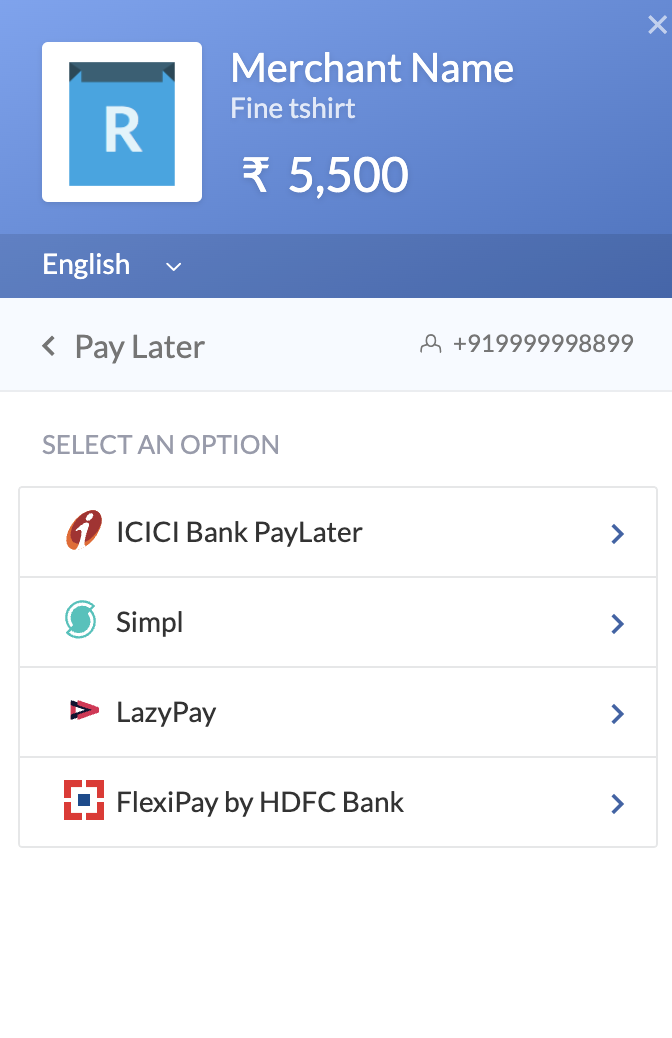

ICICI Bank PayLater

| icic

| Default

| ₹1

| ₹30,000

|

GetSimpl

| getsimpl

| Requires Approval

| ₹1

| ₹25,000

|

FlexiPay by HDFC Bank

| hdfc

| Requires Approval

| ₹1,000

| ₹20,000

|

LazyPay

| lazypay

| Requires Approval

| ₹1

| ₹10,000

|

-

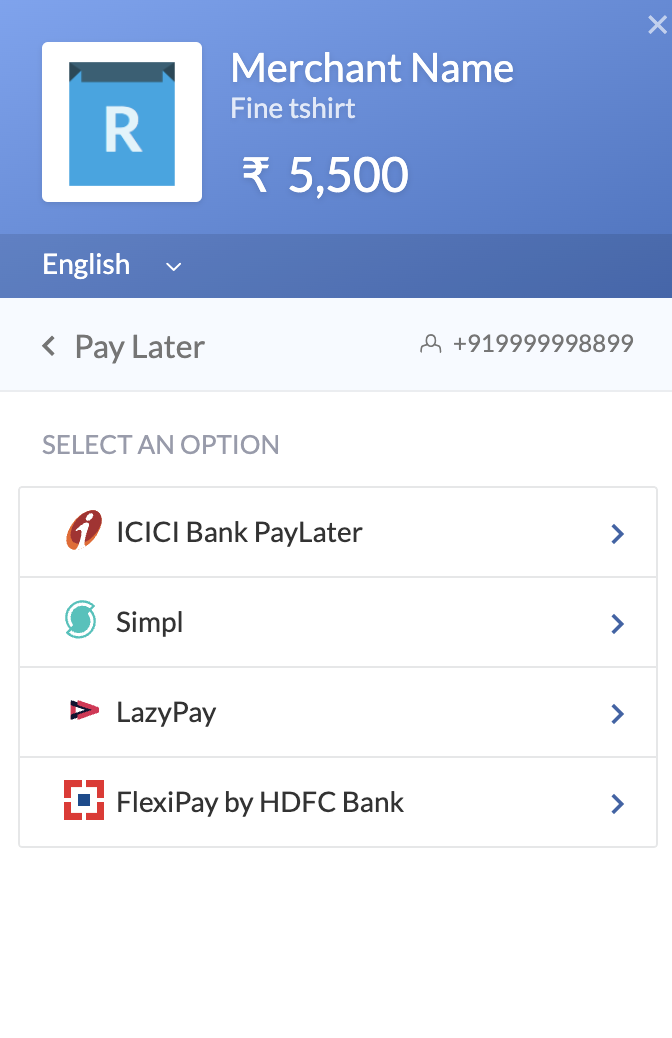

At the Checkout, customers enter the contact details and select Pay Later as the payment method.

-

From the displayed list of Pay Later providers, customers select their preferred provider.

-

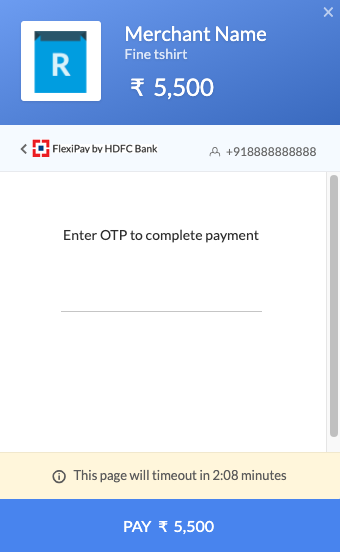

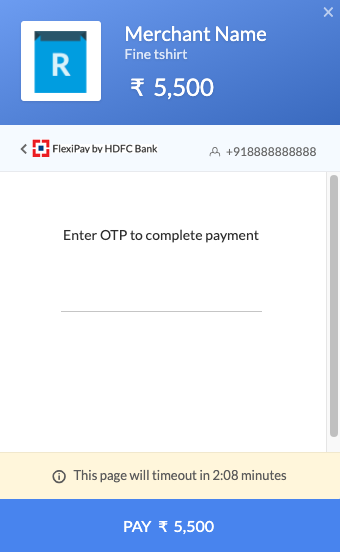

Customers authorise their accounts via the OTP sent to their registered phone numbers.

-

Payment is completed after successful validation.

No additional integration is required to show Pay Later on your Standard Checkout integration.